Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

MAERSK OIL

Contents

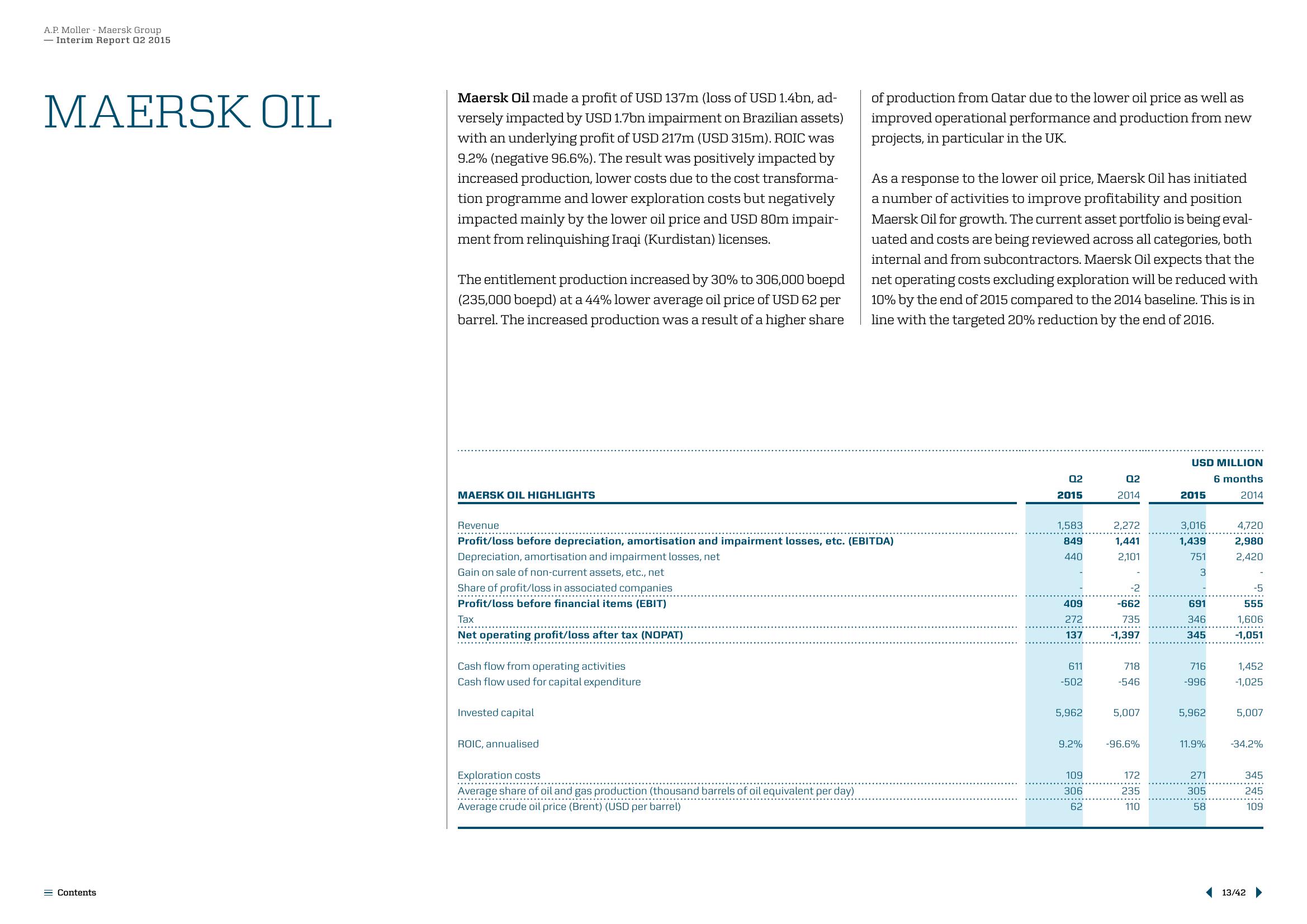

Maersk Oil made a profit of USD 137m (loss of USD 1.4bn, ad-

versely impacted by USD 1.7bn impairment on Brazilian assets)

with an underlying profit of USD 217m (USD 315m). ROIC was

9.2% (negative 96.6%). The result was positively impacted by

increased production, lower costs due to the cost transforma-

tion programme and lower exploration costs but negatively

impacted mainly by the lower oil price and USD 80m impair-

ment from relinquishing Iraqi (Kurdistan) licenses.

The entitlement production increased by 30% to 306,000 boepd

(235,000 boepd) at a 44% lower average oil price of USD 62 per

barrel. The increased production was a result of a higher share

MAERSK OIL HIGHLIGHTS

Revenue

**********

Tax

Net operating profit/loss after tax (NOPAT)

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

of production from Qatar due to the lower oil price as well as

improved operational performance and production from new

projects, in particular in the UK.

Exploration costs

Average share of oil and gas production (thousand barrels of oil equivalent per day)

Average crude oil price (Brent) (USD per barrel)

As a response to the lower oil price, Maersk Oil has initiated

a number of activities to improve profitability and position

Maersk Oil for growth. The current asset portfolio is being eval-

uated and costs are being reviewed across all categories, both

internal and from subcontractors. Maersk Oil expects that the

net operating costs excluding exploration will be reduced with

10% by the end of 2015 compared to the 2014 baseline. This is in

line with the targeted 20% reduction by the end of 2016.

02

2015

1,583

849

440

409

272

137

611

-502

5,962

9.2%

109

306

62

02

2014

2,272

1,441

2,101

-2

-662

735

-1,397

718

-546

5,007

-96.6%

172

235

110

USD MILLION

6 months

2014

2015

3,016

1,439

751

3

691

346

345

716

-996

5,962

11.9%

271

305

58

4,720

2,980

2,420

-5

555

1,606

-1,051

1,452

-1,025

5,007

-34.2%

345

245

109

13/42View entire presentation