Klaviyo IPO Presentation Deck

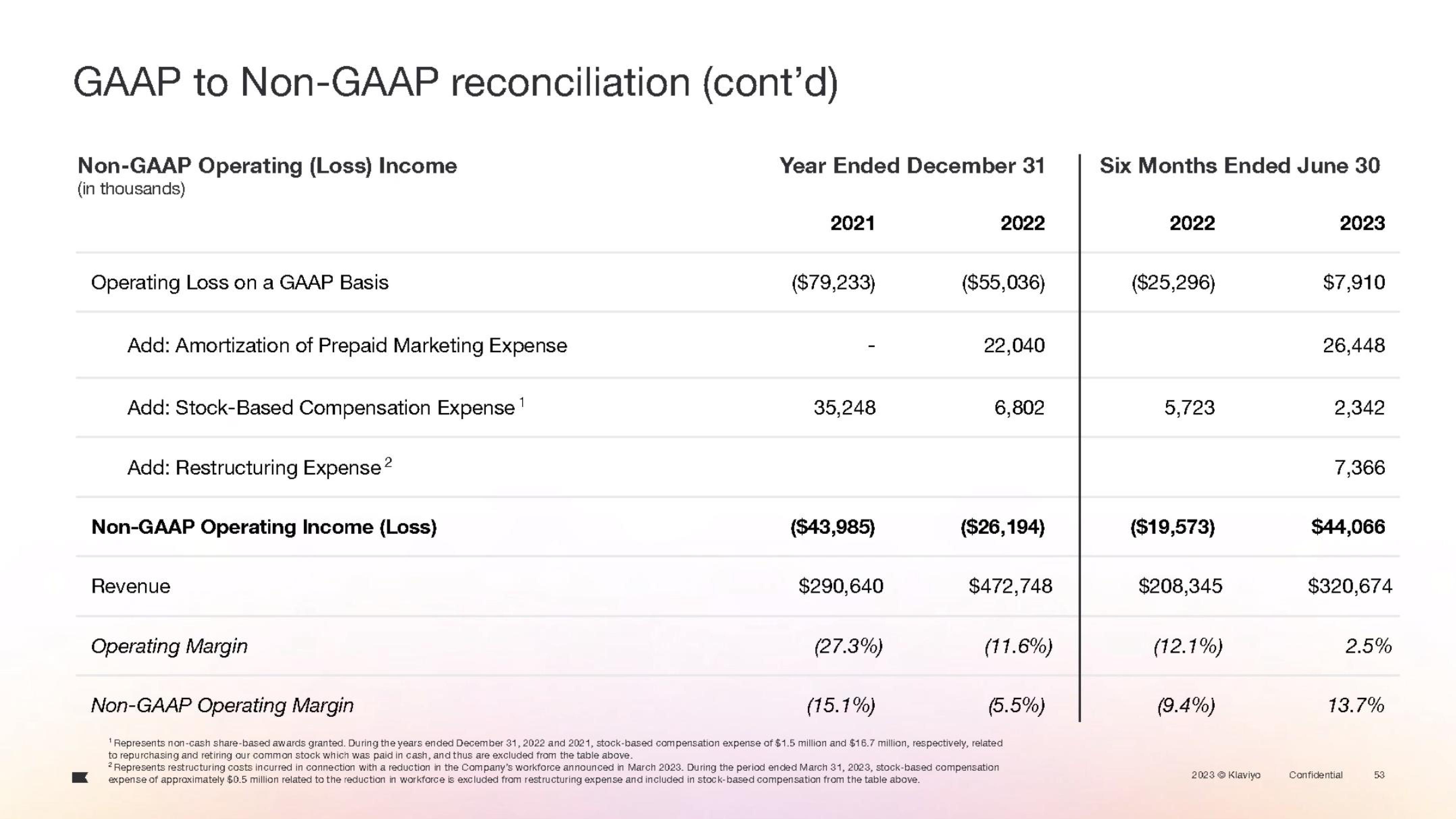

GAAP to Non-GAAP reconciliation (cont'd)

Non-GAAP Operating (Loss) Income

(in thousands)

Operating Loss on a GAAP Basis

Add: Amortization of Prepaid Marketing Expense

Add: Stock-Based Compensation Expense ¹

Add: Restructuring Expense ²

2

Non-GAAP Operating Income (Loss)

Revenue

Operating Margin

Year Ended December 31

2021

($79,233)

35,248

($43,985)

$290,640

(27.3%)

2022

($55,036)

22,040

6,802

($26, 194)

$472,748

(11.6%)

Non-GAAP Operating Margin

(15.1%)

(5.5%)

¹ Represents non-cash share-based awards granted. During the years ended December 31, 2022 and 2021, stock-based compensation expense of $1.5 million and $16.7 million, respectively, related

to repurchasing and retiring our common stock which was paid in cash, and thus are excluded from the table above.

2 Represents restructuring costs incurred in connection with a reduction in the Company's workforce announced in March 2023. During the period ended March 31, 2023, stock-based compensation

expense of approximately $0.5 million related to the reduction in workforce is excluded from restructuring expense and included in stock-based compensation from the table above.

Six Months Ended June 30

2022

($25,296)

5,723

($19,573)

$208,345

(12.1%)

(9.4%)

2023 Ⓒ Klaviyo

2023

$7,910

26,448

2,342

7,366

$44,066

$320,674

2.5%

13.7%

Confidential

53View entire presentation