Credit Suisse Results Presentation Deck

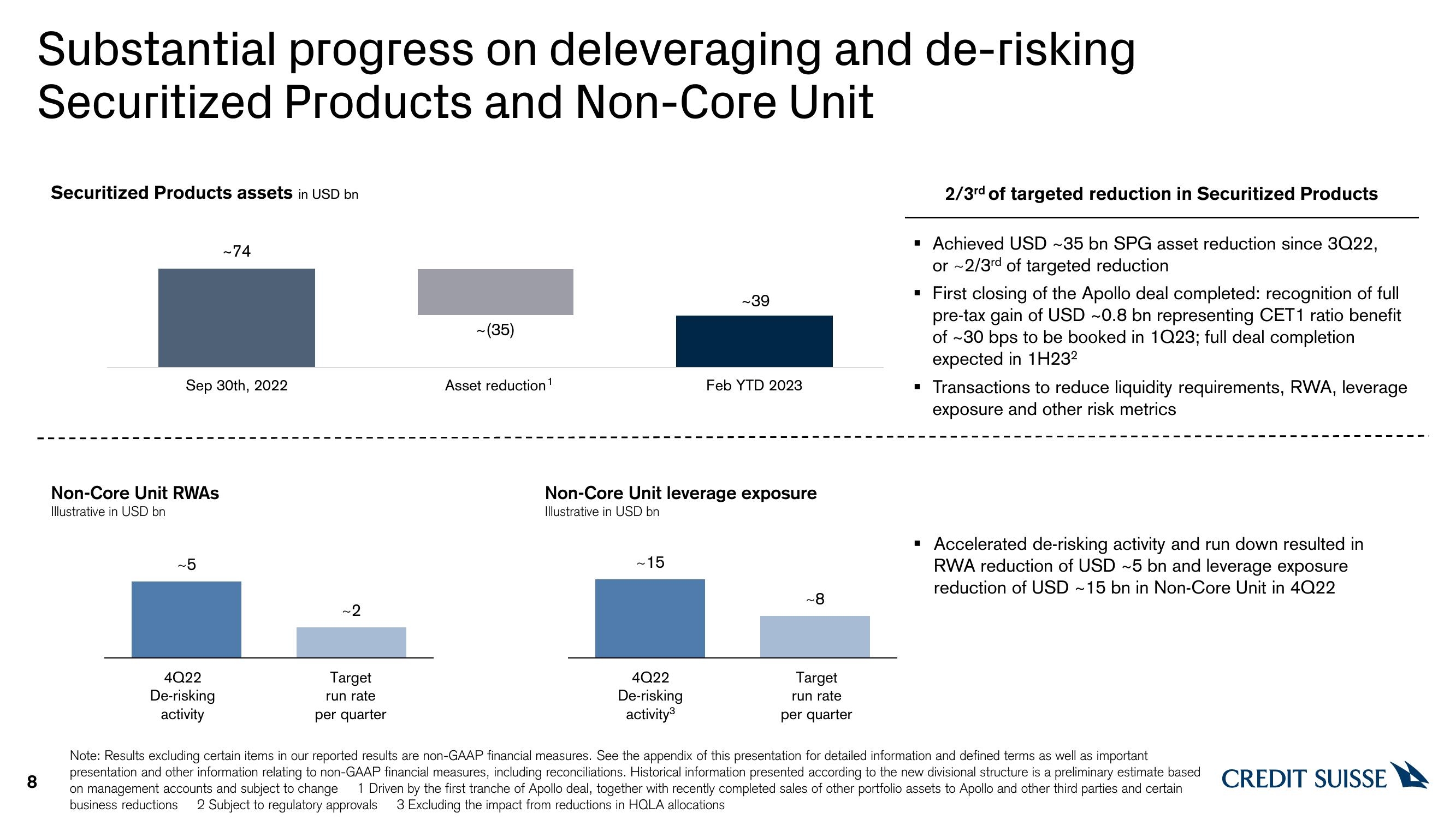

Substantial progress on deleveraging and de-risking

Securitized Products and Non-Core Unit

8

Securitized Products assets in USD bn

Sep 30th, 2022

Non-Core Unit RWAS

Illustrative in USD bn

~5

~74

4Q22

De-risking

activity

~2

Target

run rate

per quarter

~(35)

Asset reduction ¹

~15

~39

Non-Core Unit leverage exposure

Illustrative in USD bn

4Q22

De-risking

activity³

Feb YTD 2023

8~

Target

run rate

per quarter

2/3rd of targeted reduction in Securitized Products

▪ Achieved USD ~35 bn SPG asset reduction since 3Q22,

or ~2/3rd of targeted reduction

▪ First closing of the Apollo deal completed: recognition of full

pre-tax gain of USD ~0.8 bn representing CET1 ratio benefit

of ~30 bps to be booked in 1Q23; full deal completion

expected in 1H23²

▪ Transactions to reduce liquidity requirements, RWA, leverage

exposure and other risk metrics

▪ Accelerated de-risking activity and run down resulted in

RWA reduction of USD ~5 bn and leverage exposure

reduction of USD ~15 bn in Non-Core Unit in 4Q22

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. Historical information presented according to the new divisional structure is a preliminary estimate based

on management accounts and subject to change 1 Driven by the first tranche of Apollo deal, together with recently completed sales of other portfolio assets to Apollo and other third parties and certain

business reductions 2 Subject to regulatory approvals 3 Excluding the impact from reductions in HQLA allocations

CREDIT SUISSEView entire presentation