J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

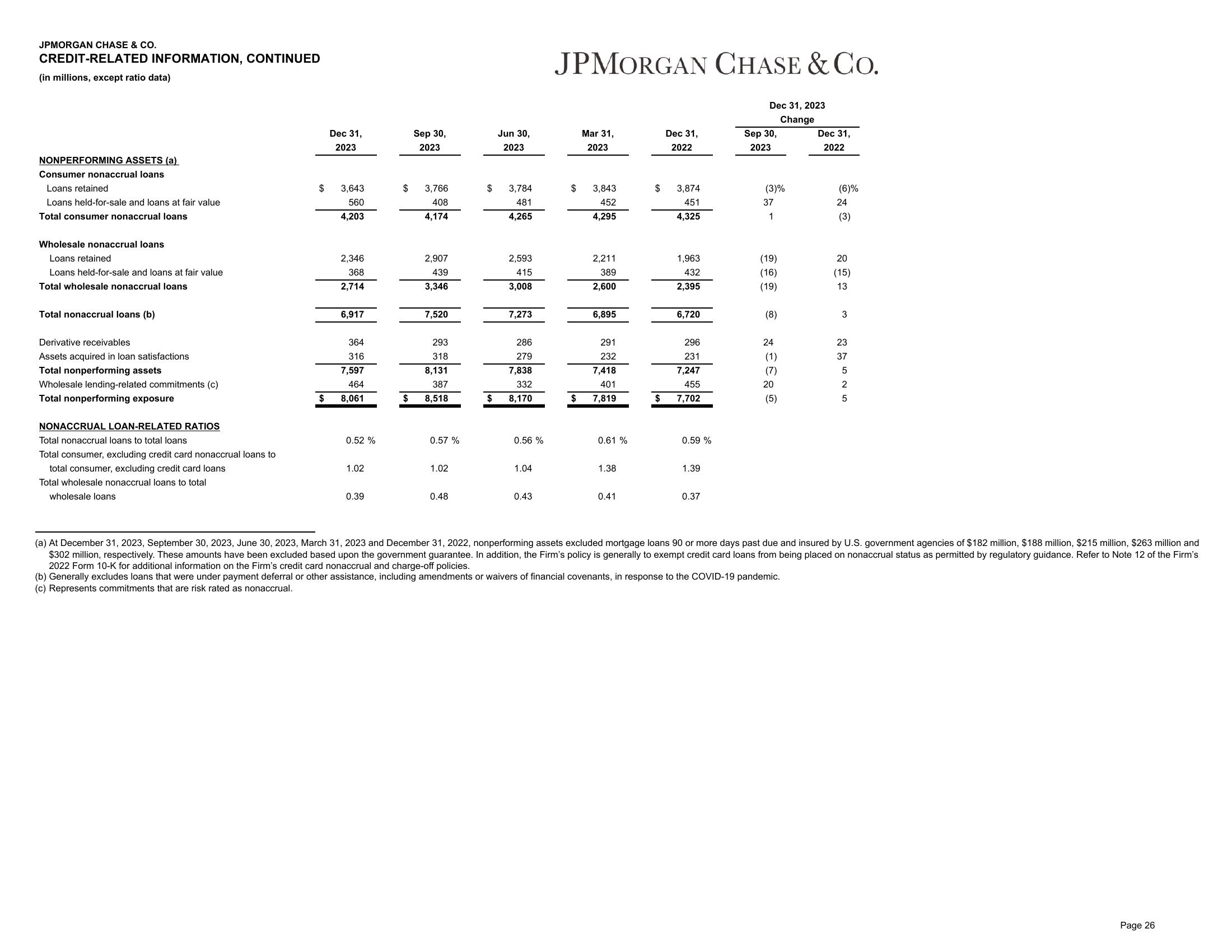

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

NONPERFORMING ASSETS (a)

Consumer nonaccrual loans

Loans retained

Loans held-for-sale and loans at fair value

Total consumer nonaccrual loans

Wholesale nonaccrual loans

Loans retained

Loans held-for-sale and loans at fair value

Total wholesale nonaccrual loans

Total nonaccrual loans (b)

Derivative receivables

Assets acquired in loan satisfactions

Total nonperforming assets

Wholesale lending-related commitments (c)

Total nonperforming exposure

NONACCRUAL LOAN-RELATED RATIOS

Total nonaccrual loans to total loans

Total consumer, excluding credit card nonaccrual loans to

total consumer, excluding credit card loans

Total wholesale nonaccrual loans to total

wholesale loans

$

$

Dec 31,

2023

3,643

560

4,203

2,346

368

2,714

6,917

364

316

7,597

464

8,061

0.52 %

1.02

0.39

$

Sep 30,

2023

3,766

408

4,174

2,907

439

3,346

7,520

293

318

8,131

387

$ 8,518

0.57 %

1.02

0.48

$

Jun 30,

2023

3,784

481

4,265

2,593

415

3,008

7,273

286

279

7,838

332

$ 8,170

0.56%

1.04

0.43

JPMORGAN CHASE & CO.

$

Mar 31,

2023

3,843

452

4,295

2,211

389

2,600

6,895

291

232

7,418

401

$ 7,819

0.61 %

1.38

0.41

$

$

Dec 31,

2022

3,874

451

4,325

1,963

432

2,395

6,720

296

231

7,247

455

7,702

0.59 %

1.39

0.37

Dec 31, 2023

Change

Sep 30,

2023

(3)%

37

1

(19)

(16)

(19)

(8)

24

(1)

(7)

20

(5)

Dec 31,

2022

(6)%

24

(3)

20

(15)

13

3

23

37

5

2

5

(a) At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, nonperforming assets excluded mortgage loans 90 or more days past due and insured by U.S. government agencies of $182 million, $188 million, $215 million, $263 million and

$302 million, respectively. These amounts have been excluded based upon the government guarantee. In addition, the Firm's policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance. Refer to Note 12 of the Firm's

2022 Form 10-K for additional information on the Firm's credit card nonaccrual and charge-off policies.

(b) Generally excludes loans that were under payment deferral or other assistance, including amendments or waivers of financial covenants, in response to the COVID-19 pandemic.

(c) Represents commitments that are risk rated as nonaccrual.

Page 26View entire presentation