Baird Investment Banking Pitch Book

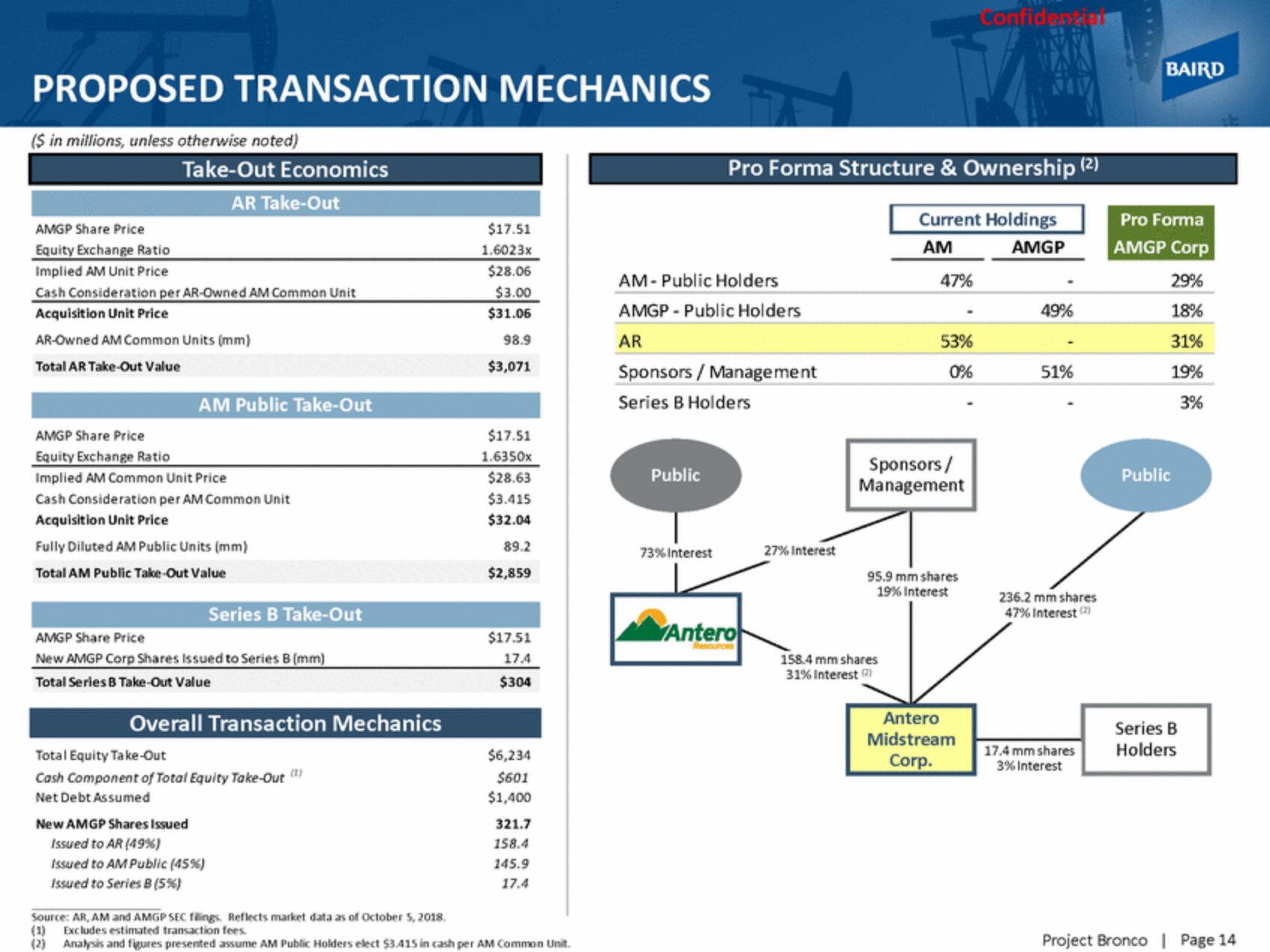

PROPOSED TRANSACTION MECHANICS

($ in millions, unless otherwise noted)

Take-Out Economics

AR Take-Out

AMGP Share Price

Equity Exchange Ratio

Implied AM Unit Price

Cash Consideration per AR-Owned AM Common Unit

Acquisition Unit Price

AR-Owned AM Common Units (mm)

Total AR Take-Out Value

AM Public Take-Out

AMGP Share Price

Equity Exchange Ratio

Implied AM Common Unit Price

Cash Consideration per AM Common Unit

Acquisition Unit Price

Fully Diluted AM Public Units (mm)

Total AM Public Take-Out Value

Series B Take-Out

AMGP Share Price

New AMGP Corp Shares Issued to Series B (mm)

Total Series B Take-Out Value

Overall Transaction Mechanics

Total Equity Take-Out

Cash Component of Total Equity Take-Out (¹)

Net Debt Assumed

New AMGP Shares Issued

Issued to AR (49%)

Issued to AM Public (45%)

Issued to Series B (5%)

$17.51

1.6023x

$28.06

$3.00

$31.06

98.9

$3,071

$17.51

1.6350x

$28.63

$3.415

$32.04

89.2

$2,859

$17.51

17.4

$304

$6,234

$601

$1,400

321.7

158.4

145.9

17.4

Source: AR, AM and AMGP SEC filings. Reflects market data as of October 5, 2018.

(1) Excludes estimated transaction fees.

(2)

Analysis and figures presented assume AM Public Holders elect $3.415 in cash per AM Common Unit.

AM- Public Holders

AMGP - Public Holders

AR

Public

7

Sponsors/Management

Series B Holders

73% Interest

Pro Forma Structure & Ownership (²)

Antero

27% Interest

Current Holdings

AM

AMGP

47%

158.4 mm shares

31% Interest (2)

53%

0%

Sponsors/

Management

95.9 mm shares

19% Interest

Confidential

Antero

Midstream

Corp.

49%

51%

236.2 mm shares

47% Interest (2)

17.4 mm shares

3% Interest

BAIRD

Pro Forma

AMGP Corp

29%

18%

31%

19%

3%

Public

Series B

Holders

Project Bronco | Page 14View entire presentation