Arrival SPAC Presentation Deck

INVESTOR PRESENTATION

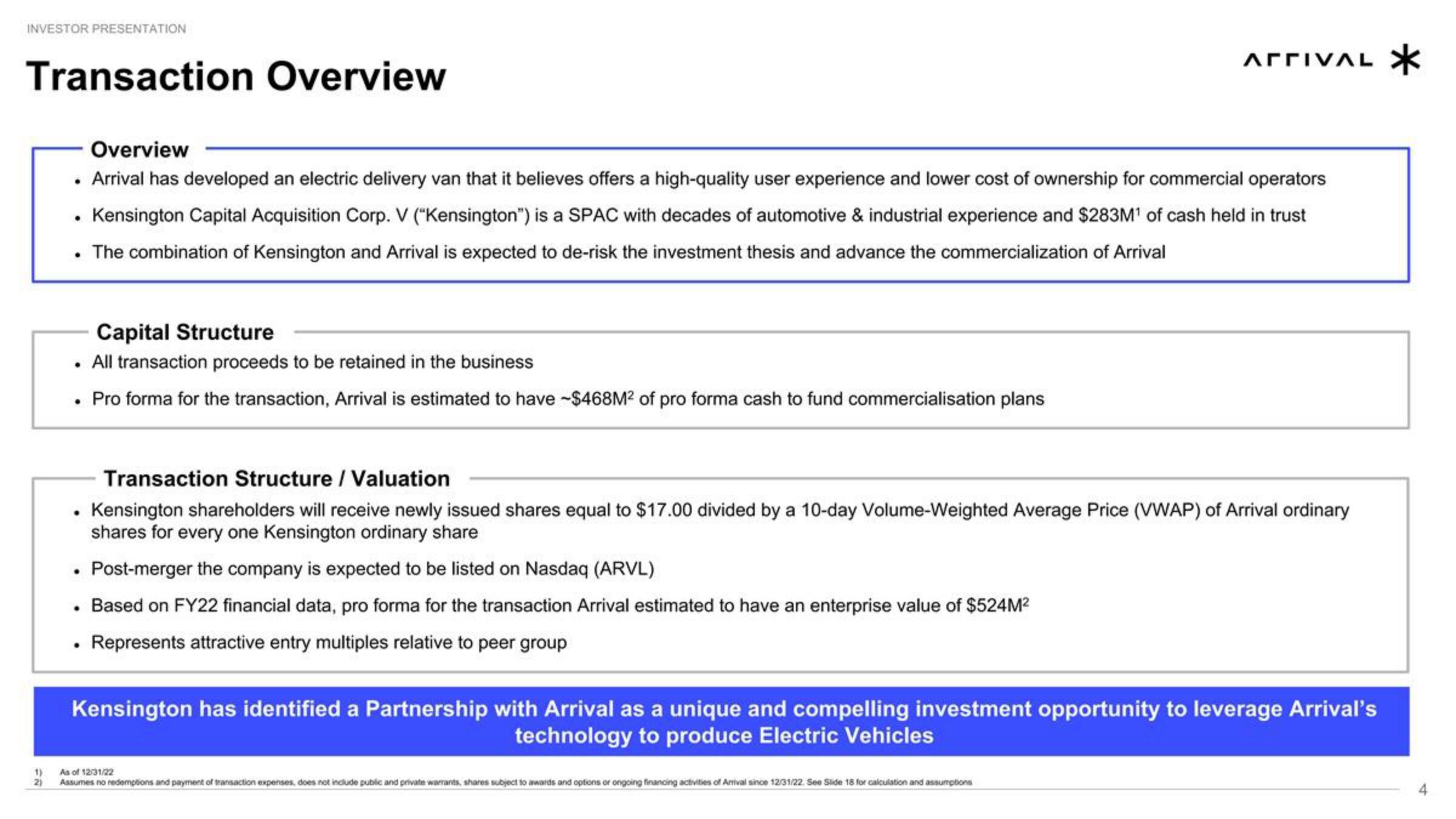

Transaction Overview

2)

Overview

. Arrival has developed an electric delivery van that it believes offers a high-quality user experience and lower cost of ownership for commercial operators

• Kensington Capital Acquisition Corp. V ("Kensington") is a SPAC with decades of automotive & industrial experience and $283M¹ of cash held in trust

• The combination of Kensington and Arrival is expected to de-risk the investment thesis and advance the commercialization of Arrival

Capital Structure

. All transaction proceeds to be retained in the business

. Pro forma for the transaction, Arrival is estimated to have -$468M² of pro forma cash to fund commercialisation plans

ΑΓΓΙVAL

Transaction Structure / Valuation

• Kensington shareholders will receive newly issued shares equal to $17.00 divided by a 10-day Volume-Weighted Average Price (VWAP) of Arrival ordinary

shares for every one Kensington ordinary share

• Post-merger the company is expected to be listed on Nasdaq (ARVL)

. Based on FY22 financial data, pro forma for the transaction Arrival estimated to have an enterprise value of $524M²

. Represents attractive entry multiples relative to peer group

Kensington has identified a Partnership with Arrival as a unique and compelling investment opportunity to leverage Arrival's

technology to produce Electric Vehicles

As of 12/31/22

Assumes no redemptions and payment of transaction expenses, does not include public and private warrants, shares subject to awards and options or ongoing financing activities of Arrival since 12/31/22. See Slide 18 for calculation and assumptionsView entire presentation