Origin SPAC Presentation Deck

Approach

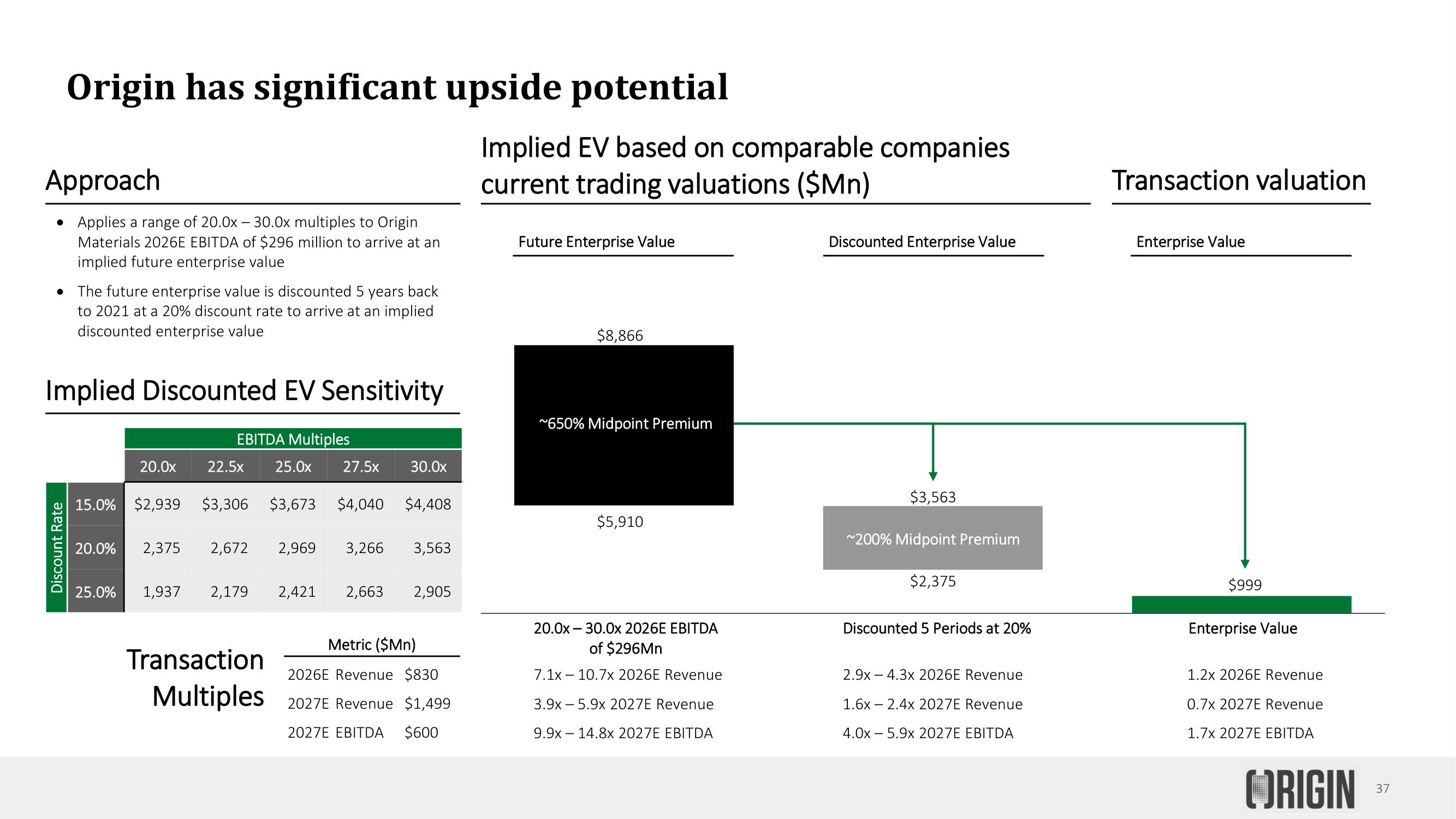

• Applies a range of 20.0x - 30.0x multiples to Origin

Materials 2026E EBITDA of $296 million to arrive at an

implied future enterprise value

●

Origin has significant upside potential

Discount Rate

The future enterprise value is discounted 5 years back

to 2021 at a 20% discount rate to arrive at an implied

discounted enterprise value

Implied Discounted EV Sensitivity

20.0x

15.0% $2,939

20.0% 2,375

25.0% 1,937

EBITDA Multiples

22.5× 25.0x 27.5x 30.0x

$3,306 $3,673 $4,040 $4,408

2,672 2,969 3,266 3,563

2,179

Transaction

Multiples

2,421 2,663 2,905

Metric ($Mn)

2026E Revenue $830

2027E Revenue $1,499

2027E EBITDA $600

Implied EV based on comparable companies

current trading valuations ($Mn)

Future Enterprise Value

$8,866

~650% Midpoint Premium

$5,910

20.0x - 30.0x 2026E EBITDA

of $296Mn

7.1x10.7x 2026E Revenue

3.9x5.9x 2027E Revenue

9.9x14.8x 2027E EBITDA

Discounted Enterprise Value

$3,563

~200% Midpoint Premium

$2,375

Discounted 5 Periods at 20%

2.9x - 4.3x 2026E Revenue

1.6x2.4x 2027E Revenue

4.0x 5.9x 2027E EBITDA

Transaction valuation

Enterprise Value

$999

Enterprise Value

1.2x 2026E Revenue

0.7x 2027E Revenue

1.7x 2027E EBITDA

ORIGIN

37View entire presentation