Deutsche Bank Results Presentation Deck

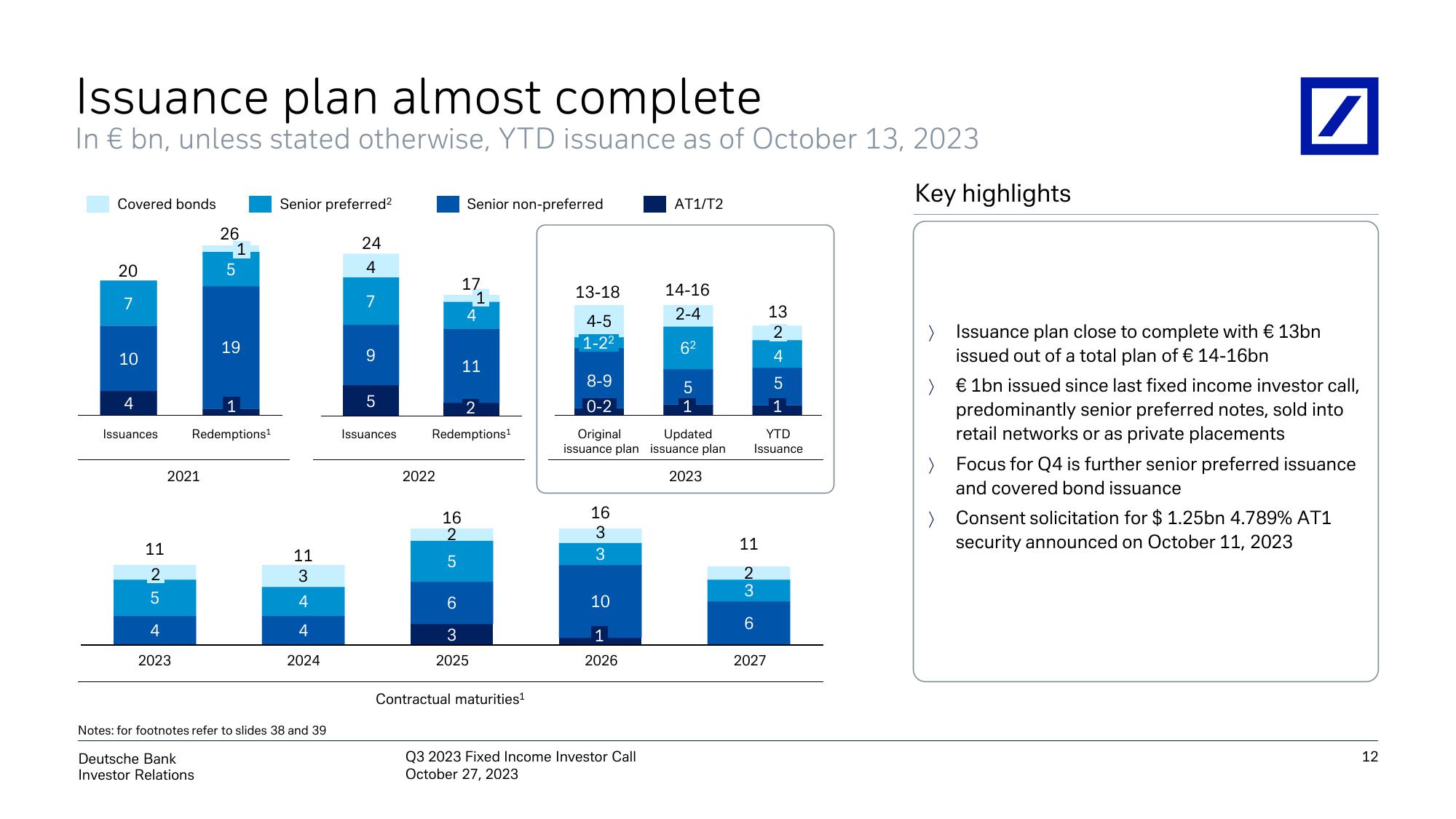

Issuance plan almost complete

In € bn, unless stated otherwise, YTD issuance as of October 13, 2023

Covered bonds

20

7

10

4

Issuances

1125

2021

4

2023

26

5

1

19

1

Redemptions¹

Senior preferred²

11

3

4

4

2024

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

24

4

7

9

5

Issuances

2022

Senior non-preferred

16

2

5

17

1

4

2

Redemptions¹

11

6

3

2025

Contractual maturities¹

13-18

4-5

1-2²

8-9

0-2

16

3

3

10

1

2026

AT1/T2

Original Updated

issuance plan issuance plan

2023

Q3 2023 Fixed Income Investor Call

October 27, 2023

14-16

2-4

6²

5

1

11

2

3

6

13

2

4

YTD

Issuance

2027

5

1

Key highlights

/

> Issuance plan close to complete with € 13bn

issued out of a total plan of € 14-16bn

> € 1bn issued since last fixed income investor call,

predominantly senior preferred notes, sold into

retail networks or as private placements

>

Focus for Q4 is further senior preferred issuance

and covered bond issuance

> Consent solicitation for $1.25bn 4.789% AT1

security announced on October 11, 2023

12View entire presentation