SpringOwl Activist Presentation Deck

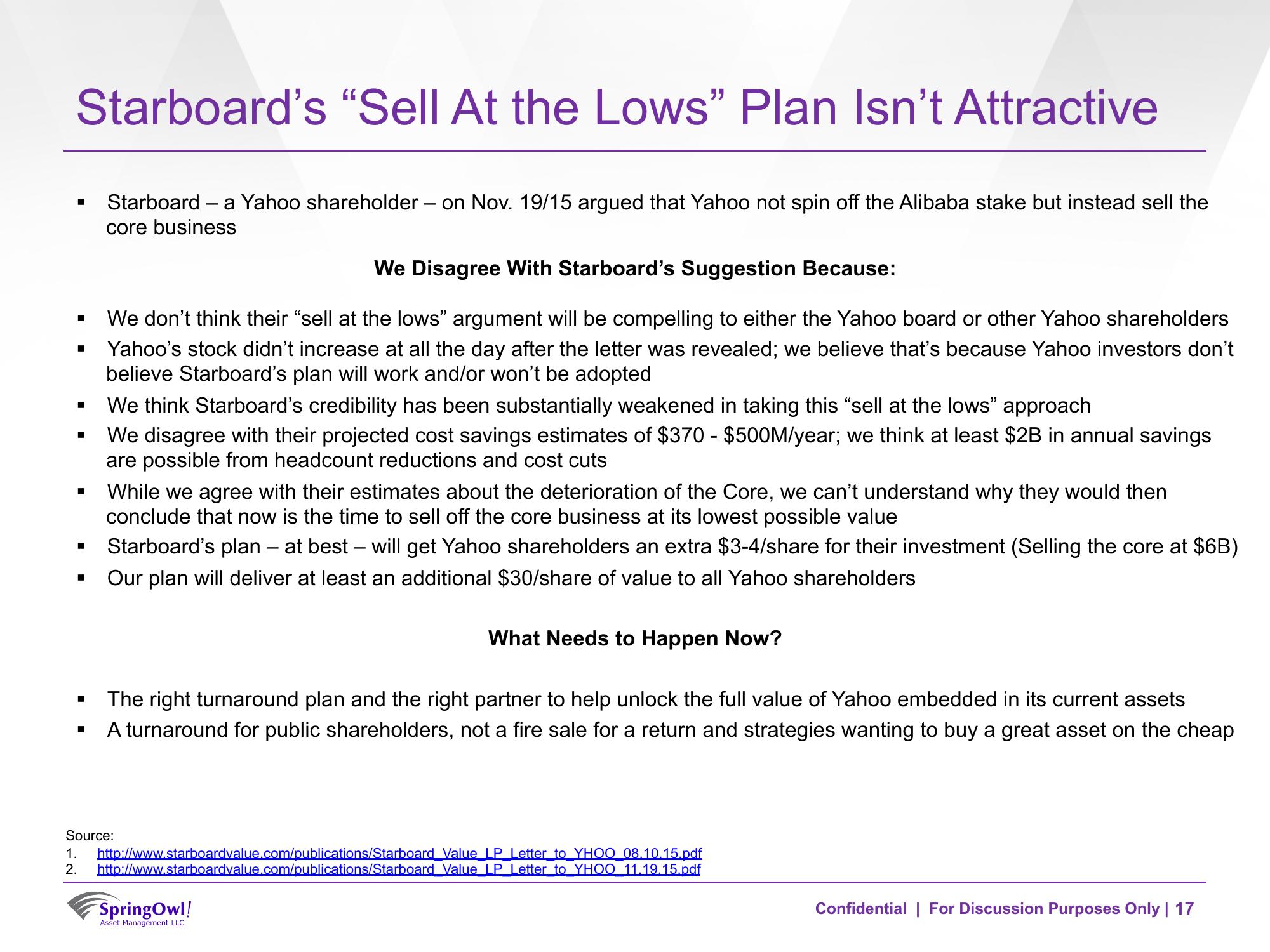

Starboard's "Sell At the Lows" Plan Isn't Attractive

Starboard - a Yahoo shareholder - on Nov. 19/15 argued that Yahoo not spin off the Alibaba stake but instead sell the

core business

■

■

■

■

■

We Disagree With Starboard's Suggestion Because:

We don't think their "sell at the lows" argument will be compelling to either the Yahoo board or other Yahoo shareholders

Yahoo's stock didn't increase at all the day after the letter was revealed; we believe that's because Yahoo investors don't

believe Starboard's plan will work and/or won't be adopted

We think Starboard's credibility has been substantially weakened in taking this "sell at the lows" approach

We disagree with their projected cost savings estimates of $370 - $500M/year; we think at least $2B in annual savings

are possible from headcount reductions and cost cuts

While we agree with their estimates about the deterioration of the Core, we can't understand why they would then

conclude that now is the time to sell off the core business at its lowest possible value

Starboard's plan - at best - will get Yahoo shareholders an extra $3-4/share for their investment (Selling the core at $6B)

Our plan will deliver at least an additional $30/share of value to all Yahoo shareholders

What Needs to Happen Now?

The right turnaround plan and the right partner to help unlock the full value of Yahoo embedded in its current assets

A turnaround for public shareholders, not a fire sale for a return and strategies wanting to buy a great asset on the cheap

Source:

1. http://www.starboardvalue.com/publications/Starboard Value LP Letter to YHOO 08.10.15.pdf

2. http://www.starboardvalue.com/publications/Starboard Value LP Letter to YHOO 11.19.15.pdf

SpringOwl!

Asset Management LLC

Confidential | For Discussion Purposes Only | 17View entire presentation