AngloAmerican Investor Update

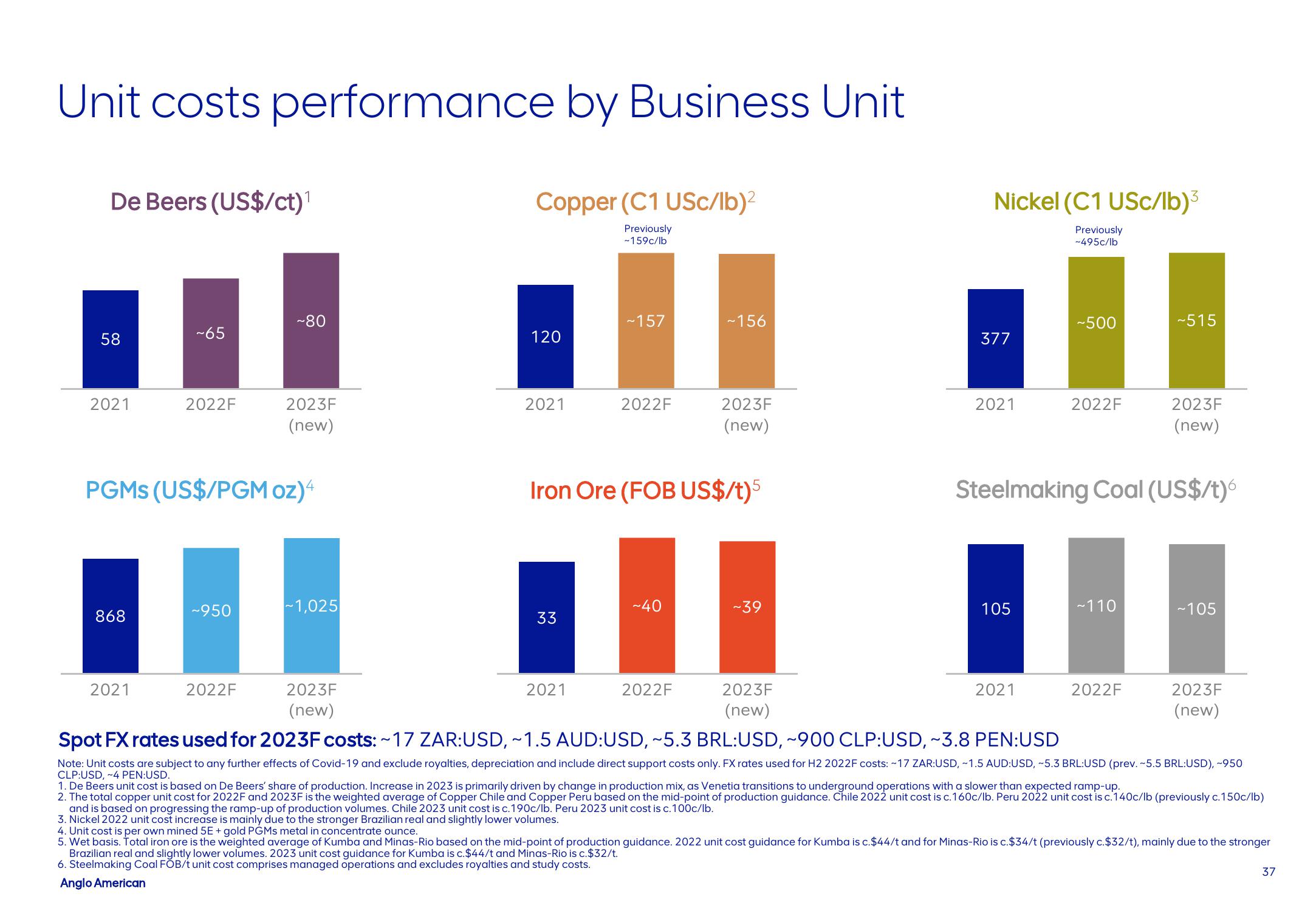

Unit costs performance by Business Unit

De Beers (US$/ct)¹

58

2021

868

~65

2021

2022F

PGMS (US$/PGM oz)4

~950

~80

2022F

2023F

(new)

~1,025

2023F

(new)

Copper (C1 USc/lb)²

Previously

-159c/lb

120

2021

33

~157

2021

2022F

Iron Ore (FOB US$/t)5

~40

~156

2022F

2023F

(new)

-39

2023F

(new)

Nickel (C1 USC/lb)³

Previously

-495c/lb

377

2021

105

~500

2021

2022F

Steelmaking Coal (US$/t)6

~110

~515

2022F

2023F

(new)

~105

2023F

(new)

Spot FX rates used for 2023F costs: ~17 ZAR:USD, ~1.5 AUD:USD, ~5.3 BRL:USD, ~900 CLP:USD, ~3.8 PEN:USD

Note: Unit costs are subject to any further effects of Covid-19 and exclude royalties, depreciation and include direct support costs only. FX rates used for H2 2022F costs: ~17 ZAR:USD, ~1.5 AUD:USD, ~5.3 BRL:USD (prev. ~5.5 BRL:USD), ~950

CLP:USD,-4 PEN:USD.

1. De Beers unit cost is based on De Beers' share of production. Increase in 2023 is primarily driven by change in production mix, as Venetia transitions to underground operations with a slower than expected ramp-up.

2. The total copper unit cost for 2022F and 2023F is the weighted average of Copper Chile and Copper Peru based on the mid-point of production guidance. Chile 2022 unit cost is c.160c/lb. Peru 2022 unit cost is c.140c/lb (previously c.150c/lb)

and is based on progressing the ramp-up of production volumes. Chile 2023 unit cost is c.190c/lb. Peru 2023 unit cost is c. 100c/lb.

3. Nickel 2022 unit cost increase is mainly due to the stronger Brazilian real and slightly lower volumes.

4. Unit cost is per own mined 5E + gold PGMs metal in concentrate ounce.

5. Wet basis. Total iron ore is the weighted average of Kumba and Minas-Rio based on the mid-point of production guidance. 2022 unit cost guidance for Kumba is c.$44/t and for Minas-Rio is c.$34/t (previously c.$32/t), mainly due to the stronger

Brazilian real and slightly lower volumes. 2023 unit cost guidance for Kumba is c.$44/t and Minas-Rio is c.$32/t.

6. Steelmaking Coal FOB/t unit cost comprises managed operations and excludes royalties and study costs.

Anglo American

37View entire presentation