Affirm Results Presentation Deck

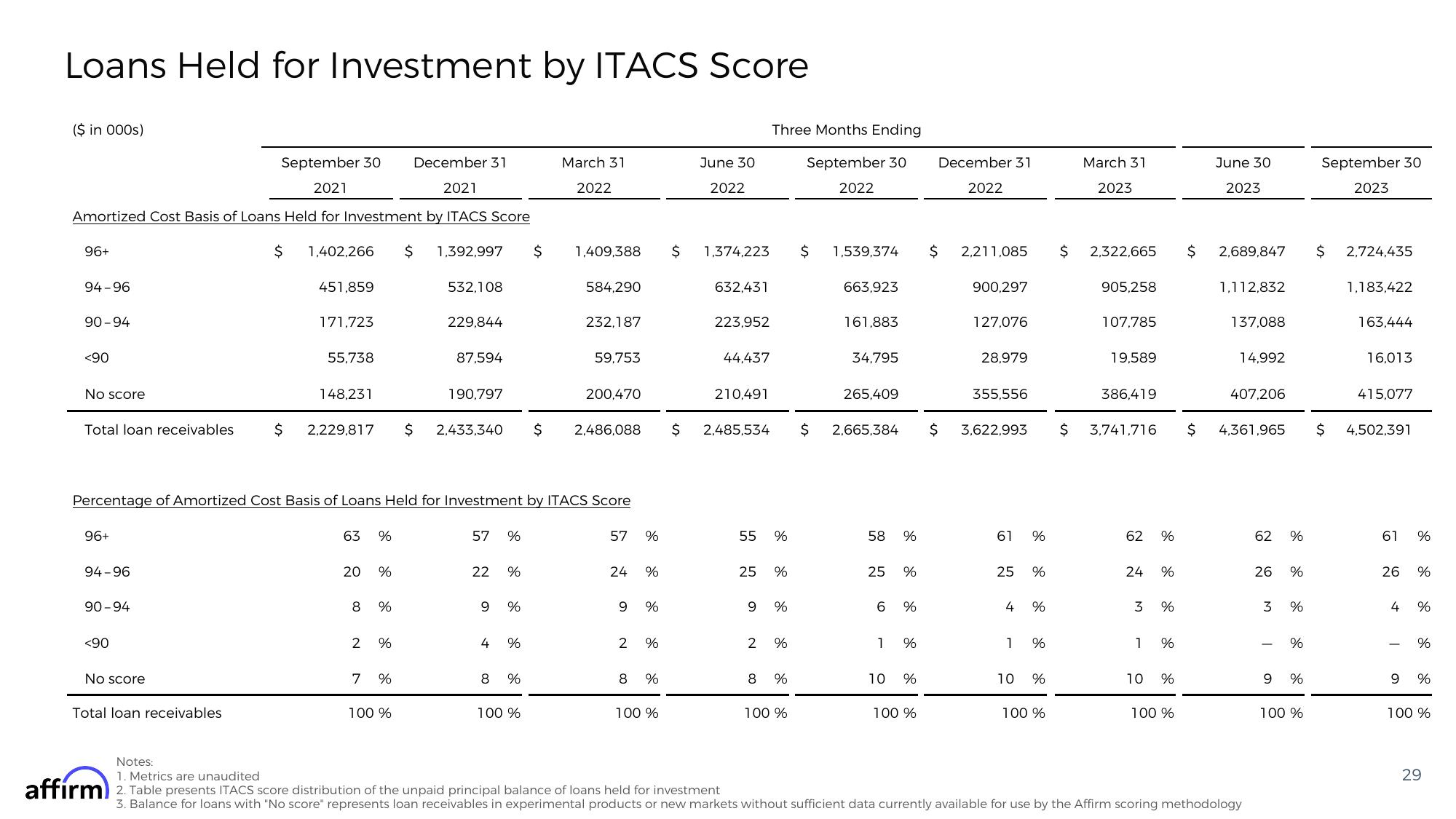

Loans Held for Investment by ITACS Score

($ in 000s)

September 30 December 31

2021

2021

Amortized Cost Basis of Loans Held for Investment by ITACS Score

$

1,402,266 $ 1,392,997 $

96+

94-96

90-94

<90

No score

Total loan receivables

96+

94-96

90-94

<90

No score

451,859

Total loan receivables

171,723

55,738

148,231

63 %

20 %

Percentage of Amortized Cost Basis of Loans Held for Investment by ITACS Score

8

2

7

190,797

$ 2,229,817 $ 2,433,340 $ 2,486,088

%

%

532,108

%

229,844

100 %

87,594

57 %

22

9

4

%

%

%

March 31

2022

8 %

1,409,388

100 %

584,290

232,187

59,753

200,470

57

24

9

%

%

%

2 %

8 %

100 %

June 30

2022

$ 1,374,223

632,431

223,952

44,437

210,491

Three Months Ending

September 30

2022

55 %

25 %

9 %

2 %

8

00

%

$

100 %

1,539,374

663,923

161,883

34,795

$ 2,485,534 $ 2,665,384 $ 3,622,993

265,409

58 %

25

6

1

%

%

%

10 %

December 31

2022

100 %

$ 2,211,085

900,297

127,076

28,979

355,556

61 %

25

4

1

%

%

%

10 %

100 %

March 31

2023

$ 2,322,665 $ 2,689,847

905,258

107,785

19,589

386,419

62 %

24 %

3 %

1

$ 3,741,716 $ 4,361,965

10

%

June 30

2023

%

100 %

1,112,832

137,088

14,992

407,206

Notes:

1. Metrics are unaudited

affirm) 2. Table presents ITACS score distribution of the unpaid principal balance of loans held for investment

3. Balance for loans with "No score" represents loan receivables in experimental products or new markets without sufficient data currently available for use by the Affirm scoring methodology

62 %

26 %

3 %

I

%

9 %

100 %

September 30

2023

$

2,724,435

1,183,422

163,444

16,013

415,077

$ 4,502,391

61 %

26 %

4 %

I

%

9 %

100 %

29View entire presentation