Samsara Investor Day Presentation Deck

71

©Samsara Inc.

samsara

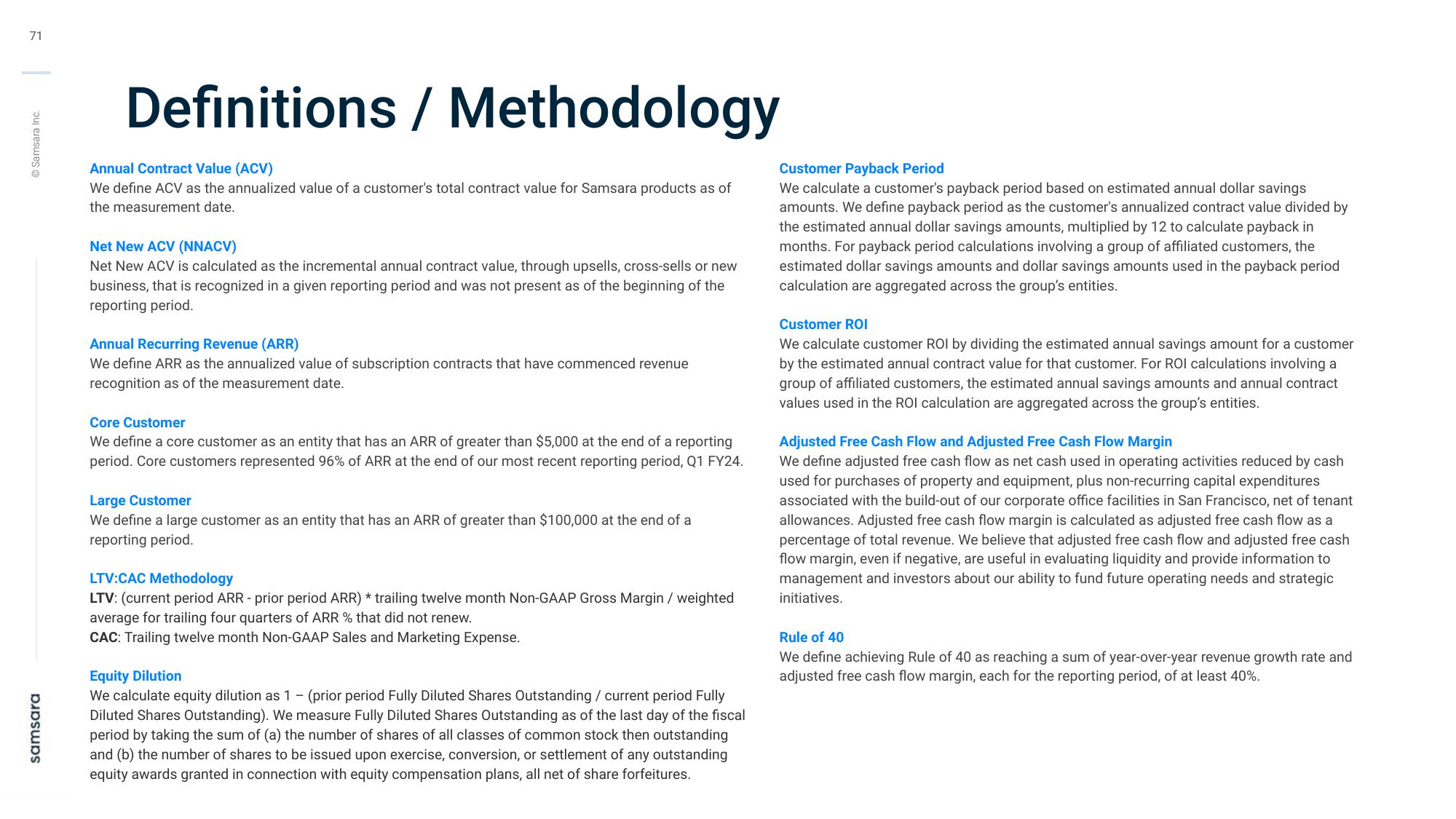

Definitions / Methodology

Annual Contract Value (ACV)

We define ACV as the annualized value of a customer's total contract value for Samsara products as of

the measurement date.

Net New ACV (NNACV)

Net New ACV is calculated as the incremental annual contract value, through upsells, cross-sells or new

business, that is recognized in a given reporting period and was not present as of the beginning of the

reporting period.

Annual Recurring Revenue (ARR)

We define ARR as the annualized value of subscription contracts that have commenced revenue

recognition as of the measurement date.

Core Customer

We define a core customer as an entity that has an ARR of greater than $5,000 at the end of a reporting

period. Core customers represented 96% of ARR at the end of our most recent reporting period, Q1 FY24.

Large Customer

We define a large customer as an entity that has an ARR of greater than $100,000 at the end of a

reporting period.

LTV:CAC Methodology

LTV: (current period ARR - prior period ARR) * trailing twelve month Non-GAAP Gross Margin / weighted

average for trailing four quarters of ARR % that did not renew.

CAC: Trailing twelve month Non-GAAP Sales and Marketing Expense.

Equity Dilution

We calculate equity dilution as 1 - (prior period Fully Diluted Shares Outstanding / current period Fully

Diluted Shares Outstanding). We measure Fully Diluted Shares Outstanding as of the last day of the fiscal

period by taking the sum of (a) the number of shares of all classes of common stock then outstanding

and (b) the number of shares to be issued upon exercise, conversion, or settlement of any outstanding

equity awards granted in connection with equity compensation plans, all net of share forfeitures.

Customer Payback Period

We calculate a customer's payback period based on estimated annual dollar savings

amounts. We define payback period as the customer's annualized contract value divided by

the estimated annual dollar savings amounts, multiplied by 12 to calculate payback in

months. For payback period calculations involving a group of affiliated customers, the

estimated dollar savings amounts and dollar savings amounts used in the payback period

calculation are aggregated across the group's entities.

Customer ROI

We calculate customer ROI by dividing the estimated annual savings amount for a customer

by the estimated annual contract value for that customer. For ROI calculations involving a

group of affiliated customers, the estimated annual savings amounts and annual contract

values used in the ROI calculation are aggregated across the group's entities.

Adjusted Free Cash Flow and Adjusted Free Cash Flow Margin

We define adjusted free cash flow as net cash used in operating activities reduced by cash

used for purchases of property and equipment, plus non-recurring capital expenditures

associated with the build-out of our corporate office facilities in San Francisco, net of tenant

allowances. Adjusted free cash flow margin is calculated as adjusted free cash flow as a

percentage of total revenue. We believe that adjusted free cash flow and adjusted free cash

flow margin, even if negative, are useful in evaluating liquidity and provide information to

management and investors about our ability to fund future operating needs and strategic

initiatives.

Rule of 40

We define achieving Rule of 40 as reaching a sum of year-over-year revenue growth rate and

adjusted free cash flow margin, each for the reporting period, of at least 40%.View entire presentation