Talkspace Results Presentation Deck

Reconciliation of Net Income to Adjusted EBITDA

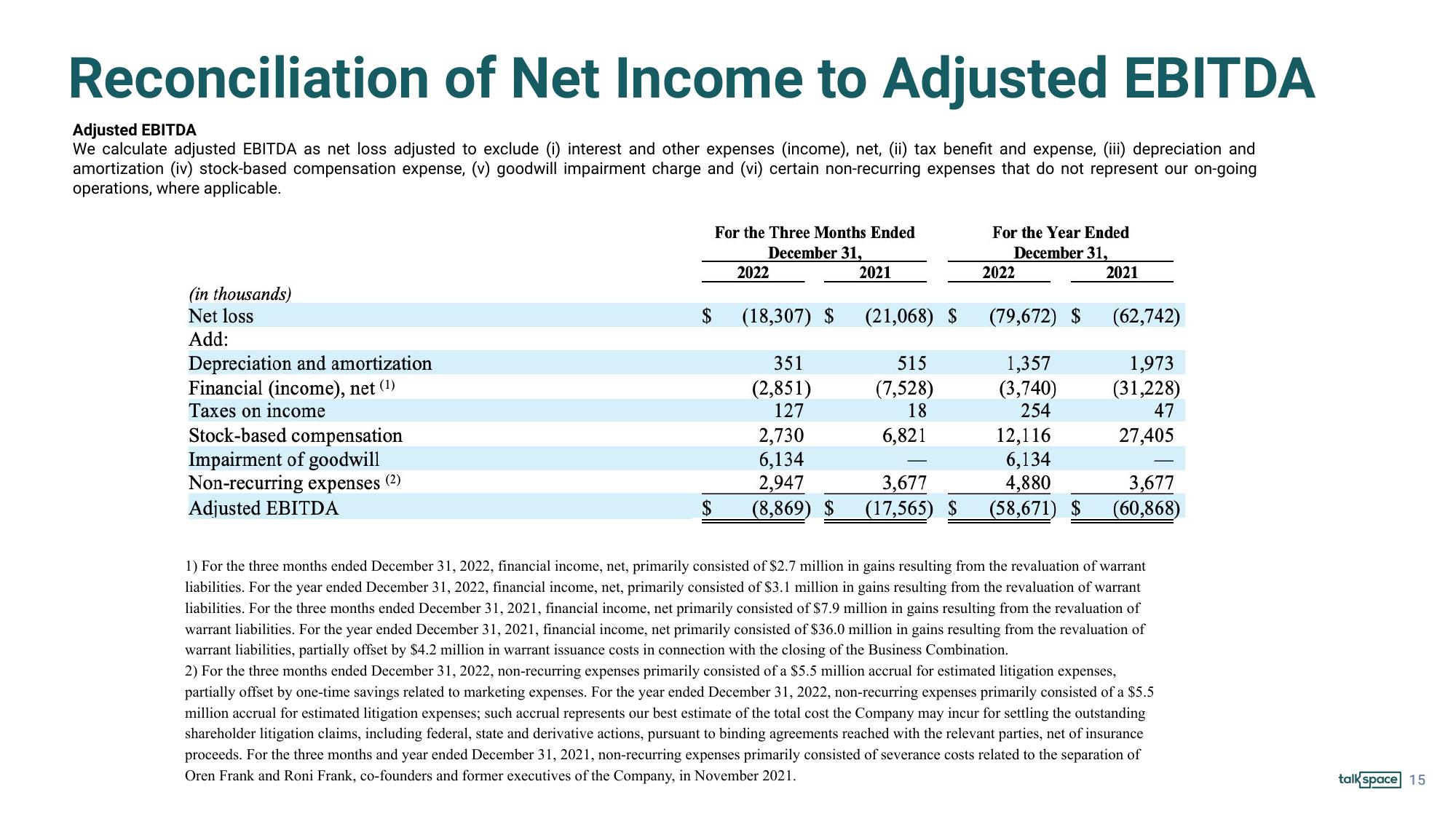

Adjusted EBITDA

We calculate adjusted EBITDA as net loss adjusted to exclude (i) interest and other expenses (income), net, (ii) tax benefit and expense, (iii) depreciation and

amortization (iv) stock-based compensation expense, (v) goodwill impairment charge and (vi) certain non-recurring expenses that do not represent our on-going

operations, where applicable.

(in thousands)

Net loss

Add:

Depreciation and amortization

Financial (income), net (¹)

Taxes on income

Stock-based compensation

Impairment of goodwill

Non-recurring expenses (2)

Adjusted EBITDA

$

$

For the Three Months Ended

December 31,

2021

2022

(18,307) $

351

(2,851)

127

2,730

6,134

2,947

(8,869) $

(21,068) S

515

(7,528)

18

6,821

3,677

(17,565) $

For the Year Ended

December 31,

2021

2022

(79,672) $

1,357

(3,740)

254

12,116

6,134

4,880

(58,671) $

(62,742)

1,973

(31,228)

47

27,405

3,677

(60,868)

1) For the three months ended December 31, 2022, financial income, net, primarily consisted of $2.7 million in gains resulting from the revaluation of warrant

liabilities. For the year ended December 31, 2022, financial income, net, primarily consisted of $3.1 million in gains resulting from the revaluation of warrant

liabilities. For the three months ended December 31, 2021, financial income, net primarily consisted of $7.9 million in gains resulting from the revaluation of

warrant liabilities. For the year ended December 31, 2021, financial income, net primarily consisted of $36.0 million in gains resulting from the revaluation of

warrant liabilities, partially offset by $4.2 million in warrant issuance costs in connection with the closing of the Business Combination.

2) For the three months ended December 31, 2022, non-recurring expenses primarily consisted of a $5.5 million accrual for estimated litigation expenses,

partially offset by one-time savings related to marketing expenses. For the year ended December 31, 2022, non-recurring expenses primarily consisted of a $5.5

million accrual for estimated litigation expenses; such accrual represents our best estimate of the total cost the Company may incur for settling the outstanding

shareholder litigation claims, including federal, state and derivative actions, pursuant to binding agreements reached with the relevant parties, net of insurance

proceeds. For the three months and year ended December 31, 2021, non-recurring expenses primarily consisted of severance costs related to the separation of

Oren Frank and Roni Frank, co-founders and former executives of the Company, in November 2021.

talk space 15View entire presentation