J.P.Morgan ESG Presentation Deck

F

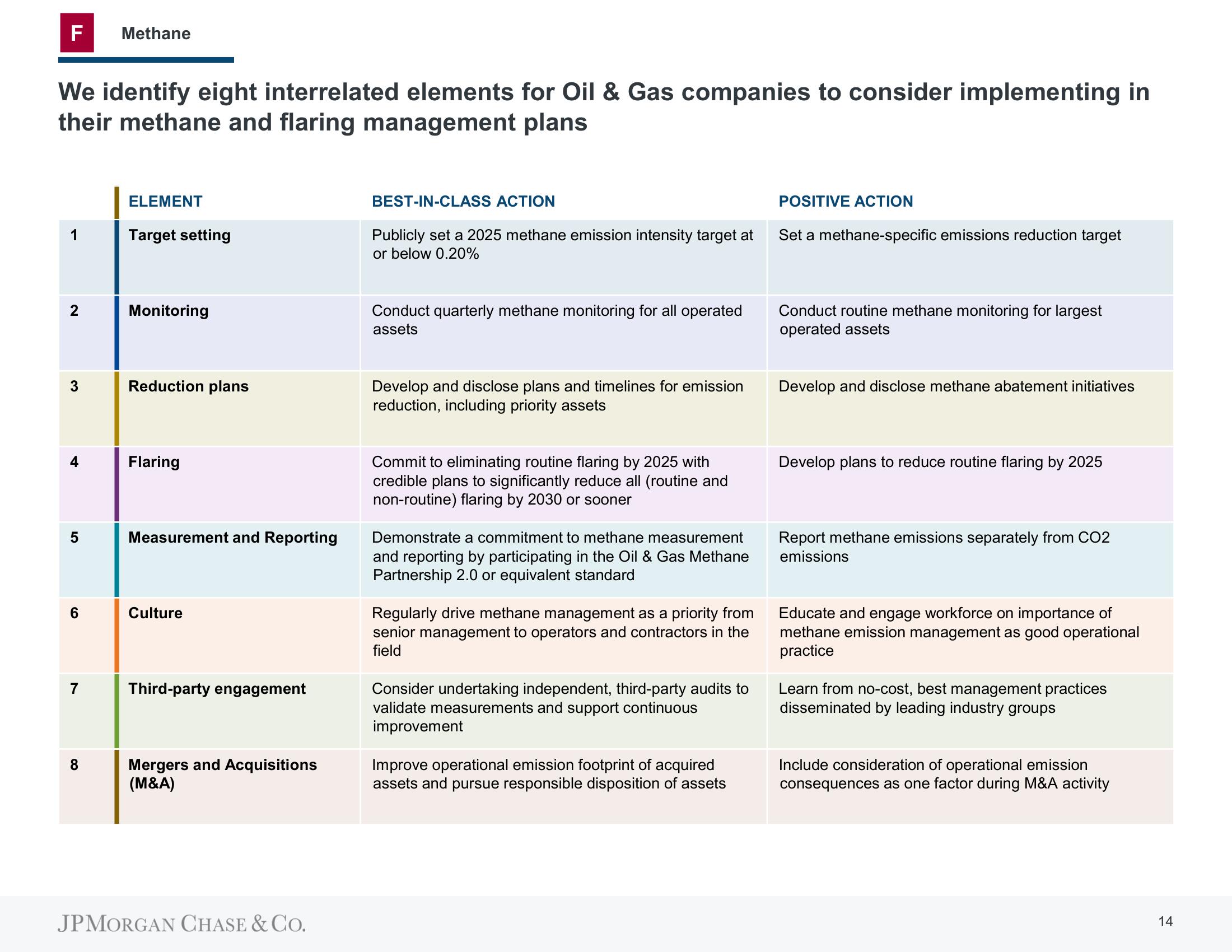

We identify eight interrelated elements for Oil & Gas companies to consider implementing in

their methane and flaring management plans

1

2

3

4

LO

5

6

7

Methane

8

ELEMENT

Target setting

Monitoring

Reduction plans

Flaring

Measurement and Reporting

Culture

Third-party engagement

Mergers and Acquisitions

(M&A)

JPMORGAN CHASE & CO.

BEST-IN-CLASS ACTION

Publicly set a 2025 methane emission intensity target at

or below 0.20%

Conduct quarterly methane monitoring for all operated

assets

Develop and disclose plans and timelines for emission

reduction, including priority assets

Commit to eliminating routine flaring by 2025 with

credible plans to significantly reduce all (routine and

non-routine) flaring by 2030 or sooner

Demonstrate a commitment to methane measurement

and reporting by participating in the Oil & Gas Methane

Partnership 2.0 or equivalent standard

Regularly drive methane management as a priority from

senior management to operators and contractors in the

field

Consider undertaking independent, third-party audits to

validate measurements and support continuous

improvement

Improve operational emission footprint of acquired

assets and pursue responsible disposition of assets

POSITIVE ACTION

Set a methane-specific emissions reduction target

Conduct routine methane monitoring for largest

operated assets

Develop and disclose methane abatement initiatives

Develop plans to reduce routine flaring by 2025

Report methane emissions separately from CO2

emissions

Educate and engage workforce on importance of

methane emission management as good operational

practice

Learn from no-cost, best management practices

disseminated by leading industry groups

Include consideration of operational emission

consequences as one factor during M&A activity

14View entire presentation