Credit Suisse Results Presentation Deck

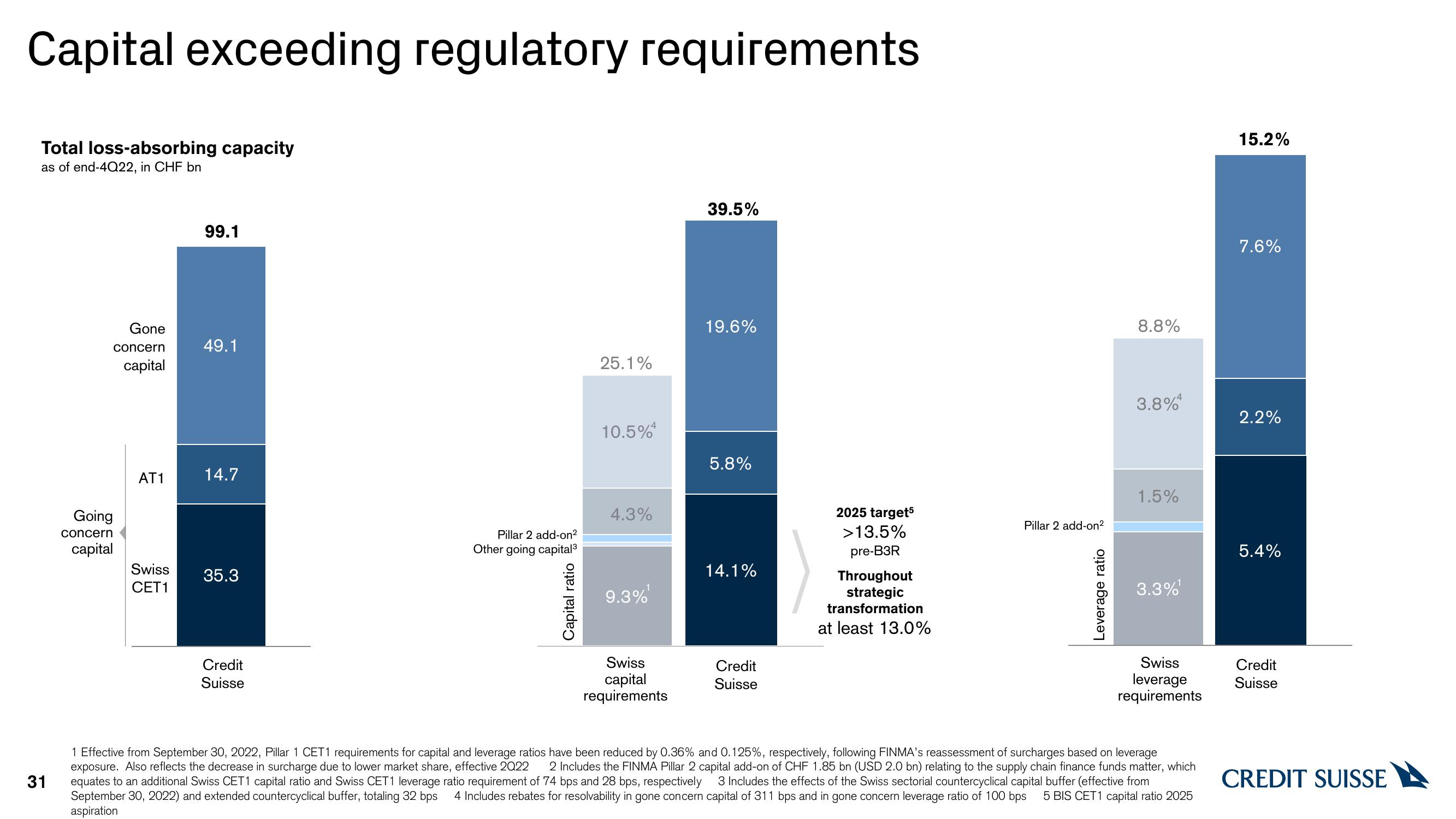

Capital exceeding regulatory requirements

Total loss-absorbing capacity

as of end-4Q22, in CHF bn

31

Gone

concern

capital

Going

concern

capital

AT1

99.1

49.1

14.7

Swiss 35.3

CET1

Credit

Suisse

Pillar 2 add-on²

Other going capital³

Capital ratio

25.1%

10.5%**

4.3%

9.3%

Swiss

capital

requirements

39.5%

19.6%

5.8%

14.1%

Credit

Suisse

2025 target5

>13.5%

pre-B3R

Throughout

strategic

transformation

at least 13.0%

Pillar 2 add-on²

Leverage ratio

8.8%

3.8%A

1.5%

3.3%

Swiss

leverage

requirements

1 Effective from September 30, 2022, Pillar 1 CET1 requirements for capital and leverage ratios have been reduced by 0.36% and 0.125%, respectively, following FINMA's reassessment of surcharges based on leverage

exposure. Also reflects the decrease in surcharge due to lower market share, effective 2022 2 Includes the FINMA Pillar 2 capital add-on of CHF 1.85 bn (USD 2.0 bn) relating to the supply chain finance funds matter, which

equates to an additional Swiss CET1 capital ratio and Swiss CET1 leverage ratio requirement of 74 bps and 28 bps, respectively 3 Includes the effects of the Swiss sectorial countercyclical capital buffer (effective from

September 30, 2022) and extended countercyclical buffer, totaling 32 bps 4 Includes rebates for resolvability in gone concern capital of 311 bps and in gone concern leverage ratio of 100 bps 5 BIS CET1 capital ratio 2025

aspiration

15.2%

7.6%

2.2%

5.4%

Credit

Suisse

CREDIT SUISSEView entire presentation