J.P.Morgan Investment Banking

APPENDIX

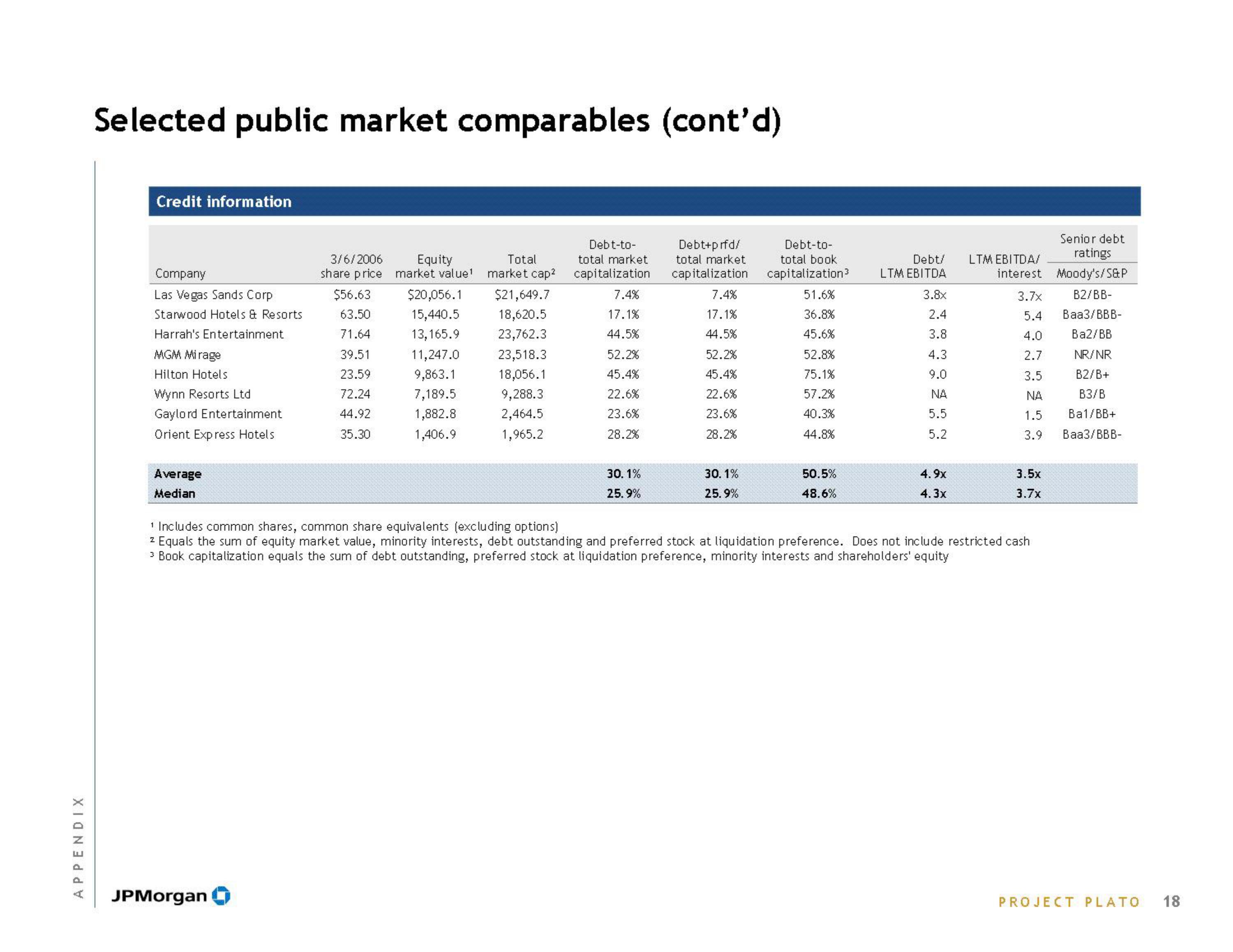

Selected public market comparables (cont'd)

Credit information

Company

Las Vegas Sands Corp

Starwood Hotels & Resorts

Harrah's Entertainment

MGM Mirage

Hilton Hotels

Wynn Resorts Ltd

Gaylord Entertainment

Orient Express Hotels

Average

Median

3/6/2006

Equity

share price market value¹

$56.63 $20,056.1

63.50

15,440.5

71.64

13,165.9

39.51

11,247.0

23.59

9,863.1

72.24

7,189.5

44.92

1,882.8

35.30

1,406.9

JPMorgan

Debt-to-

Total

total market

market cap² capitalization

$21,649.7

7.4%

18,620.5

17.1%

23,762.3

44.5%

23,518.3

52.2%

18,056.1

45.4%

9,288.3

22.6%

2,464.5

23.6%

1,965.2

28.2%

30.1%

25.9%

Debt+prfd/

total market

capitalization

7.4%

17.1%

44.5%

52.2%

45.4%

22.6%

23.6%

28.2%

30.1%

25.9%

Debt-to-

total book

capitalization³

51.6%

36.8%

45.6%

52.8%

75.1%

57.2%

40.3%

44.8%

50.5%

48.6%

Debt/

LTM EBITDA

3.8x

2.4

3.8

4.3

9.0

NA

5.5

5.2

4.9x

4.3x

Senior debt

ratings

LTM EBITDA/

interest Moody's/S&P

3.7x

B2/BB-

5.4 Baa3/BBB-

4.0

Ba2/BB

2.7

NR/NR

3.5

NA

B2/B+

B3/B

Ba1/BB+

Baa3/BBB-

1.5

3.9

3.5x

3.7x

¹ Includes common shares, common share equivalents (excluding options)

z Equals the sum of equity market value, minority interests, debt outstanding and preferred stock at liquidation preference. Does not include restricted cash

> Book capitalization equals the sum of debt outstanding, preferred stock at liquidation preference, minority interests and shareholders' equity

PROJECT PLATO 18View entire presentation