Evercore Investment Banking Pitch Book

Supplemental Soda Ash Pricing Data

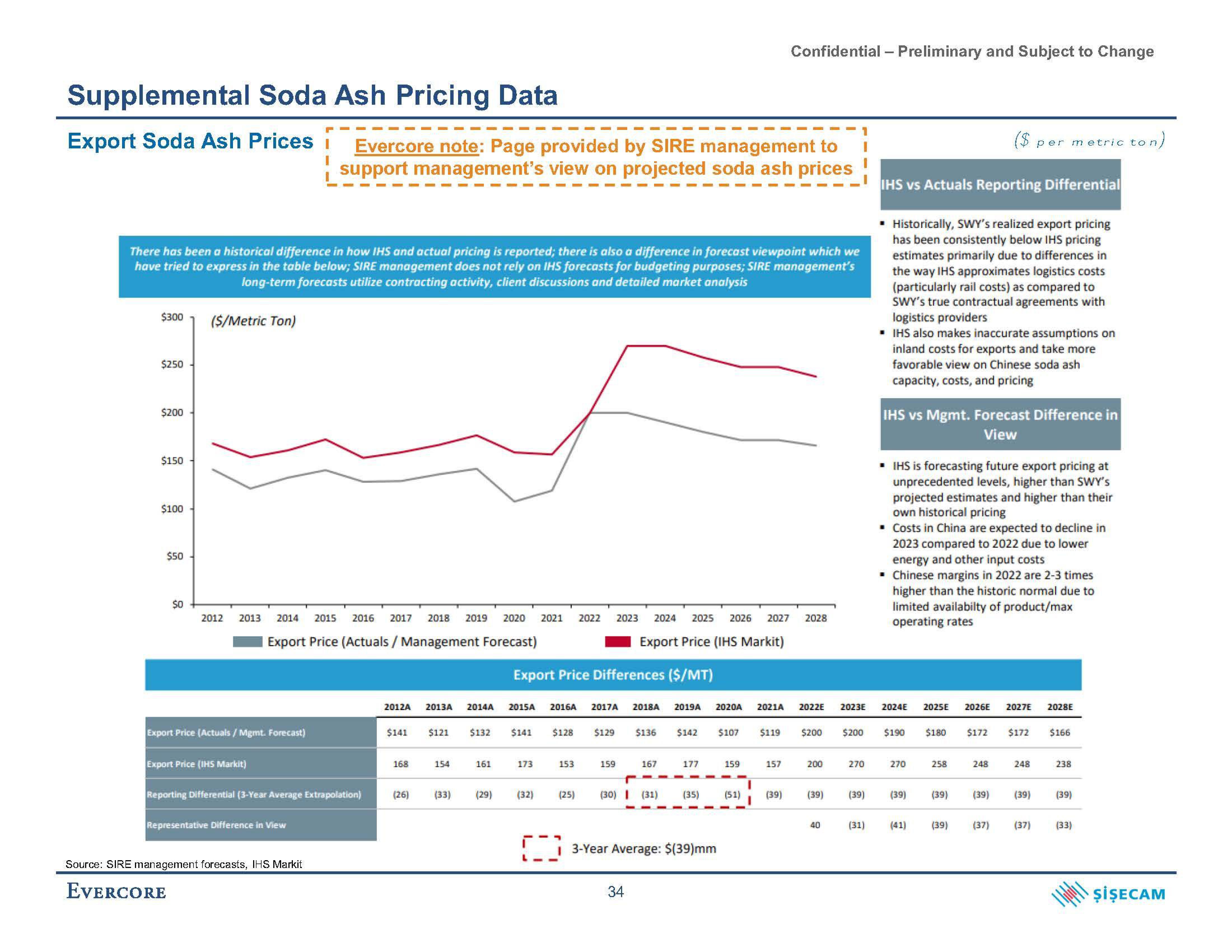

Export Soda Ash Prices i

$300

There has been a historical difference in how IHS and actual pricing is reported; there is also a difference in forecast viewpoint which we

have tried to express in the table below; SIRE management does not rely on IHS forecasts for budgeting purposes; SIRE management's

long-term forecasts utilize contracting activity, client discussions and detailed market analysis

$250

$200

$150

$100

$50

$0

($/Metric Ton)

2012

2013

Export Price (Actuals/Mgmt. Forecast)

Export Price (IHS Markit)

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Export Price (Actuals / Management Forecast)

Export Price (IHS Markit)

Evercore note: Page provided by SIRE management to

support management's view on projected soda ash prices

Reporting Differential (3-Year Average Extrapolation)

Representative Difference in View

Source: SIRE management forecasts, IHS Markit

EVERCORE

2012A 2013A 2014A

$141

168

(26)

$121

154

(33)

$132

161

(29)

Export Price Differences ($/MT)

2015A 2016A 2017A 2018A 2019A

173

(32)

$141 $128 $129 $136 $142 $107 $119 $200

153

159

10:00

(25) (30) I (31)

167

34

177

(35)

3-Year Average: $(39)mm

2020A 2021A

Confidential - Preliminary and Subject to Change

159

(51)

157

(39)

200

2022E 2023E 2024E

(39)

40

270

(39)

IHS vs Actuals Reporting Differential

Historically, SWY's realized export pricing

has been consistently below IHS pricing

estimates primarily due to differences in

the way IHS approximates logistics costs

(particularly rail costs) as compared to

SWY's true contractual agreements with

logistics providers

▪ IHS also makes inaccurate assumptions on

inland costs for exports and take more

favorable view on Chinese soda ash

capacity, costs, and pricing

(31)

IHS vs Mgmt. Forecast Difference in

View

▪ IHS is forecasting future export pricing at

unprecedented levels, higher than SWY's

projected estimates and higher than their

own historical pricing

■ Costs in China are expected to decline in

2023 compared to 2022 due to lower

energy and other input costs

▪ Chinese margins in 2022 are 2-3 times

higher than the historic normal due to

limited availabilty of product/max

operating rates

$200 $190 $180 $172 $172 $166

270

2025E 2026E 2027E 2028E

(41)

258

(39) (39) (39)

248

(39)

per metric ton)

(37)

248

(39)

(37)

238

(39)

(33)

ŞİŞECAMView entire presentation