Kinnevik Results Presentation Deck

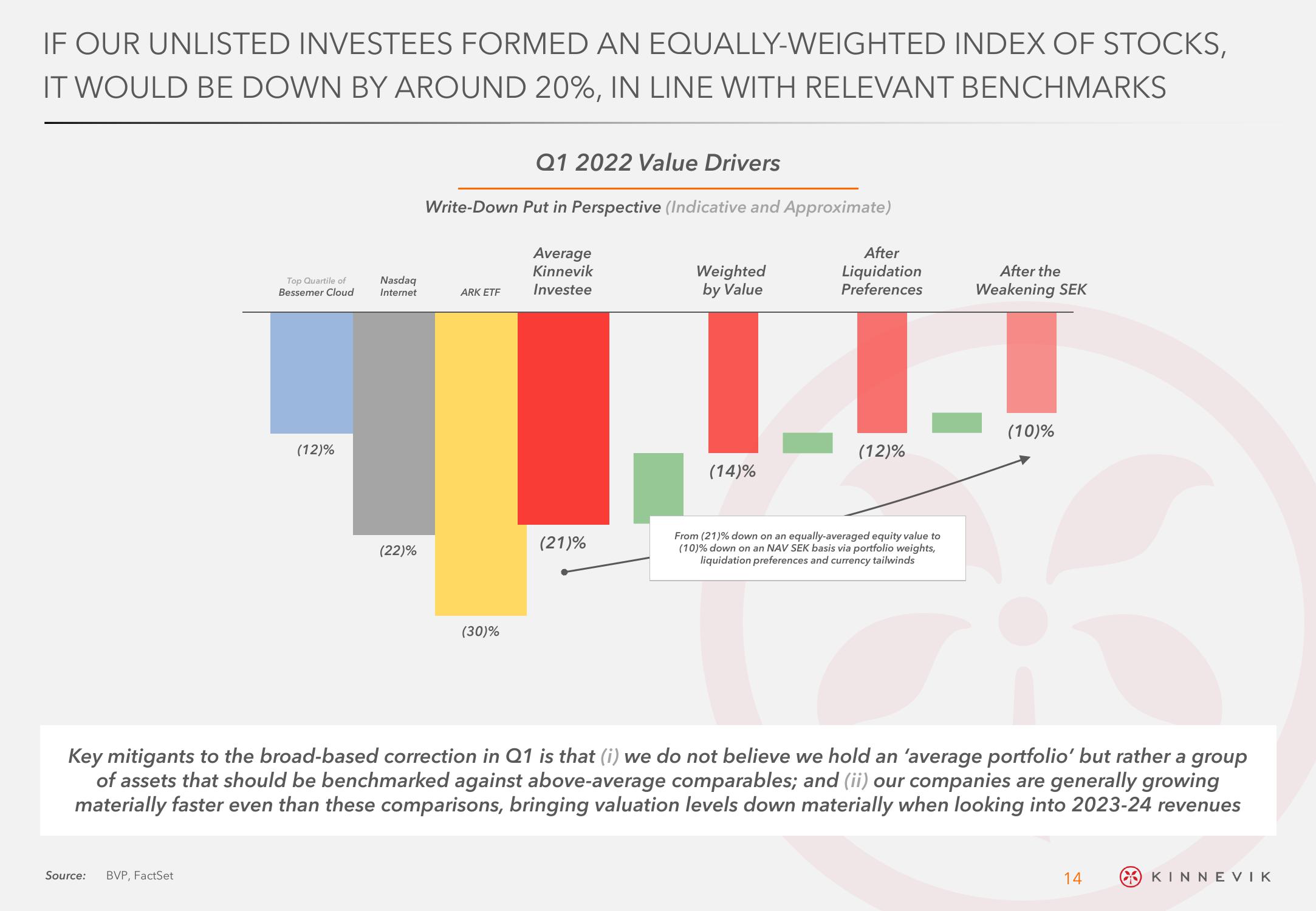

IF OUR UNLISTED INVESTEES FORMED AN EQUALLY-WEIGHTED INDEX OF STOCKS,

IT WOULD BE DOWN BY AROUND 20%, IN LINE WITH RELEVANT BENCHMARKS

Source:

Top Quartile of

Bessemer Cloud

BVP, FactSet

(12)%

daq

Internet

(22)%

Q1 2022 Value Drivers

Write-Down Put in Perspective (Indicative and Approximate)

ARK ETF

(30)%

Average

Kinnevik

Investee

(21)%

Weighted

by Value

(14)%

After

Liquidation

Preferences

(12)%

From (21)% down on an equally-averaged equity value to

(10)% down on an NAV SEK basis via portfolio weights,

liquidation preferences and currency tailwinds

After the

Weakening SEK

Key mitigants to the broad-based correction in Q1 is that (i) we do not believe we hold an 'average portfolio' but rather a group

of assets that should be benchmarked against above-average comparables; and (ii) our companies are generally growing

materially faster even than these comparisons, bringing valuation levels down materially when looking into 2023-24 revenues

(10)%

14

KINNEVIKView entire presentation