jetBlue Results Presentation Deck

ROBUST PROGRESS TOWARDS EARNINGS RECOVERY

●

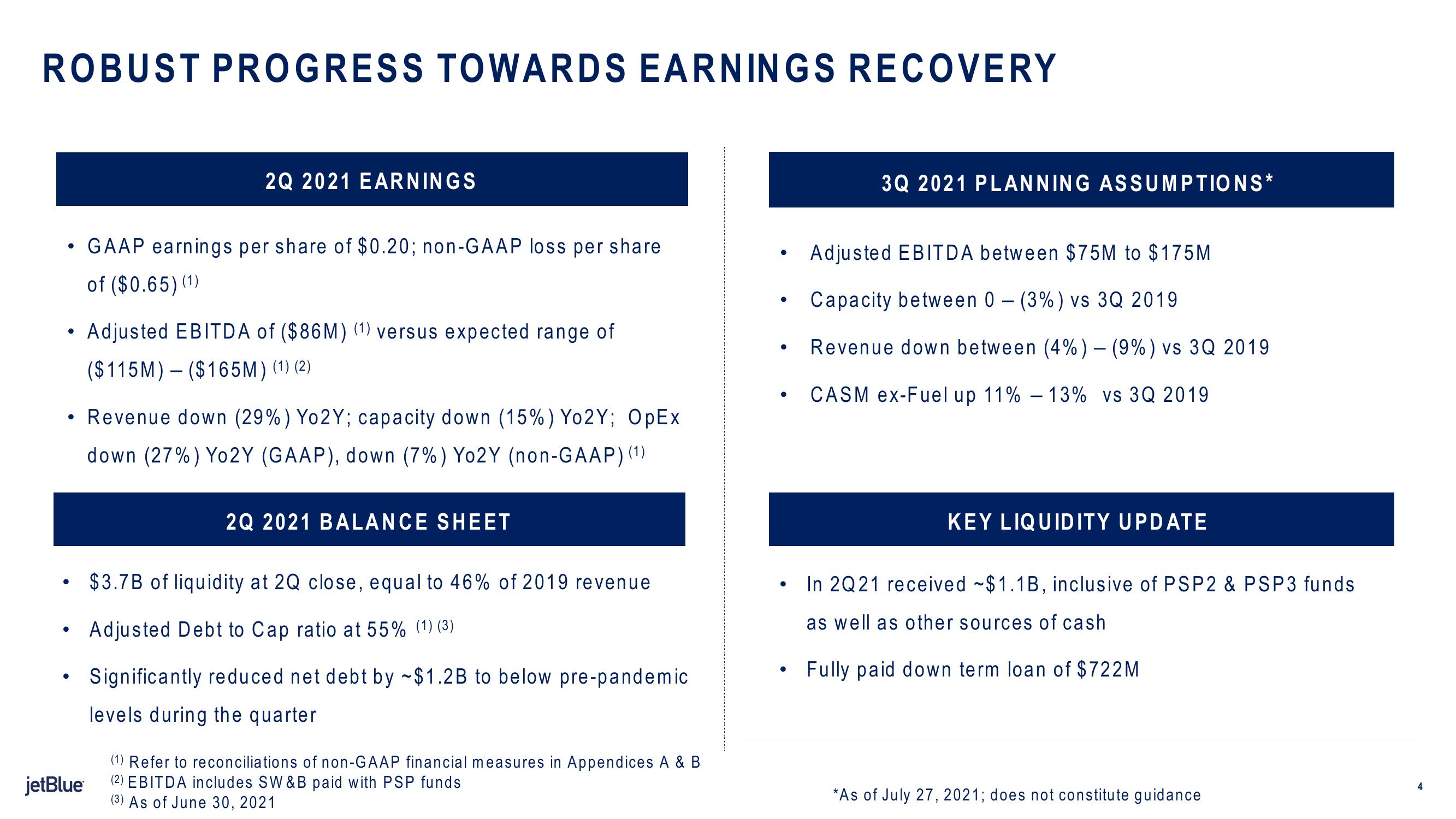

2Q 2021 EARNINGS

jetBlue

GAAP earnings per share of $0.20; non-GAAP loss per share

of ($0.65) (1)

Adjusted EBITDA of ($86M) (1) versus expected range of

($115M) - ($165M) (1) (2)

• Revenue down (29%) Yo2Y; capacity down (15%) Yo2Y; OpEx

down (27%) Yo2Y (GAAP), down (7%) Yo2Y (non-GAAP)

) (1)

2Q 2021 BALANCE SHEET

$3.7B of liquidity at 2Q close, equal to 46% of 2019 revenue

Adjusted Debt to Cap ratio at 55% (1) (3)

Significantly reduced net debt by ~$1.2B to below pre-pandemic

levels during the quarter

(1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B

(2) EBITDA includes SW & B paid with PSP funds

(3) As of June 30, 2021

●

●

●

●

3Q 2021 PLANNING ASSUMPTIONS*

Adjusted EBITDA between $75M to $175M

Capacity between 0 - (3%) vs 3Q 2019

Revenue down between (4%) - (9%) vs 3Q 2019

CASM ex-Fuel up 11% -13% vs 3Q 2019

KEY LIQUIDITY UPDATE

In 2Q21 received -$1.1B, inclusive of PSP2 & PSP3 funds

as well as other sources of cash

Fully paid down term loan of $722M

*As of July 27, 2021; does not constitute guidance

4View entire presentation