Proterra SPAC Presentation Deck

PROTERRA FINANCIALS

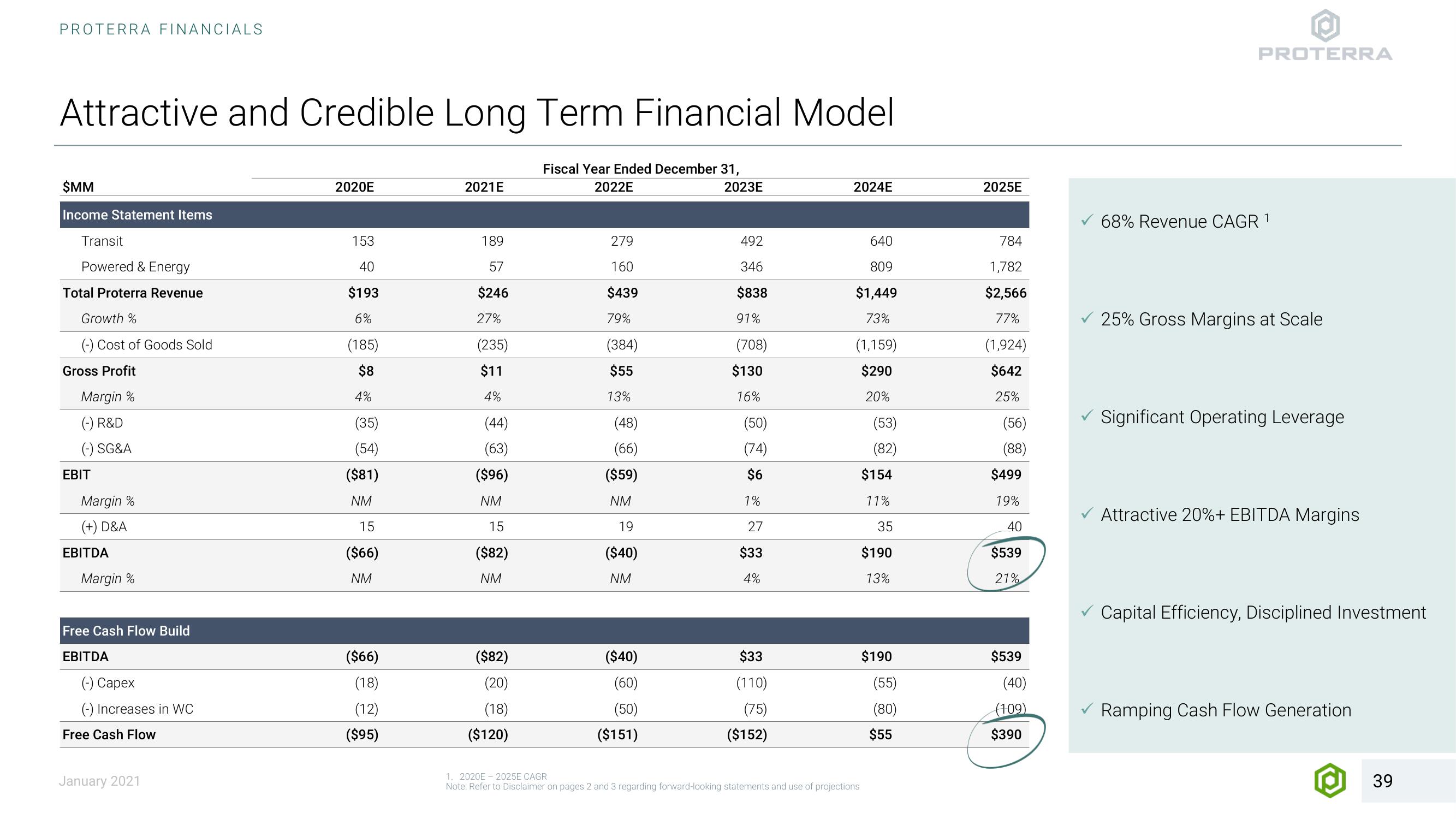

Attractive and Credible Long Term Financial Model

Fiscal Year Ended December 31,

2022E

SMM

Income Statement Items

Transit

Powered & Energy

Total Proterra Revenue

Growth %

(-) Cost of Goods Sold

Gross Profit

Margin %

(-) R&D

(-) SG&A

EBIT

Margin %

(+) D&A

EBITDA

Margin %

Free Cash Flow Build

EBITDA

(-) Capex

(-) Increases in WC

Free Cash Flow

January 2021

2020E

153

40

$193

6%

(185)

$8

4%

(35)

(54)

($81)

NM

15

($66)

NM

($66)

(18)

(12)

($95)

2021E

189

57

$246

27%

(235)

$11

4%

(44)

(63)

($96)

NM

15

($82)

NM

($82)

(20)

(18)

($120)

279

160

$439

79%

(384)

$55

13%

(48)

(66)

($59)

NM

19

($40)

NM

($40)

(60)

(50)

($151)

2023E

492

346

$838

91%

(708)

$130

16%

(50)

(74)

$6

1%

27

$33

4%

$33

(110)

(75)

($152)

2024E

640

809

$1,449

73%

(1,159)

$290

20%

1. 2020E-2025E CAGR

Note: Refer to Disclaimer on pages 2 and 3 regarding forward-looking statements and use of projections

(53)

(82)

$154

11%

35

$190

13%

$190

(55)

(80)

$55

2025E

784

1,782

$2,566

77%

(1,924)

$642

25%

(56)

(88)

$499

19%

40

$539

21%

$539

(40)

(109)

$390

PROTERRA

68% Revenue CAGR 1

25% Gross Margins at Scale

✓Significant Operating Leverage

Attractive 20%+ EBITDA Margins

Capital Efficiency, Disciplined Investment

Ramping Cash Flow Generation

39View entire presentation