PJT Partners Investment Banking Pitch Book

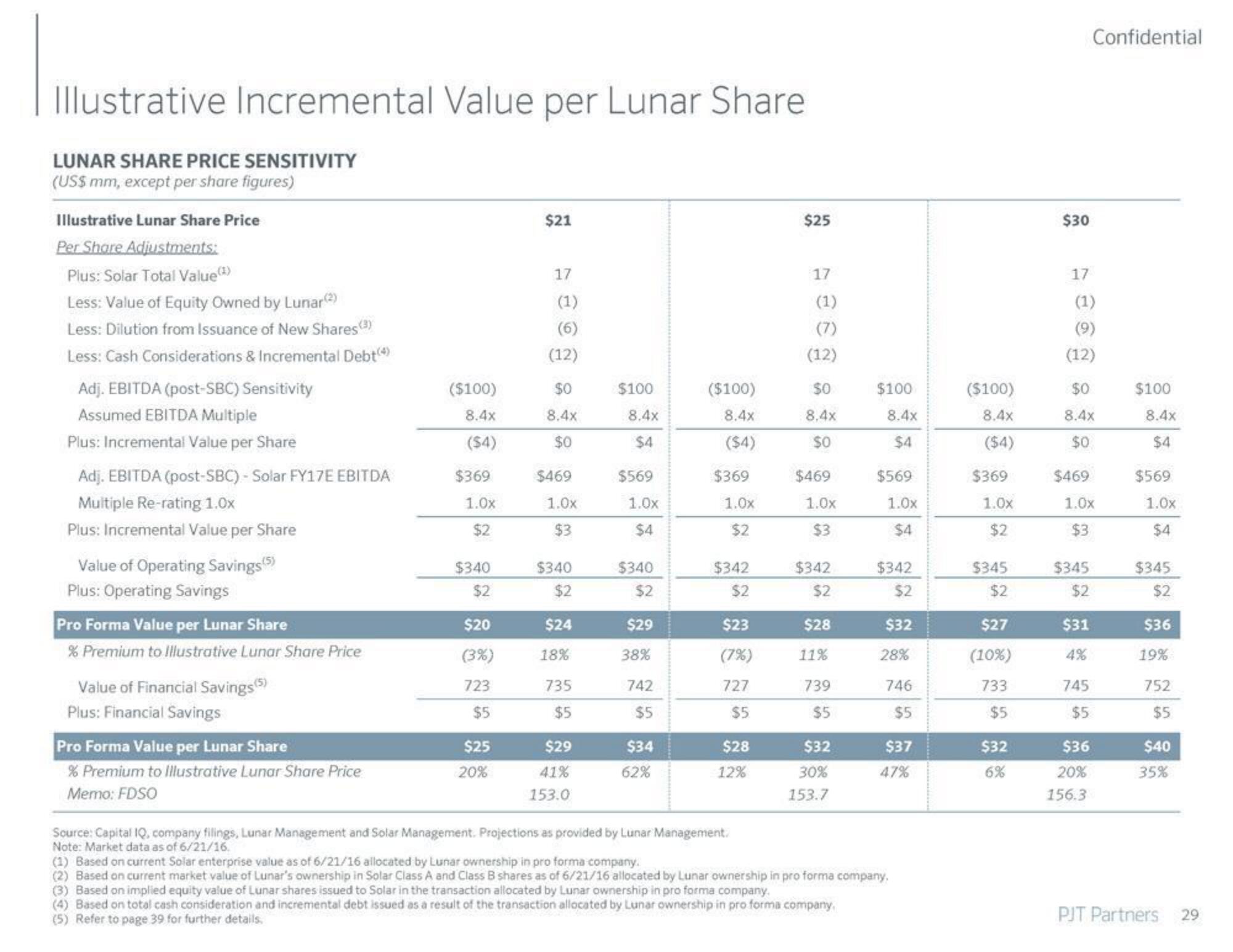

Illustrative Incremental Value per Lunar Share

LUNAR SHARE PRICE SENSITIVITY

(US$ mm, except per share figures)

Illustrative Lunar Share Price

Per Share Adjustments:

Plus: Solar Total Value(¹)

Less: Value of Equity Owned by Lunar(2)

Less: Dilution from Issuance of New Shares (3)

Less: Cash Considerations & Incremental Debt (4)

Adj. EBITDA (post-SBC) Sensitivity

Assumed EBITDA Multiple

Plus: Incremental Value per Share

Adj. EBITDA (post-SBC)- Solar FY17E EBITDA

Multiple Re-rating 1.0x

Plus: Incremental Value per Share

Value of Operating Savings (5)

Plus: Operating Savings

Pro Forma Value per Lunar Share

% Premium to Illustrative Lunar Share Price

Value of Financial Savings (5)

Plus: Financial Savings

Pro Forma Value per Lunar Share

% Premium to Illustrative Lunar Share Price

Memo: FDSO

($100)

8.4x

($4)

$369

1.0x

$2

$340

$2

$20

(3%)

723

$5

$25

20%

$21

17

(1)

(6)

(12)

$0

8.4x

$0

$469

1.0x

$3

$340

$2

$24

18%

735

$5

$29

41%

153.0

$100

8.4x

$4

$569

1.0x

$4

$340

$2

$29

38%

742

$5

$34

62%

($100)

8.4x

($4)

$369

1.0x

$2

$342

$2

$23

(7%)

727

$5

$28

12%

Source: Capital IQ, company filings, Lunar Management and Solar Management. Projections as provided by Lunar Management.

Note: Market data as of 6/21/16

$25

17

(1)

(7)

(12)

$0

8.4x

$0

$469

1.0x

$3

$342

$2

$28

11%

739

$5

$32

30%

153.7

$100

(4) Based on total cash consideration and incremental debt issued as a result of the transaction allocated by Lunar ownership in pro forma company.

(5) Refer to page 39 for further details.

8.4x

$4

$569

1.0x

$4

$342

$2

$32

28%

746

$5

$37

47%

(1) Based on current Solar enterprise value as of 6/21/16 allocated by Lunar ownership in pro forma company.

(2) Based on current market value of Lunar's ownership in Solar Class A and Class B shares as of 6/21/16 allocated by Lunar ownership in pro forma company,

(3) Based on implied equity value of Lunar shares issued to Solar in the transaction allocated by Lunar ownership in pro forma company.

($100)

8.4x

($4)

$369

1.0x

$2

$345

$2

$27

(10%)

733

$5

$32

6%

$30

17

(1)

(9)

(12)

$0

8.4x

$0

$469

1.0x

$3

$345

$2

$31

4%

Confidential

745

$5

$36

20%

156.3

$100

8.4x

$4

$569

1.0x

$4

$345

$2

$36

19%

752

$5

$40

35%

PJT Partners

29View entire presentation