Evercore Investment Banking Pitch Book

Valuation Analyses

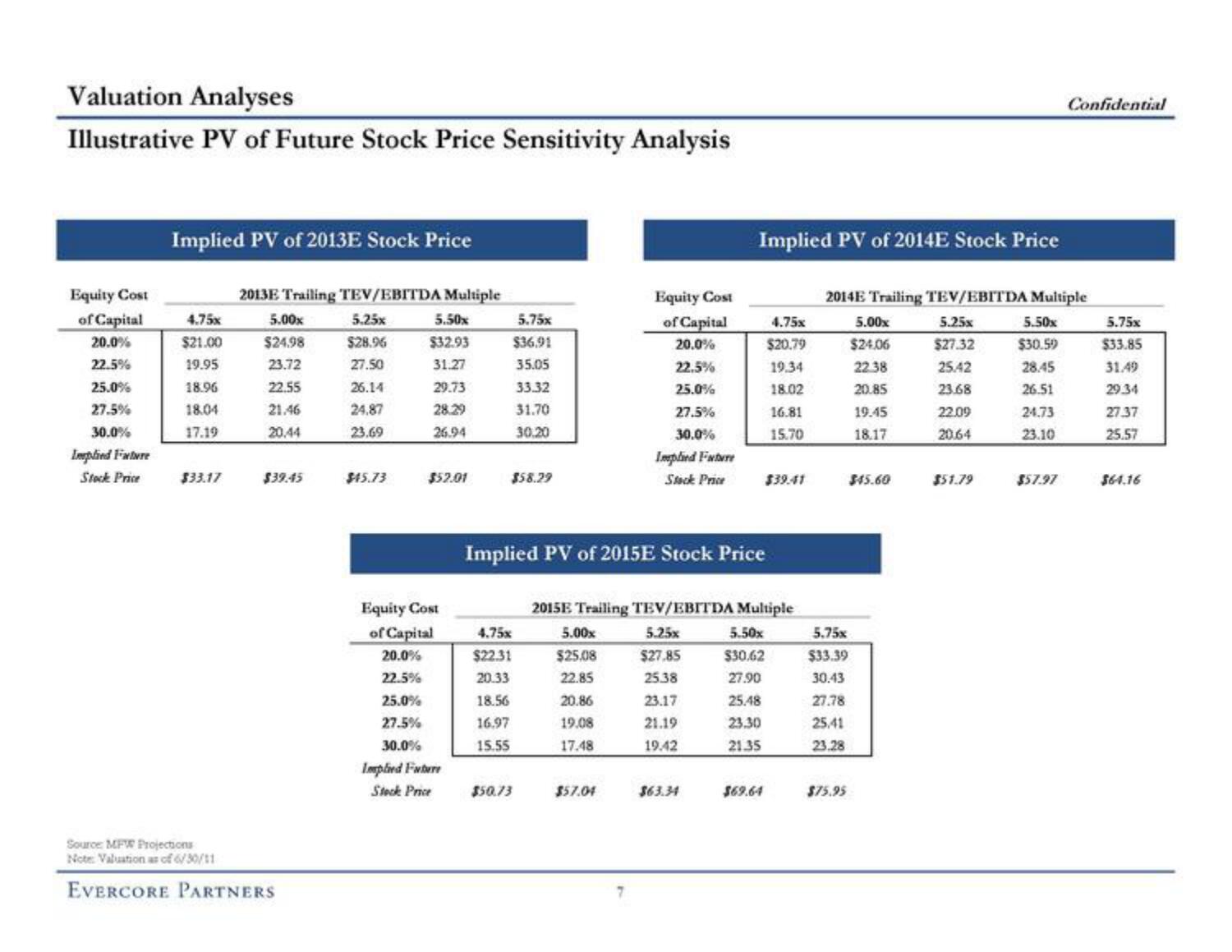

Illustrative PV of Future Stock Price Sensitivity Analysis

Equity Cost

of Capital

20.0%

22.5%

25.0%

27.5%

30.0%

Implied Facture

Stock Price

Implied PV of 2013E Stock Price

4.75x

$21.00

19.95

18.96

18.04

17.19

$33.17

2013E Trailing TEV/EBITDA Multiple

5.00x

5.25x

5.50x

$24.98

$28.96

$32.93

23.72

27.50

31.27

26.14

29.73

24.87

28.29

23.69

26.94

22.55

21.46

20,44

$39.45

Source: MFW Projections

Note: Valuation as of 6/30/11

EVERCORE PARTNERS

$15.73

$52.01

Equity Cost

of Capital

20.0%

22.5%

25.0%

27.5%

30.0%

Implied Future

Stock Price

5.75x

$36.91

35.05

33.32

31.70

30.20

$58.29

4.75x

$22.31

20.33

18.56

16.97

15.55

$50.73

5.00x

$25.08

22.85

Equity Cost

of Capital

20.0%

Implied PV of 2015E Stock Price

20.86

19.08

17.48

22.5%

25.0%

27.5%

30.0%

$57.04

Implied Future

Stock Price

Implied PV of 2014E Stock Price

2015E Trailing TEV/EBITDA Multiple

5.25x

5.50x

$27.85

$30.62

25.38

27.90

23.17

25.48

21.19

23.30

19.42

21.35

$63.34

4.75x

$20.79

19.34

18.02

$69.64

16.81

15.70

$39.41

2014 Trailing TEV/EBITDA Multiple

5.25x

5.50x

$27.32

$30.59

25.42

28.45

23.68

26.51

22.09

24.73

20.64

23.10

5.75x

$33.39

30.43

27.78

25.41

23.28

$75.95

5.00x

$24.06

22.38

20.85

19.45

18.17

$45.60

$51.79

Confidential

$57.97

5.75x

$33.85

31.49

29.34

27.37

25.57

$64.16View entire presentation