Ready Capital Investor Presentation Deck

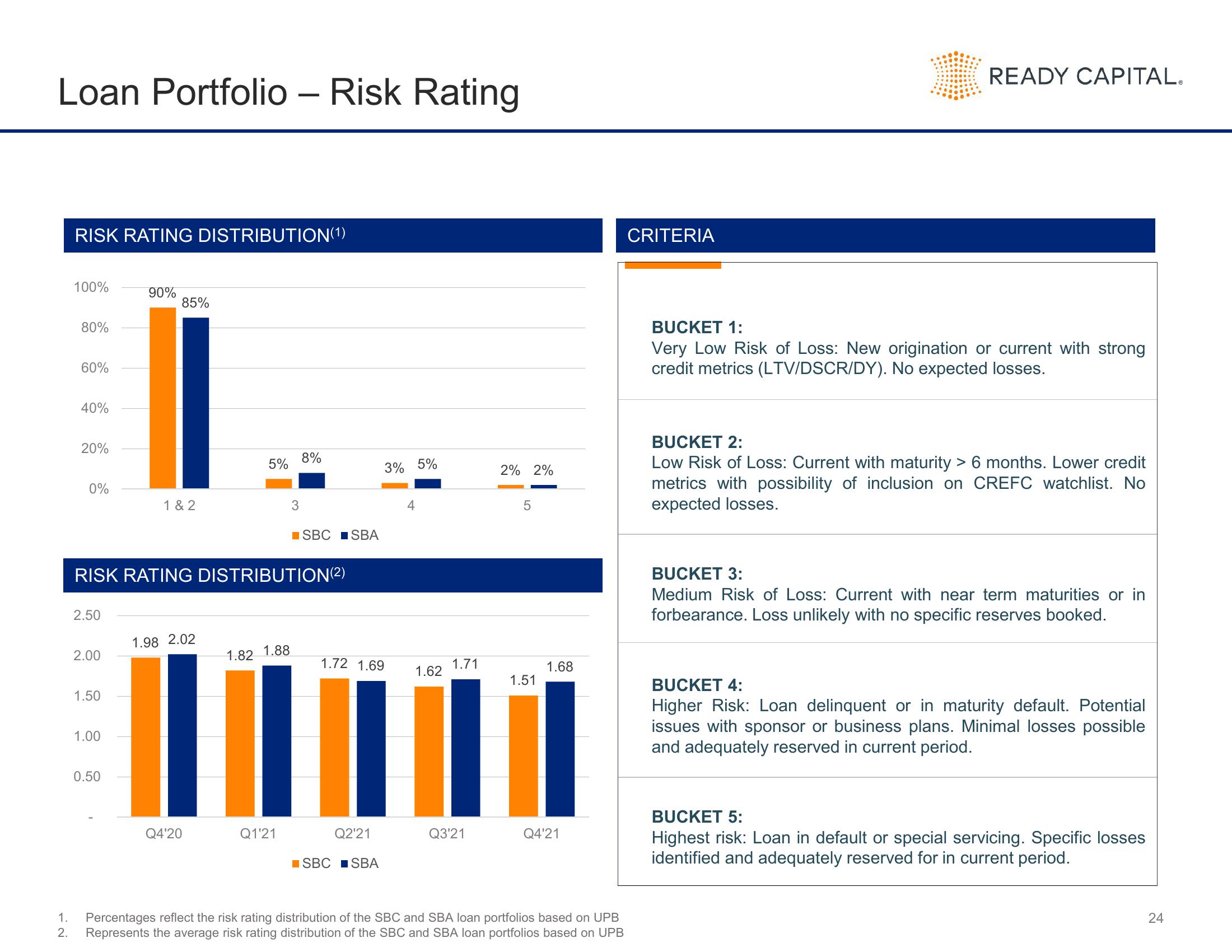

Loan Portfolio - Risk Rating

RISK RATING DISTRIBUTION (1)

100%

80%

60%

40%

20%

0%

2.50

2.00

1.50

1.00

90%

|

0.50

85%

1 & 2

RISK RATING DISTRIBUTION (²)

1.98 2.02

5%

Q4'20

1.82 1.88

3

Q1'21

8%

■SBC SBA

1.72 1.69

Q2'21

3% 5%

SBC SBA

4

1.62

1.71

Q3'21

2% 2%

5

1.51

1.68

Q4'21

1. Percentages reflect the risk rating distribution of the SBC and SBA loan portfolios based on UPB

2. Represents the average risk rating distribution of the SBC and SBA loan portfolios based on UPB

CRITERIA

READY CAPITAL.

BUCKET 1:

Very Low Risk of Loss: New origination or current with strong

credit metrics (LTV/DSCR/DY). No expected losses.

BUCKET 2:

Low Risk of Loss: Current with maturity > 6 months. Lower credit

metrics with possibility of inclusion on CREFC watchlist. No

expected losses.

BUCKET 3:

Medium Risk of Loss: Current with near term maturities or in

forbearance. Loss unlikely with no specific reserves booked.

BUCKET 4:

Higher Risk: Loan delinquent or in maturity default. Potential

issues with sponsor or business plans. Minimal losses possible

and adequately reserved in current period.

BUCKET 5:

Highest risk: Loan in default or special servicing. Specific losses

identified and adequately reserved for in current period.

24View entire presentation