J.P.Morgan Results Presentation Deck

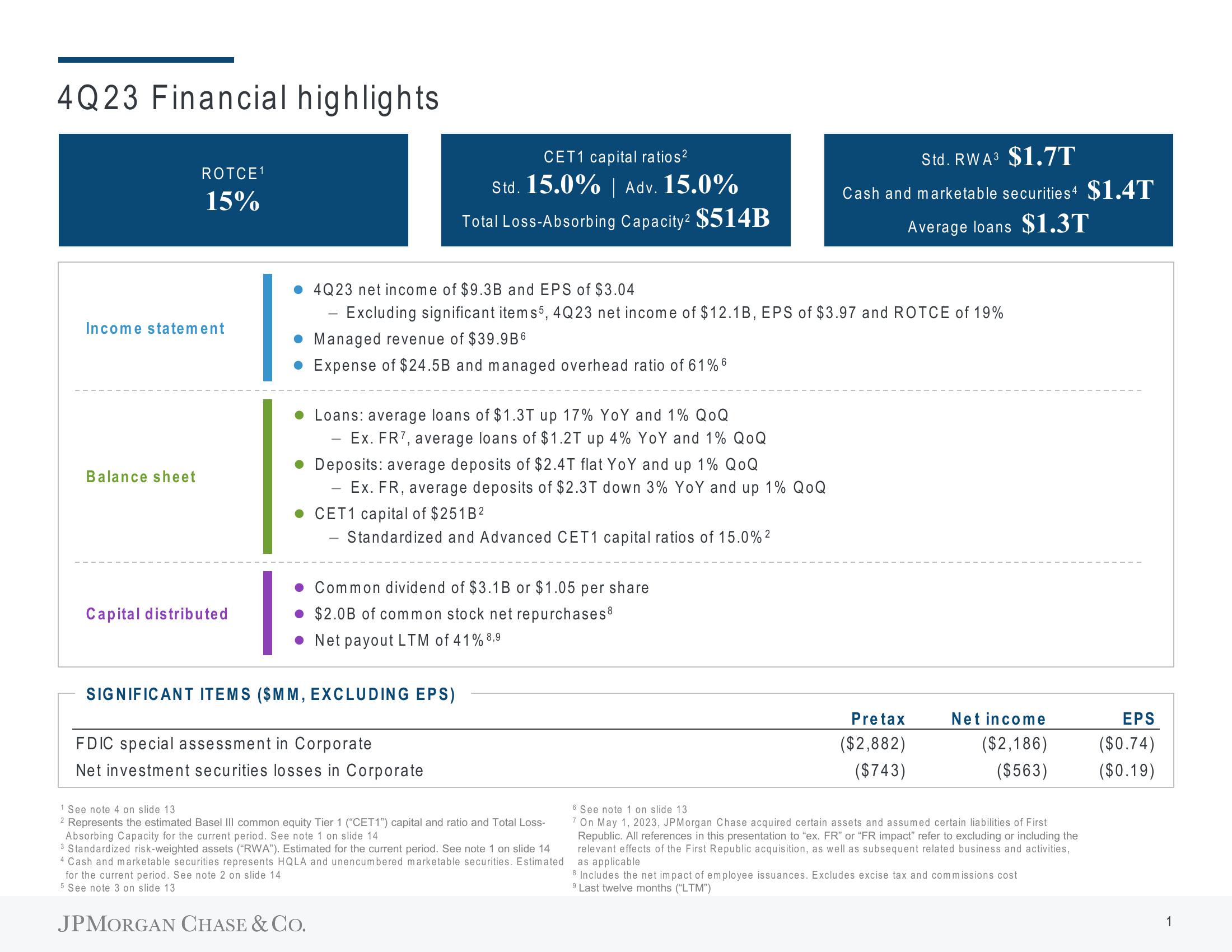

4Q23 Financial highlights

ROTCE¹

15%

Income statement

Balance sheet

Capital distributed

4Q23 net income of $9.3B and EPS of $3.04

Excluding significant items5, 4Q23 net income of $12.1B, EPS of $3.97 and ROTCE of 19%

Managed revenue of $39.9B6

Expense of $24.5B and managed overhead ratio of 61% 6

Loans: average loans of $1.3T up 17% YoY and 1% QOQ

Ex. FR7, average loans of $1.2T up 4% YoY and 1% QOQ

-

JPMORGAN CHASE & CO.

CET1 capital ratios²

Std. 15.0% | Adv. 15.0%

Total Loss-Absorbing Capacity² $514B

Deposits: average deposits of $2.4T flat YoY and up 1% QOQ

Ex. FR, average deposits of $2.3T down 3% YoY and up 1% QOQ

CET1 capital of $251B²

Standardized and Advanced CET1 capital ratios of 15.0% ²

SIGNIFICANT ITEMS ($MM, EXCLUDING EPS)

Common dividend of $3.1B or $1.05 per share

$2.0B of common stock net repurchases8

Net payout LTM of 41% 8,9

FDIC special assessment in Corporate

Net investment securities losses in Corporate

1 See note 4 on slide 13

2 Represents the estimated Basel III common equity Tier 1 ("CET1") capital and ratio and Total Loss-

Absorbing Capacity for the current period. See note 1 on slide 14

3 Standardized risk-weighted assets ("RWA"). Estimated for the current period. See note 1 on slide 14

4 Cash and marketable securities represents HQLA and unencumbered marketable securities. Estimated

for the current period. See note 2 on slide 14

5 See note 3 on slide 13

Std. RWA3 $1.7T

Cash and marketable securities $1.4T

Average loans $1.3T

Pretax

($2,882)

($743)

Net income

($2,186)

($563)

6 See note 1 on slide 13.

7 On May 1, 2023, JPMorgan Chase acquired certain assets and assumed certain liabilities of First

Republic. All references in this presentation to "ex. FR" or "FR impact" refer to excluding or including the

relevant effects of the First Republic acquisition, as well as subsequent related business and activities,

as applicable

8 Includes the net impact of employee issuances. Excludes excise tax and commissions cost

9 Last twelve months ("LTM")

EPS

($0.74)

($0.19)

1View entire presentation