HBT Financial Results Presentation Deck

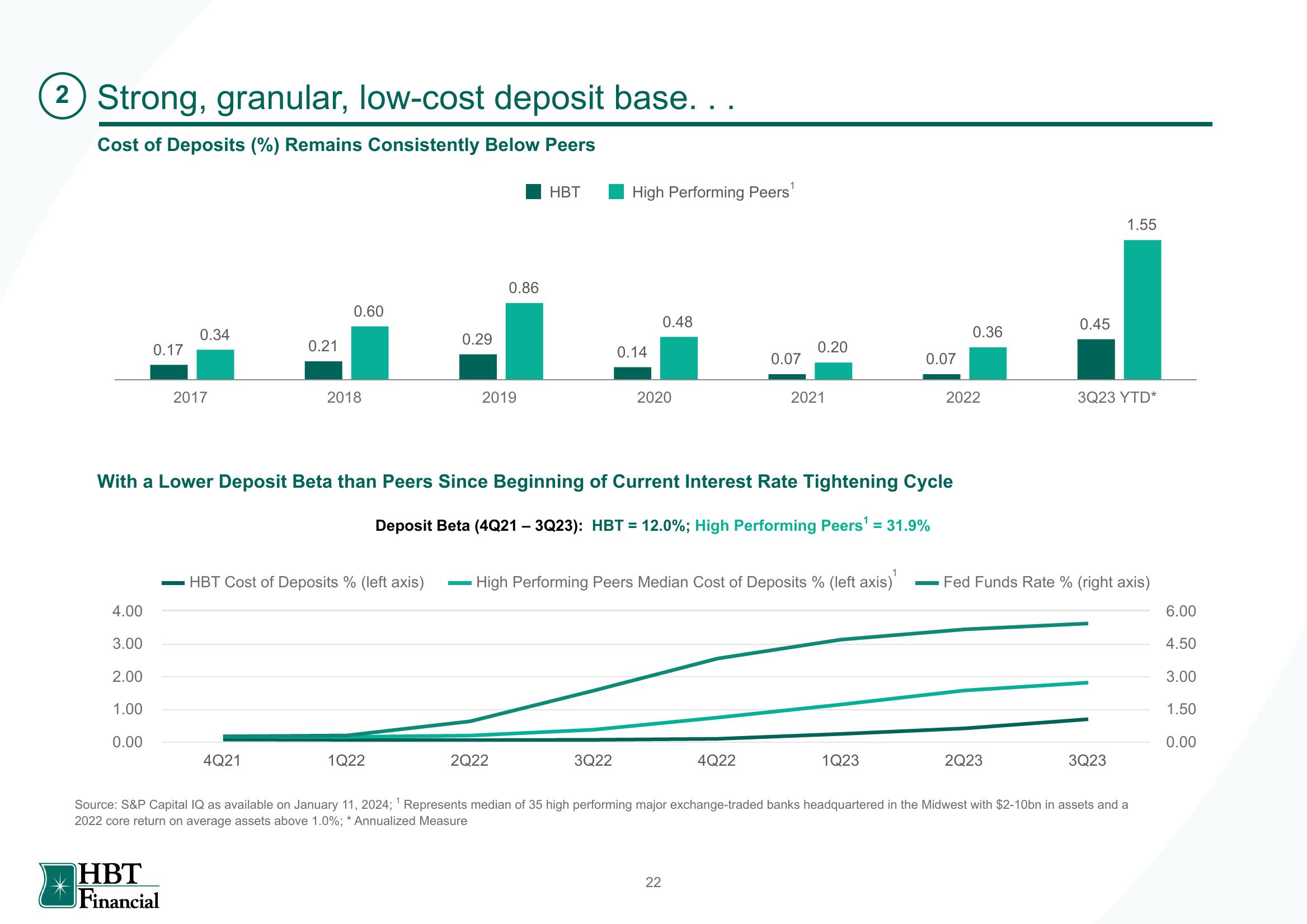

2 Strong, granular, low-cost deposit base. ..

Cost of Deposits (%) Remains Consistently Below Peers

4.00

3.00

2.00

0.17

1.00

0.00

0.34

2017

HBT

Financial

0.21

0.60

4Q21

2018

HBT Cost of Deposits % (left axis)

0.29

1Q22

0.86

2019

HBT

2Q22

High Performing Peers¹

With a Lower Deposit Beta than Peers Since Beginning of Current Interest Rate Tightening Cycle

Deposit Beta (4Q21 - 3Q23): HBT = 12.0%; High Performing Peers¹ = 31.9%

0.14

3Q22

0.48

2020

0.07

High Performing Peers Median Cost of Deposits % (left axis)¹

22

0.20

4Q22

2021

0.07

1Q23

0.36

2022

0.45

2Q23

1.55

3Q23 YTD*

Fed Funds Rate % (right axis)

3Q23

Source: S&P Capital IQ as available on January 11, 2024; ¹ Represents median of 35 high performing major exchange-traded banks headquartered in the Midwest with $2-10bn in assets and a

2022 core return on average assets above 1.0%; * Annualized Measure

6.00

4.50

3.00

1.50

0.00View entire presentation