J.P.Morgan Results Presentation Deck

Key methodologies used in capital adequacy assessment projections

(cont'd)

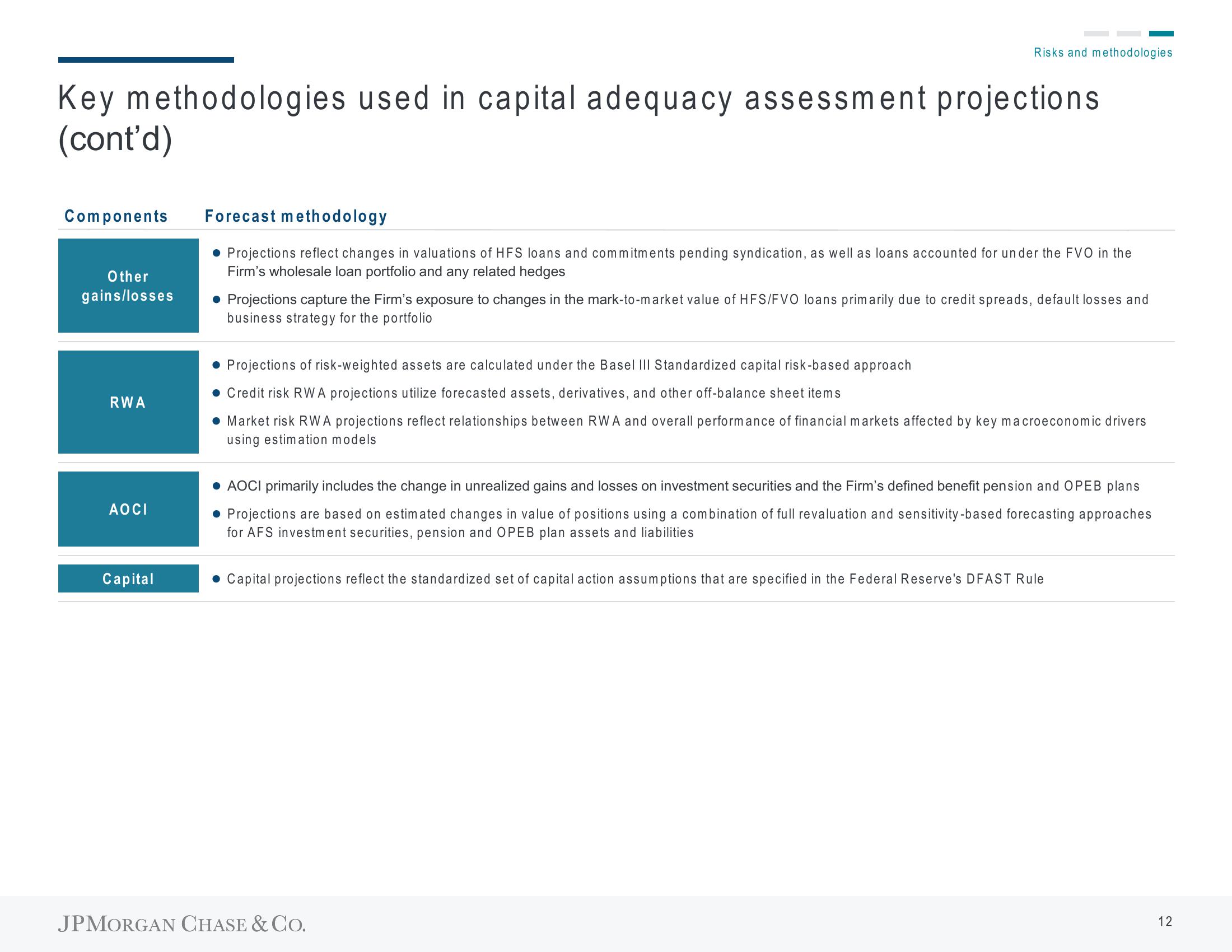

Components

Other

gains/losses

RWA

AOCI

Capital

Risks and methodologies

Forecast methodology

• Projections reflect changes in valuations of HFS loans and commitments pending syndication, as well as loans accounted for under the FVO in the

Firm's wholesale loan portfolio and any related hedges

• Projections capture the Firm's exposure to changes in the mark-to-market value of HFS/FVO loans primarily due to credit spreads, default losses and

business strategy for the portfolio

• Projections of risk-weighted assets are calculated under the Basel III Standardized capital risk-based approach

● Credit risk RW A projections utilize forecasted assets, derivatives, and other off-balance sheet items

• Market risk RW A projections reflect relationships between RWA and overall performance of financial markets affected by key macroeconomic drivers

using estimation models

● AOCI primarily includes the change in unrealized gains and losses on investment securities and the Firm's defined benefit pension and OPEB plans

• Projections are based on estimated changes in value of positions using a combination of full revaluation and sensitivity-based forecasting approaches

for AFS investment securities, pension and OPEB plan assets and liabilities

Capital projections reflect the standardized set of capital action assumptions that are specified in the Federal Reserve's DFAST Rule

JPMORGAN CHASE & CO.

12View entire presentation