Trian Partners Activist Presentation Deck

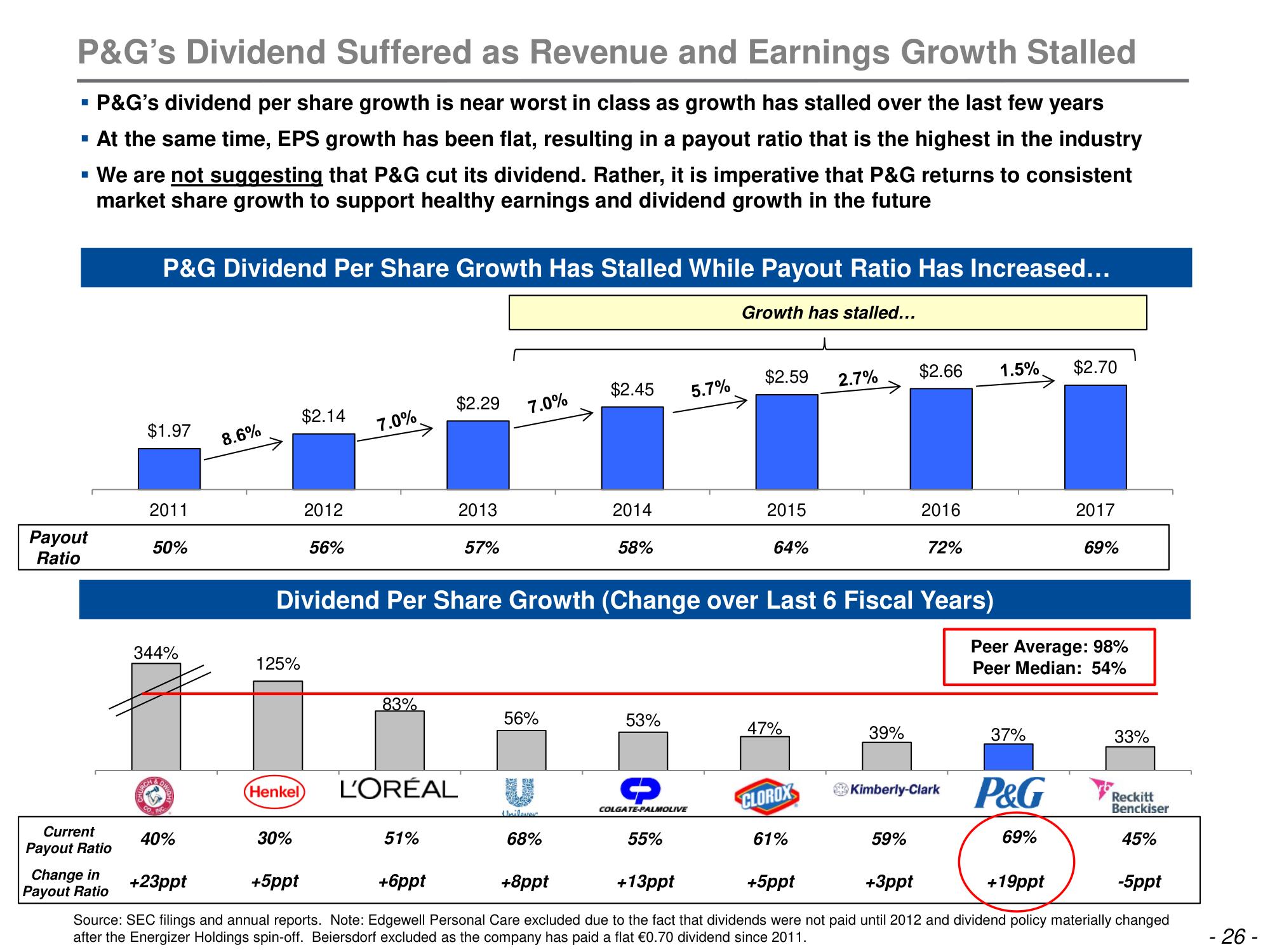

P&G's Dividend Suffered as Revenue and Earnings Growth Stalled

P&G's dividend per share growth is near worst in class as growth has stalled over the last few years

▪ At the same time, EPS growth has been flat, resulting in a payout ratio that is the highest in the industry

We are not suggesting that P&G cut its dividend. Rather, it is imperative that P&G returns to consistent

market share growth to support healthy earnings and dividend growth in the future

■

Payout

Ratio

Current

Payout Ratio

Change in

Payout Ratio

P&G Dividend Per Share Growth Has Stalled While Payout Ratio Has Increased...

Growth has stalled...

$1.97

2011

50%

344%

URCH

DWI

LING

40%

8.6%

125%

(Henkel

$2.14

30%

2012

56%

7.0%

83%

$2.29

L'ORÉAL

51%

2013

57%

7.0%

56%

Dividend Per Share Growth (Change over Last 6 Fiscal Years)

Unilever

$2.45

68%

2014

58%

53%

→

COLGATE-PALMOLIVE

5.7%

55%

$2.59

2015

64%

47%

CLOROX

2.7%

61%

39%

$2.66

2016

72%

59%

1.5%

37%

Kimberly-Clark P&G

$2.70

Peer Average: 98%

Peer Median: 54%

69%

2017

69%

33%

Reckitt

Benckiser

45%

+23ppt

+5ppt

+6ppt

+8ppt

+13ppt

+5ppt

+3ppt

+19ppt

-5ppt

Source: SEC filings and annual reports. Note: Edgewell Personal Care excluded due to the fact that dividends were not paid until 2012 and dividend policy materially changed

after the Energizer Holdings spin-off. Beiersdorf excluded as the company has paid a flat €0.70 dividend since 2011.

- 26 -View entire presentation