Kin SPAC Presentation Deck

kin.com | 83

kin.

DTC, Own Carrier

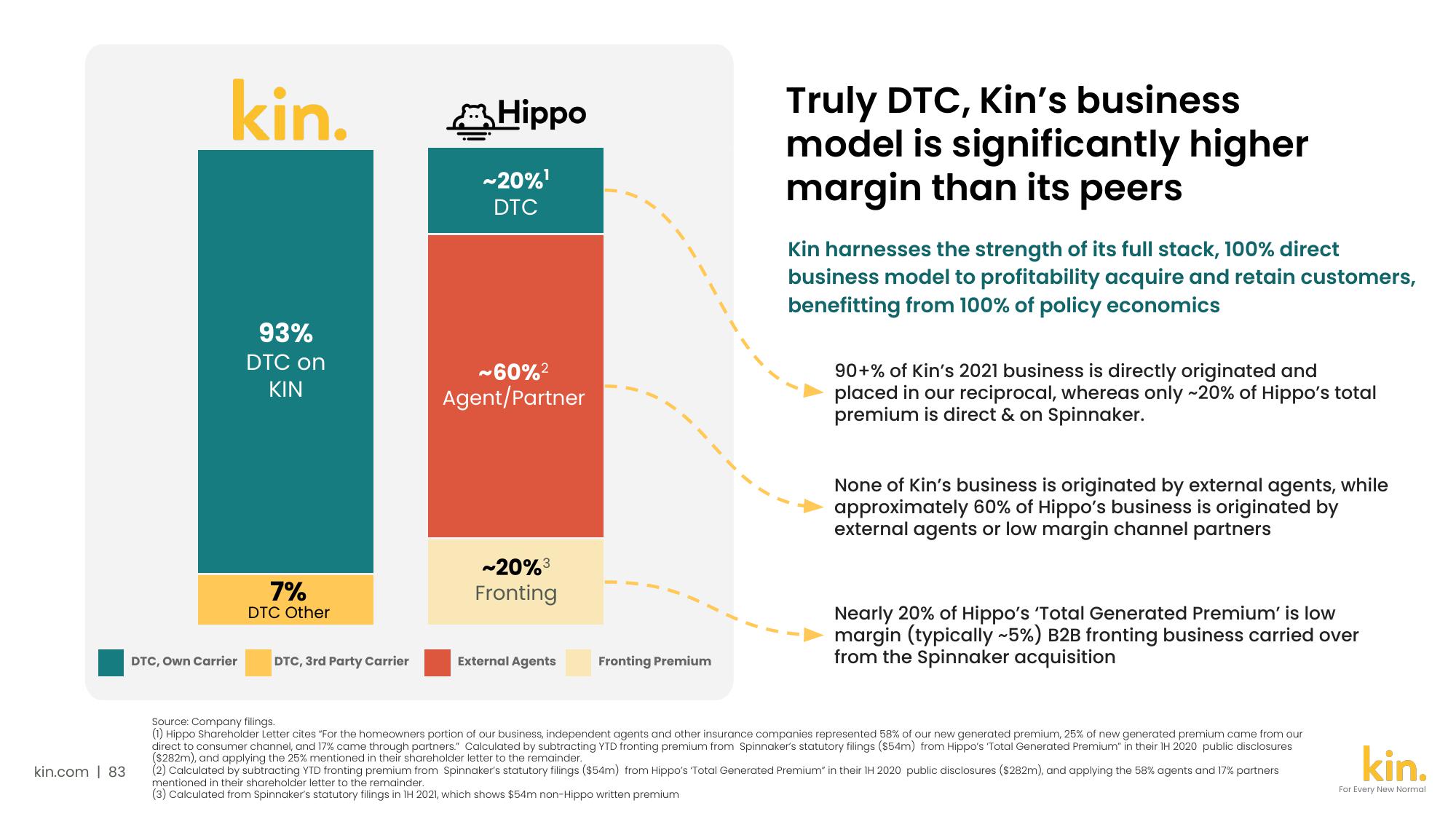

93%

DTC on

KIN

7%

DTC Other

DTC, 3rd Party Carrier

Hippo

~20%¹

DTC

~60%²

Agent/Partner

~20%³

Fronting

External Agents

Fronting Premium

Truly DTC, Kin's business

model is significantly higher

margin than its peers

Kin harnesses the strength of its full stack, 100% direct

business model to profitability acquire and retain customers,

benefitting from 100% of policy economics

90+% of Kin's 2021 business is directly originated and

placed in our reciprocal, whereas only ~20% of Hippo's total

premium is direct & on Spinnaker.

None of Kin's business is originated by external agents, while

approximately 60% of Hippo's business is originated by

external agents or low margin channel partners

Nearly 20% of Hippo's 'Total Generated Premium' is low

(typically ~5%) B2B fronting business carried over

from the Spinnaker acquisition

ma

Source: Company filings.

(1) Hippo Shareholder Letter cites "For the homeowners portion of our business, independent agents and other insurance companies represented 58% of our new generated premium, 25% of new generated premium came from our

direct to consumer channel, and 17% came through partners." Calculated by subtracting YTD fronting premium from Spinnaker's statutory filings ($54m) from Hippo's Total Generated Premium" in their 1H 2020 public disclosures

($282m), and applying the 25% mentioned in their shareholder letter to the remainder.

(2) Calculated by subtracting YTD fronting premium from Spinnaker's statutory filings ($54m) from Hippo's 'Total Generated Premium" in their 1H 2020 public disclosures ($282m), and applying the 58% agents and 17% partners

(3) Calculated from Spinnaker's statutory filings in 1H 2021, which shows $54m non-Hippo written premium

mentioned in their shareholder letter to the remainder.

kin.

For Every New NormalView entire presentation