Axos Financial, Inc. Fixed Income Investor Presentation

Select Financials

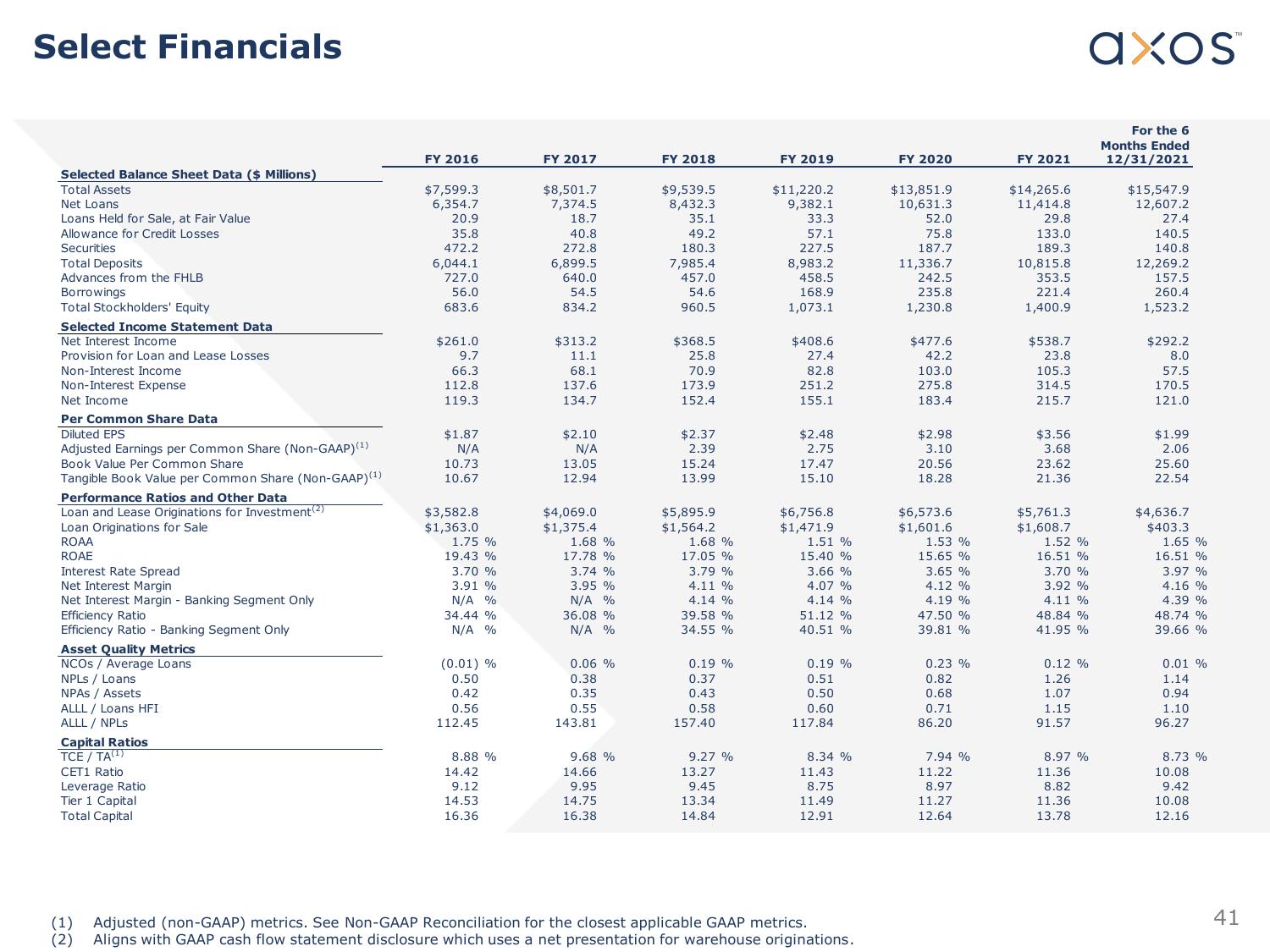

Selected Balance Sheet Data ($ Millions)

Total Assets

Net Loans

Loans Held for Sale, at Fair Value

Allowance for Credit Losses

Securities

Total Deposits

Advances from the FHLB

Borrowings

Total Stockholders' Equity

Selected Income Statement Data

Net Interest Income

Provision for Loan and Lease Losses

Non-Interest Income

Non-Interest Expense

Net Income

Per Common Share Data

Diluted EPS

Adjusted Earnings per Common Share (Non-GAAP)(¹)

Book Value Per Common Share

Tangible Book Value per Common Share (Non-GAAP)(¹)

Performance Ratios and Other Data

Loan and Lease Originations for Investment (2)

Loan Originations for Sale

ROAA

ROAE

Interest Rate Spread

Net Interest Margin

Net Interest Margin - Banking Segment Only

Efficiency Ratio

Efficiency Ratio - Banking Segment Only

Asset Quality Metrics

NCOS / Average Loans

NPLS / Loans

NPAS / Assets

ALLL / Loans HFI

ALLL / NPLs

Capital Ratios

TCE / TA(¹)

CET1 Ratio

Leverage Ratio

Tier 1 Capital

Total Capital

FY 2016

$7,599.3

6,354.7

20.9

35.8

472.2

6,044.1

727.0

56.0

683.6

$261.0

9.7

66.3

112.8

119.3

$1.87

N/A

10.73

10.67

$3,582.8

$1,363.0

1.75 %

19.43 %

3.70 %

3.91 %

N/A %

34.44 %

N/A %

(0.01) %

0.50

0.42

0.56

112.45

8.88 %

14.42

9.12

14.53

16.36

FY 2017

$8,501.7

7,374.5

18.7

40.8

272.8

6,899.5

640.0

54.5

834.2

$313.2

11.1

68.1

137.6

134.7

$2.10

N/A

13.05

12.94

$4,069.0

$1,375.4

1.68 %

17.78 %

3.74 %

3.95 %

N/A %

36.08 %

N/A %

0.06 %

0.38

0.35

0.55

143.81

9.68 %

14.66

9.95

14.75

16.38

FY 2018

$9,539.5

8,432.3

35.1

49.2

180.3

7,985.4

457.0

54.6

960.5

$368.5

25.8

70.9

173.9

152.4

$2.37

2.39

15.24

13.99

$5,895.9

$1,564.2

1.68 %

17.05 %

3.79 %

4.11 %

4.14 %

39.58 %

34.55 %

0.19 %

0.37

0.43

0.58

157.40

9.27 %

13.27

9.45

13.34

14.84

FY 2019

$11,220.2

9,382.1

33.3

57.1

227.5

8,983.2

458.5

168.9

1,073.1

$408.6

27.4

82.8

251.2

155.1

$2.48

2.75

17.47

15.10

$6,756.8

$1,471.9

1.51 %

15.40 %

3.66 %

4.07 %

4.14 %

51.12 %

40.51 %

0.19 %

0.51

0.50

0.60

117.84

8.34 %

11.43

8.75

11.49

12.91

(1)

Adjusted (non-GAAP) metrics. See Non-GAAP Reconciliation for the closest applicable GAAP metrics.

(2) Aligns with GAAP cash flow statement disclosure which uses a net presentation for warehouse originations.

FY 2020

$13,851.9

10,631.3

52.0

75.8

187.7

11,336.7

242.5

235.8

1,230.8

$477.6

42.2

103.0

275.8

183.4

$2.98

3.10

20.56

18.28

$6,573.6

$1,601.6

1.53 %

15.65 %

3.65 %

4.12 %

4.19 %

47.50 %

39.81 %

0.23%

0.82

0.68

0.71

86.20

7.94 %

11.22

8.97

11.27

12.64

FY 2021

$14,265.6

11,414.8

29.8

133.0

189.3

10,815.8

353.5

221.4

1,400.9

$538.7

23.8

105.3

314.5

215.7

$3.56

3.68

23.62

21.36

$5,761.3

$1,608.7

1.52 %

16.51 %

3.70 %

3.92 %

4.11 %

48.84 %

41.95 %

0.12 %

1.26

1.07

1.15

91.57

8.97 %

11.36

8.82

11.36

13.78

axos

For the 6

Months Ended

12/31/2021

$15,547.9

12,607.2

27.4

140.5

140.8

12,269.2

157.5

260.4

1,523.2

$292.2

8.0

57.5

170.5

121.0

$1.99

2.06

25.60

22.54

$4,636.7

$403.3

1.65 %

16.51 %

3.97 %

4.16 %

4.39 %

48.74 %

39.66 %

0.01 %

1.14

0.94

1.10

96.27

8.73 %

10.08

9.42

10.08

12.16

41View entire presentation