LSE Investor Presentation Deck

SwapClear and ForexClear

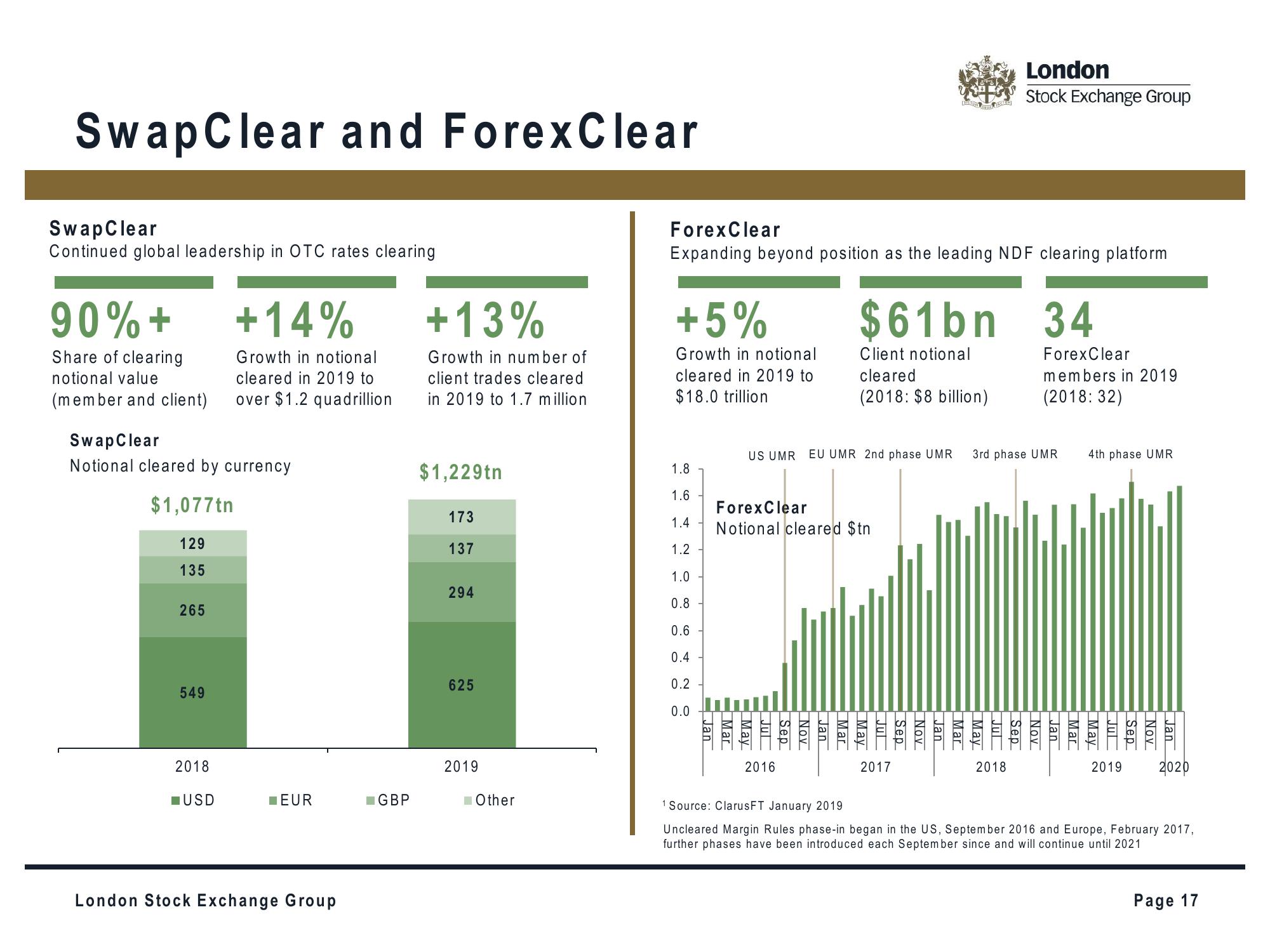

SwapClear

Continued global leadership in OTC rates clearing

90%+

Share of clearing

notional value

(member and client)

SwapClear

Notional cleared by currency

$1,077tn

129

135

265

549

2018

+14%

Growth in notional

cleared in 2019 to

over $1.2 quadrillion

USD

EUR

London Stock Exchange Group

GBP

+13%

Growth in number of

client trades cleared

in 2019 to 1.7 million

$1,229tn

173

137

294

625

2019

Other

ForexClear

Expanding beyond position as the leading NDF clearing platform

+5%

Growth in notional

cleared in 2019 to

$18.0 trillion

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

ForexClear

Notional cleared $tn

Jan

Mar

May

US UMR EU UMR 2nd phase UMR 3rd phase UMR

Jul

Sep

$61bn 34

Client notional

cleared

(2018: $8 billion)

2016

London

Stock Exchange Group

Nov

Jan

Mar

May

Jul

Sep

NOV

Jan

2017

ForexClear

members in 2019

(2018: 32)

2018

4th phase UMR

Mar

May

Jul

Sep

Nov

Jan

Mar

May

Sep

Nov

Jan

2019 2020

1 Source: ClarusFT January 2019

Uncleared Margin Rules phase-in began in the US, September 2016 and Europe, February 2017,

further phases have been introduced each September since and will continue until 2021

Page 17View entire presentation