Apollo Global Management Investor Day Presentation Deck

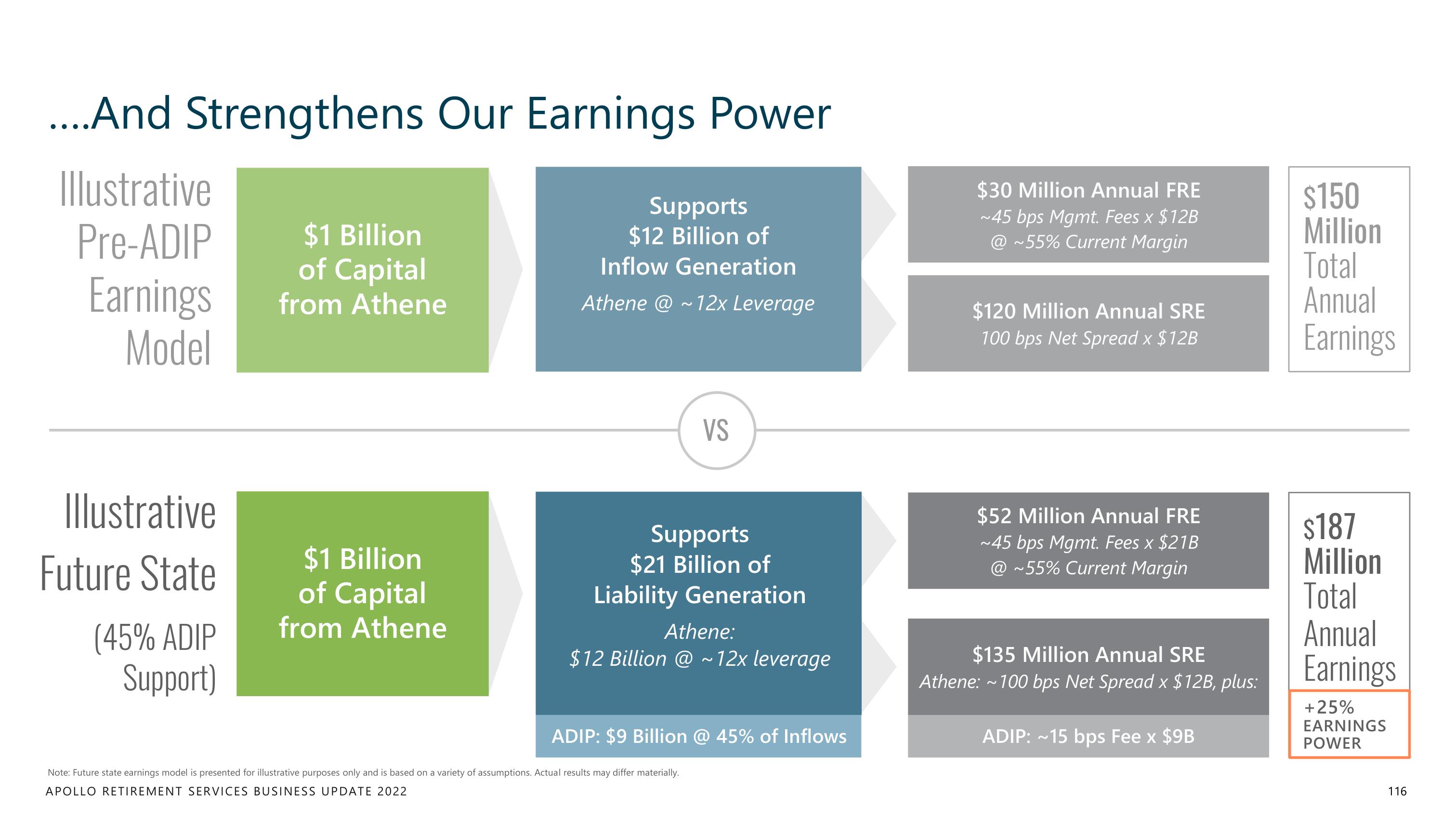

....And Strengthens Our Earnings Power

Illustrative

Pre-ADIP

Earnings

Model

Illustrative

Future State

(45% ADIP

Support)

$1 Billion

of Capital

from Athene

$1 Billion

of Capital

from Athene

Supports

$12 Billion of

Inflow Generation

Athene @~12x Leverage

VS

Supports

$21 Billion of

Liability Generation

Athene:

$12 Billion @ ~ 12x leverage

ADIP: $9 Billion @ 45% of Inflows

Note: Future state earnings model is presented for illustrative purposes only and is based on a variety of assumptions. Actual results may differ materially.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

$30 Million Annual FRE

~45 bps Mgmt. Fees x $12B

@ ~55% Current Margin

$120 Million Annual SRE

100 bps Net Spread x $12B

$52 Million Annual FRE

~45 bps Mgmt. Fees x $21B

@ ~55% Current Margin

$135 Million Annual SRE

Athene: ~100 bps Net Spread x $12B, plus:

ADIP: ~15 bps Fee x $9B

$150

Million

Total

Annual

Earnings

$187

Million

Total

Annual

Earnings

+ 25%

EARNINGS

POWER

116View entire presentation