KKR Real Estate Finance Trust Investor Presentation Deck

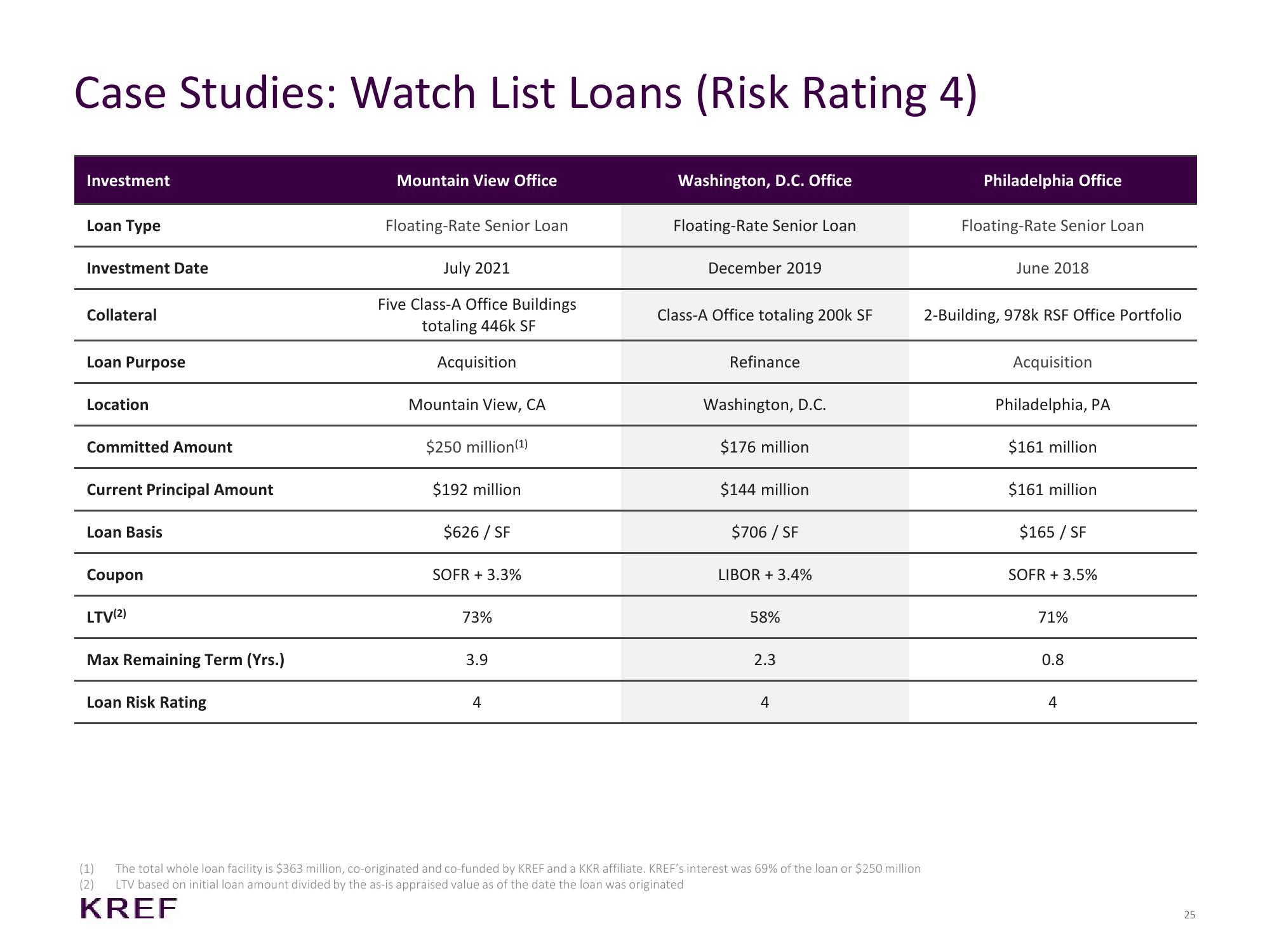

Case Studies: Watch List Loans (Risk Rating 4)

Investment

Loan Type

Investment Date

Collateral

Loan Purpose

Location

Committed Amount

Current Principal Amount

Loan Basis

Coupon

LTV(2)

Max Remaining Term (Yrs.)

Loan Risk Rating

Mountain View Office

(1)

(2)

Floating-Rate Senior Loan

July 2021

Five Class-A Office Buildings

totaling 446k SF

Acquisition

Mountain View, CA

$250 million (¹)

$192 million

$626 / SF

SOFR + 3.3%

73%

3.9

4

Washington, D.C. Office

Floating-Rate Senior Loan

December 2019

Class-A Office totaling 200k SF

Refinance

Washington, D.C.

$176 million

$144 million

$706 / SF

LIBOR + 3.4%

58%

2.3

4

The total whole loan facility is $363 million, co-originated and co-funded by KREF and a KKR affiliate. KREF's interest was 69% of the loan or $250 million

LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated

KREF

Philadelphia Office

Floating-Rate Senior Loan

June 2018

2-Building, 978k RSF Office Portfolio

Acquisition

Philadelphia, PA

$161 million

$161 million

$165 / SF

SOFR + 3.5%

71%

0.8

4

25View entire presentation