Volta SPAC Presentation Deck

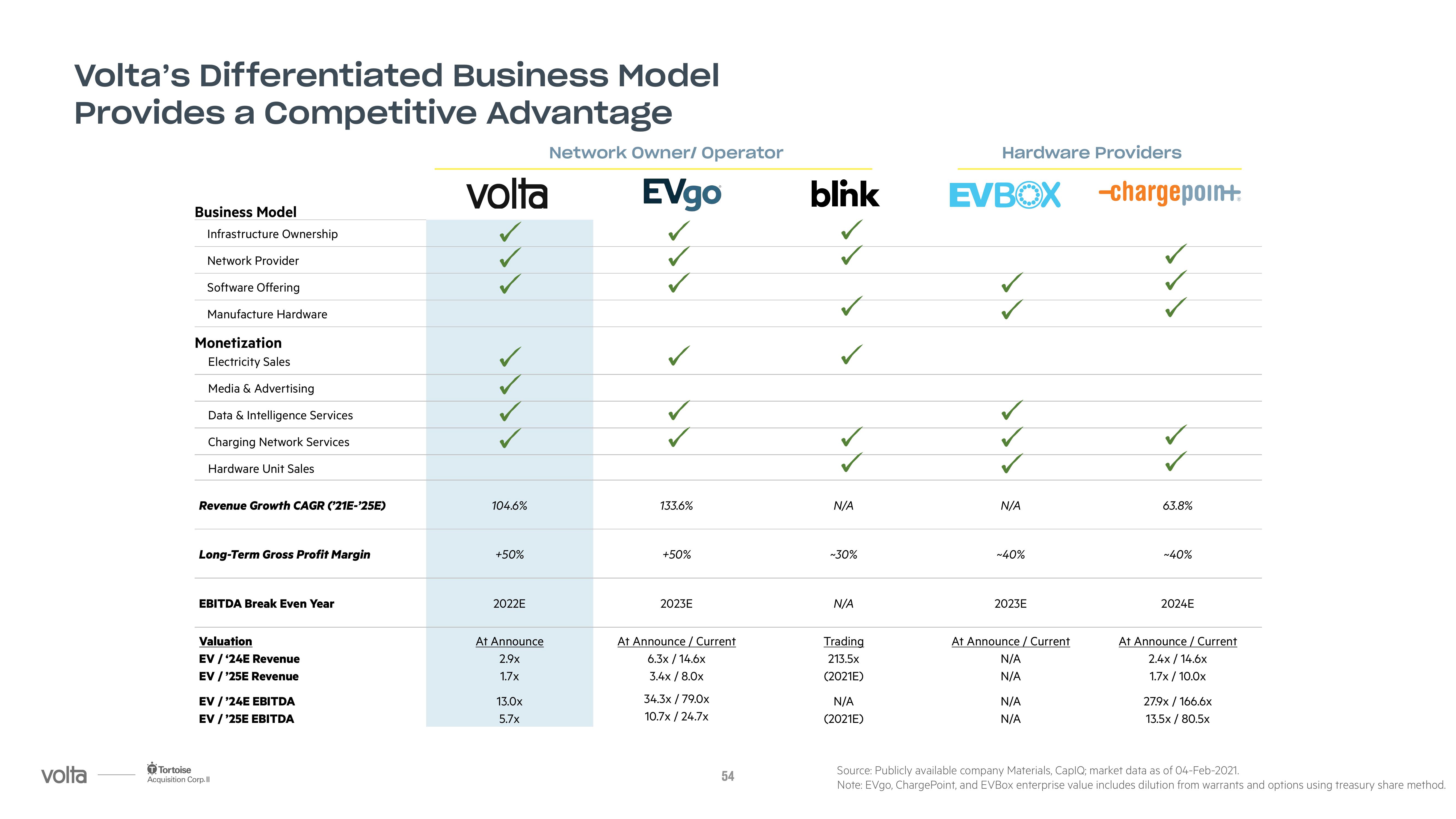

Volta's Differentiated Business Model

Provides a Competitive Advantage

volta

Business Model

Infrastructure Ownership

Network Provider

Software Offering

Manufacture Hardware

Monetization

Electricity Sales

Media & Advertising

Data & Intelligence Services

Charging Network Services

Hardware Unit Sales

Revenue Growth CAGR ('21E-'25E)

Long-Term Gross Profit Margin

EBITDA Break Even Year

Valuation

EV / '24E Revenue

EV /'25E Revenue

EV /'24E EBITDA

EV/'25E EBITDA

Tortoise

Acquisition Corp.ll

volta

104.6%

+50%

2022E

At Announce

2.9x

1.7x

13.0x

5.7x

Network Owner/ Operator

EVgo

✓

133.6%

+50%

2023E

At Announce / Current

6.3x/14.6x

3.4x / 8.0x

34.3x/79.0x

10.7x / 24.7x

54

blink

✓

N/A

~30%

N/A

Trading

213.5x

(2021E)

N/A

(2021E)

Hardware Providers

EVBOX -chargepoin+:

✓

N/A

~40%

2023E

At Announce / Current

N/A

N/A

N/A

N/A

✓

63.8%

~40%

2024E

At Announce / Current

2.4x/14.6x

1.7x / 10.0x

27.9x/166.6x

13.5x / 80.5×

Source: Publicly available company Materials, CapIQ; market data as of 04-Feb-2021.

Note: EVgo, ChargePoint, and EVBox enterprise value includes dilution from warrants and options using treasury share method.View entire presentation