HBT Financial Results Presentation Deck

1... drives long-term tangible book value growth

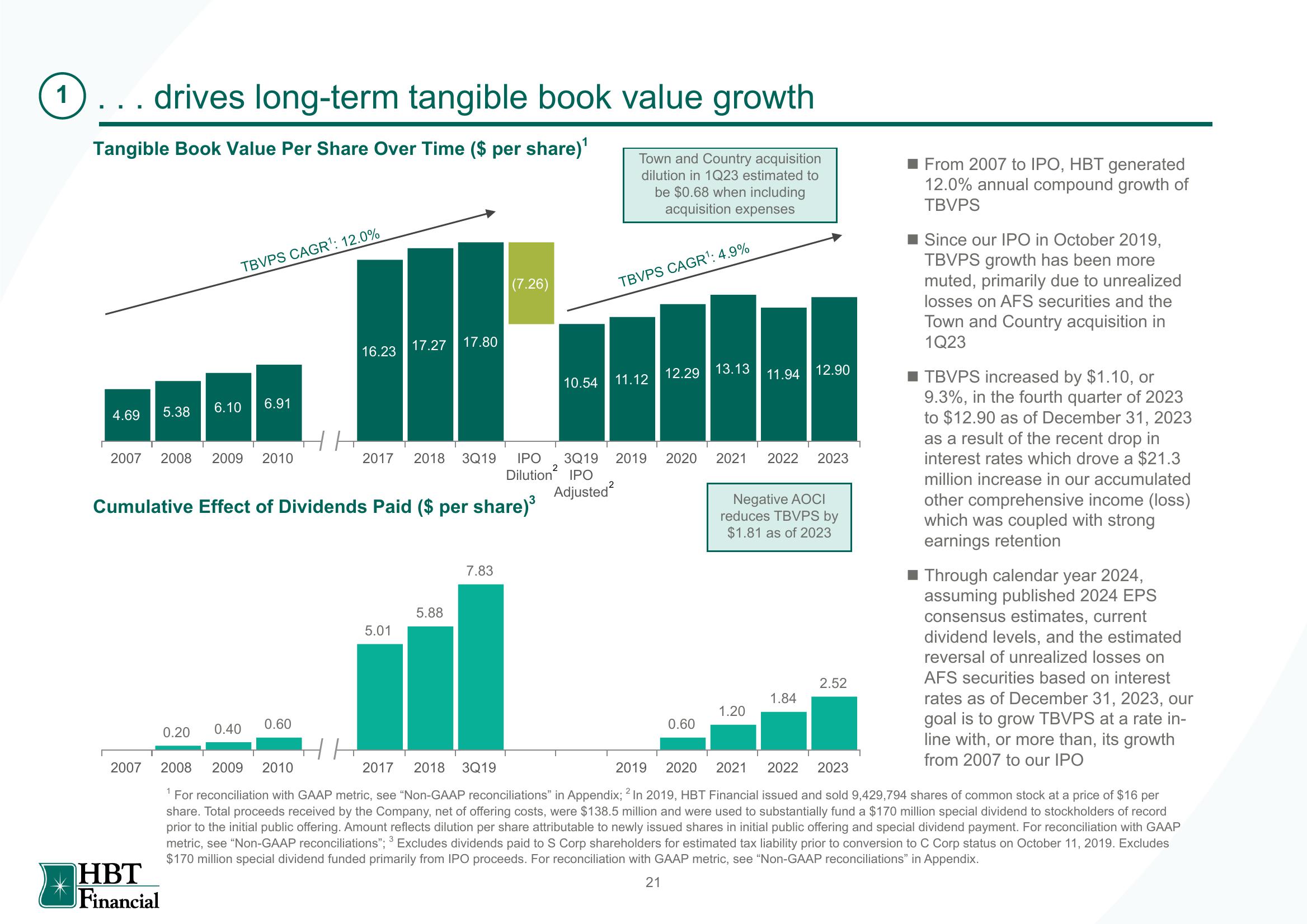

Tangible Book Value Per Share Over Time ($ per share)¹

4.69 5.38

TBVPS CAGR¹: 12.0%

2007 2008 2009 2010

2007

6.10 6.91

HBT

Financial

0.20 0.40

16.23

Cumulative Effect of Dividends Paid ($ per share)³

0.60

17.27 17.80

5.01

(7.26)

5.88

7.83

10.54

Town and Country acquisition

dilution in 1Q23 estimated to

be $0.68 when including

acquisition expenses

TBVPS CAGR¹: 4.9%

11.12

2017 2018 3Q19 IPO 3Q19 2019 2020 2021 2022 2023

Dilution IPO

Adjusted²

12.29

13.13

0.60

11.94 12.90

Negative AOCI

reduces TBVPS by

$1.81 as of 2023

1.20

1.84

2.52

■ From 2007 to IPO, HBT generated

12.0% annual compound growth of

TBVPS

Since our IPO in October 2019,

TBVPS growth has been more

muted, primarily due to unrealized

losses on AFS securities and the

Town and Country acquisition in

1Q23

■ TBVPS increased by $1.10, or

9.3%, in the fourth quarter of 2023

to $12.90 as of December 31, 2023

as a result of the recent drop in

interest rates which drove a $21.3

million increase in our accumulated

other comprehensive income (loss)

which was coupled with strong

earnings retention

Through calendar year 2024,

assuming published 2024 EPS

consensus estimates, current

dividend levels, and the estimated

reversal of unrealized losses on

AFS securities based on interest

rates as of December 31, 2023, our

goal is to grow TBVPS at a rate in-

line with, or more than, its growth

from 2007 to our IPO

НН

2008 2009 2010

2017 2018 3Q19

2019 2020 2021 2022 2023

¹ For reconciliation with GAAP metric, see "Non-GAAP reconciliations" in Appendix; 2 In 2019, HBT Financial issued and sold 9,429,794 shares of common stock at a price of $16 per

share. Total proceeds received by the Company, net of offering costs, were $138.5 million and were used to substantially fund a $170 million special dividend to stockholders of record

prior to the initial public offering. Amount reflects dilution per share attributable to newly issued shares in initial public offering and special dividend payment. For reconciliation with GAAP

metric, see "Non-GAAP reconciliations"; 3 Excludes dividends paid to S Corp shareholders for estimated tax liability prior to conversion to C Corp status on October 11, 2019. Excludes

$170 million special dividend funded primarily from IPO proceeds. For reconciliation with GAAP metric, see "Non-GAAP reconciliations" in Appendix.

21View entire presentation