Silicon Valley Bank Results Presentation Deck

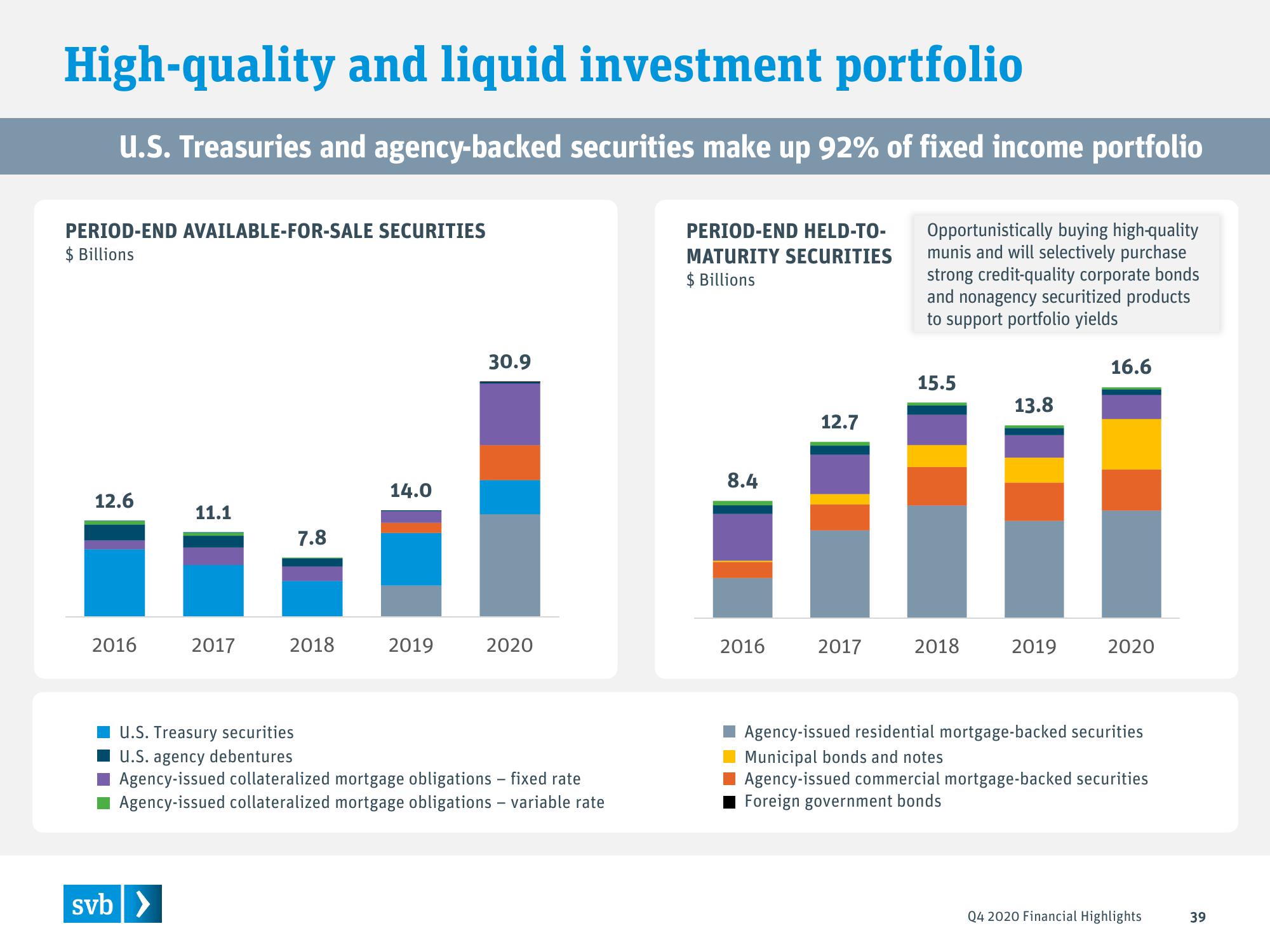

High-quality and liquid investment portfolio

U.S. Treasuries and agency-backed securities make up 92% of fixed income portfolio

PERIOD-END AVAILABLE-FOR-SALE SECURITIES

$Billions

12.6

2016

11.1

svb >

2017

7.8

2018

14.0

2019

30.9

2020

U.S. Treasury securities

U.S. agency debentures

Agency-issued collateralized mortgage obligations - fixed rate

Agency-issued collateralized mortgage obligations - variable rate

PERIOD-END HELD-TO-

MATURITY SECURITIES

$ Billions

8.4

2016

12.7

2017

Opportunistically buying high-quality

munis and will selectively purchase

strong credit-quality corporate bonds

and nonagency securitized products

to support portfolio yields

15.5

2018

13.8

2019

16.6

2020

Agency-issued residential mortgage-backed securities

Municipal bonds and notes

Agency-issued commercial mortgage-backed securities

Foreign government bonds

Q4 2020 Financial Highlights

39View entire presentation