Kinnevik Results Presentation Deck

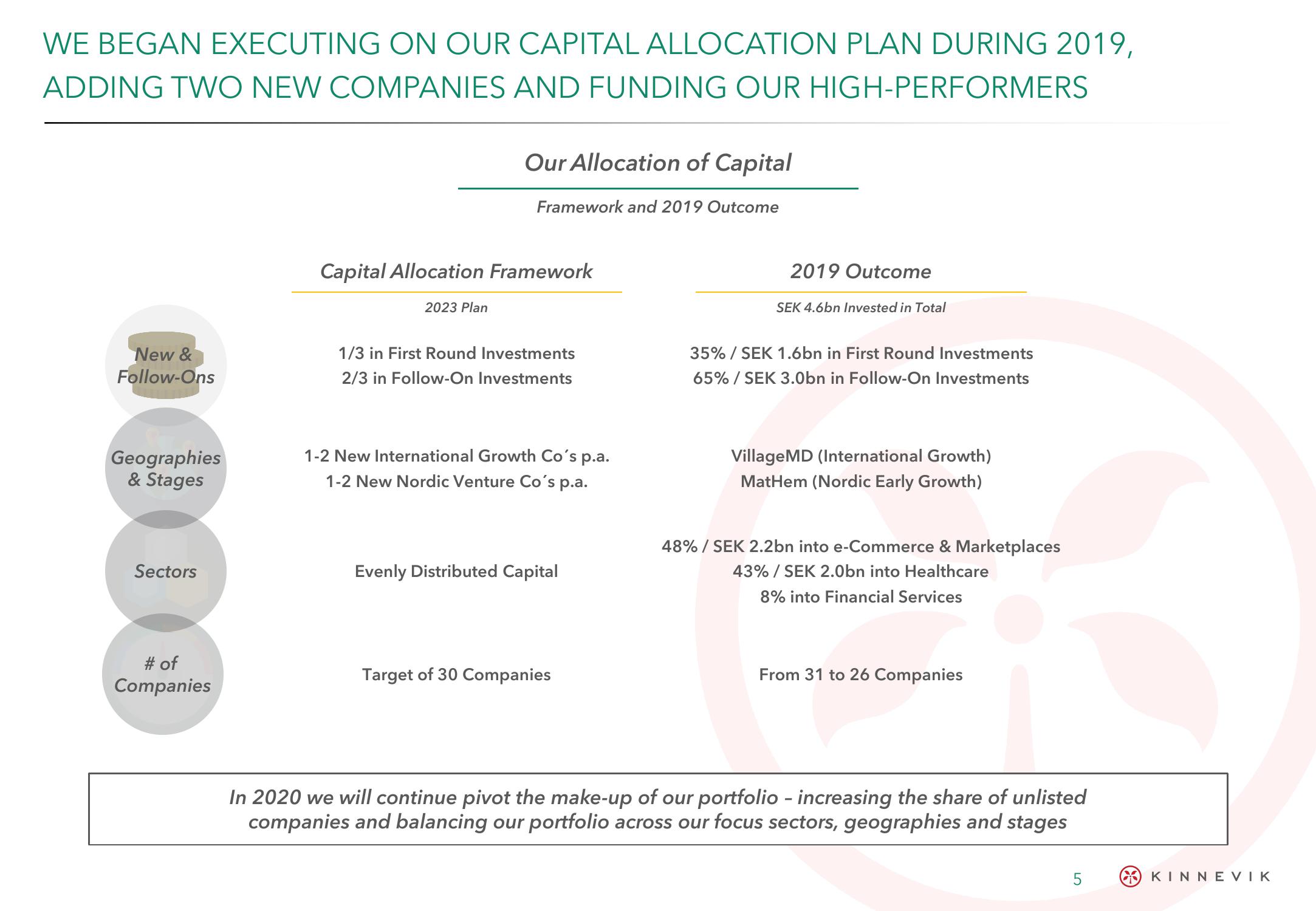

WE BEGAN EXECUTING ON OUR CAPITAL ALLOCATION PLAN DURING 2019,

ADDING TWO NEW COMPANIES AND FUNDING OUR HIGH-PERFORMERS

New &

Follow-Ons

Geographies

& Stages

Sectors

# of

Companies

Our Allocation of Capital

2023 Plan

Framework and 2019 Outcome

Capital Allocation Framework

1/3 in First Round Investments

2/3 in Follow-On Investments

1-2 New International Growth Co's p.a.

1-2 New Nordic Venture Co's p.a.

Evenly Distributed Capital

Target of 30 Companies

2019 Outcome

SEK 4.6bn Invested in Total

35% / SEK 1.6bn in First Round Investments

65% / SEK 3.0bn in Follow-On Investments

VillageMD (International Growth)

MatHem (Nordic Early Growth)

48% / SEK 2.2bn into e-Commerce & Marketplaces

43% / SEK 2.0bn into Healthcare

8% into Financial Services

From 31 to 26 Companies

In 2020 we will continue pivot the make-up of our portfolio - increasing the share of unlisted

companies and balancing our portfolio across our focus sectors, geographies and stages

5

KINNEVIKView entire presentation