Mondee SPAC

Net Revenue to Adjusted EBITDA

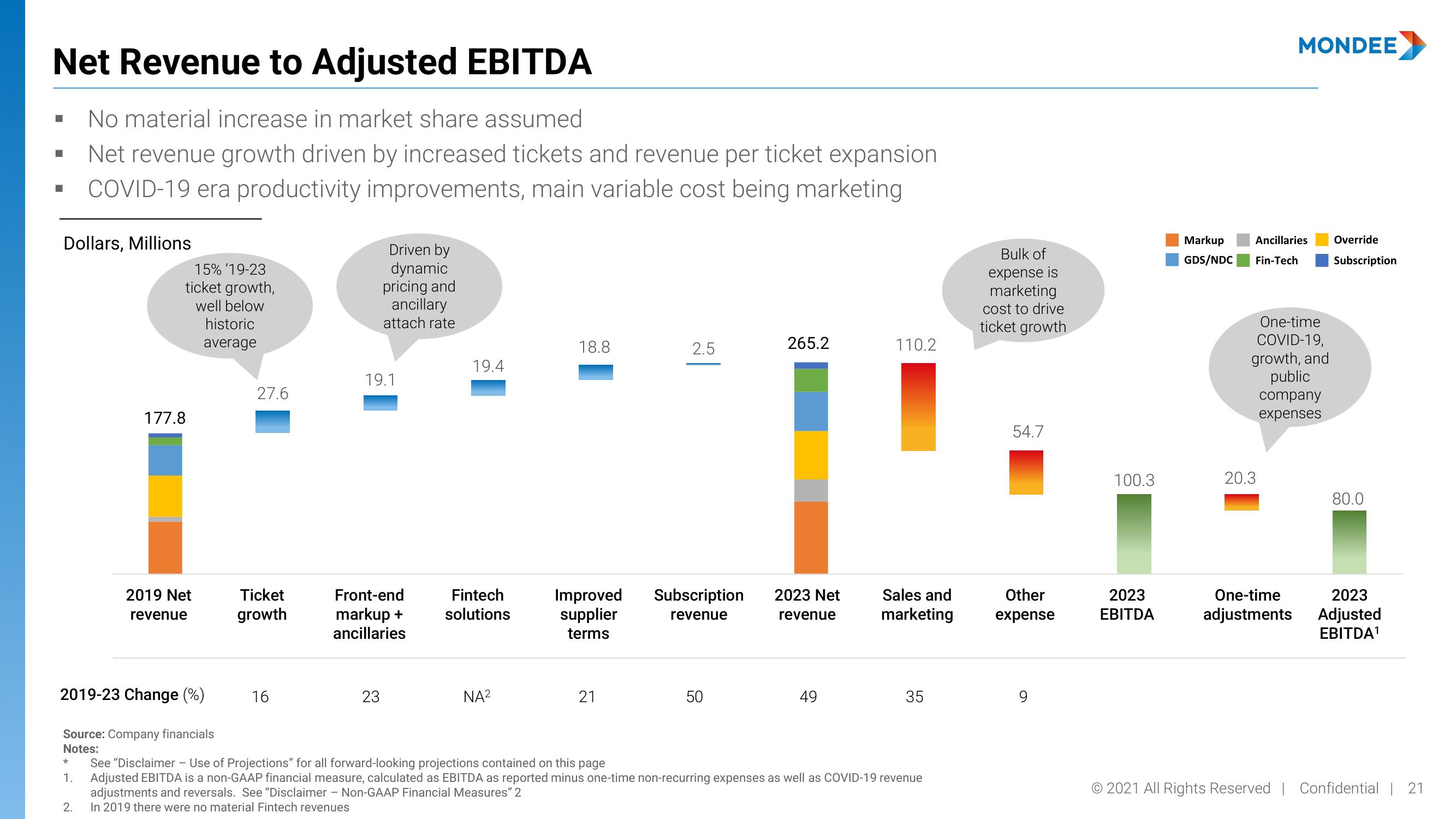

No material increase in market share assumed

Net revenue growth driven by increased tickets and revenue per ticket expansion

COVID-19 era productivity improvements, main variable cost being marketing

Dollars, Millions

*

15% '19-23

ticket growth,

well below

historic

average

2019-23 Change (%)

1.

177.8

Source: Company financials

Notes:

2.

2019 Net

revenue

27.6

Ticket

growth

16

Driven by

dynamic

pricing and

ancillary

attach rate

19.1

23

19.4

Front-end Fintech

markup + solutions

ancillaries

NA²

18.8

2.5

Improved Subscription

supplier

terms

revenue

21

50

265.2

2023 Net

revenue

49

110.2

Sales and

marketing

35

See "Disclaimer - Use of Projections" for all forward-looking projections contained on this page

Adjusted EBITDA is a non-GAAP financial measure, calculated as EBITDA as reported minus one-time non-recurring expenses as well as COVID-19 revenue

adjustments and reversals. See "Disclaimer - Non-GAAP Financial Measures" 2

In 2019 there were no material Fintech revenues

Bulk of

expense is

marketing

cost to drive

ticket growth

54.7

Other

expense

9

100.3

2023

EBITDA

Markup

GDS/NDC

Ancillaries

Fin-Tech

MONDEE

One-time

COVID-19,

growth, and

public

company

expenses

20.3

One-time

adjustments

Override

Subscription

80.0

2023

Adjusted

EBITDA¹

© 2021 All Rights Reserved | Confidential | 21View entire presentation