Elms SPAC Presentation Deck

Pro Forma Equity Ownership

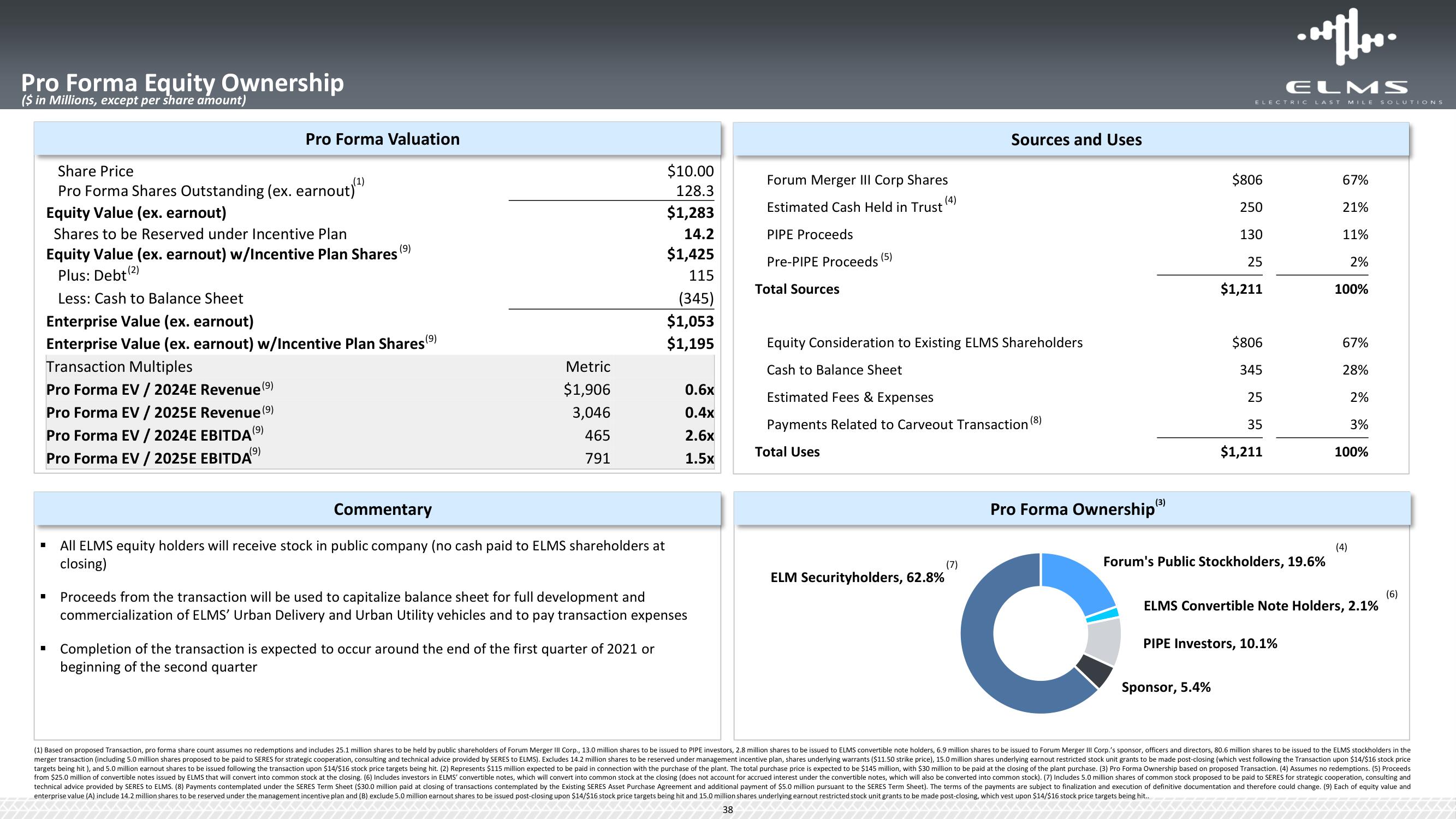

($ in Millions, except per share amount)

Share Price

Pro Forma Shares Outstanding (ex. earnout)

Equity Value (ex. earnout)

Shares to be Reserved under Incentive Plan

Equity Value (ex. earnout) w/Incentive Plan Shares (⁹)

Plus: Debt (2)

Less: Cash to Balance Sheet

Enterprise Value (ex. earnout)

Enterprise Value (ex. earnout) w/Incentive Plan Shares (⁹)

Transaction Multiples

(9)

Pro Forma EV / 2024E Revenue

Pro Forma EV / 2025E Revenue (⁹)

Pro Forma EV / 2024E EBITDA (⁹)

Pro Forma EV / 2025E EBITDA

(9)

Pro Forma Valuation

■

Metric

$1,906

3,046

465

791

Commentary

All ELMS equity holders will receive stock in public company (no cash paid to ELMS shareholders at

closing)

$10.00

128.3

$1,283

14.2

$1,425

115

(345)

$1,053

$1,195

■ Completion of the transaction expected to occur around the end of the first quarter of 2021 or

beginning of the second quarter

0.6x

0.4x

2.6x

1.5x

Proceeds from the transaction will be used to capitalize balance sheet for full development and

commercialization of ELMS' Urban Delivery and Urban Utility vehicles and to pay transaction expenses

Forum Merger III Corp Shares

(4)

Estimated Cash Held in Trust

PIPE Proceeds

Pre-PIPE Proceeds (5)

Total Sources

Equity Consideration to Existing ELMS Shareholders

Cash to Balance Sheet

Sources and Uses

Estimated Fees & Expenses

Payments Related to Carveout Transaction (8)

Total Uses

ELM Securityholders, 62.8%

(7)

Pro Forma Ownership (3)

O

$806

250

130

25

ELECTRIC LAST MILE SOLUTIONS

$1,211

Sponsor, 5.4%

$806

345

25

35

$1,211

.....

ELMS

Forum's Public Stockholders, 19.6%

PIPE Investors, 10.1%

67%

21%

11%

2%

100%

67%

28%

2%

3%

100%

ELMS Convertible Note Holders, 2.1%

(4)

(6)

(1) Based on proposed Transaction, pro forma share count assumes no redemptions and includes 25.1 million shares to be held by public shareholders of Forum Merger III Corp., 13.0 million shares to be issued to PIPE investors, 2.8 million shares to be issued to ELMS convertible note holders, 6.9 million shares to be issued to Forum Merger III Corp.'s sponsor, officers and directors, 80.6 million shares to be issued to the ELMS stockholders in the

merger transaction (including 5.0 million shares proposed to be paid to SERES for strategic cooperation, consulting and technical advice provided by SERES to ELMS). Excludes 14.2 million shares to be reserved under management incentive plan, shares underlying warrants ($11.50 strike price), 15.0 million shares underlying earnout restricted stock unit grants to be made post-closing (which vest following the Transaction upon $14/$16 stock price

targets being hit ), and 5.0 million earnout shares to be issued following the transaction upon $14/$16 stock price targets being hit. (2) Represents $115 million expected to be paid in connection with the purchase of the plant. The total purchase price is expected to be $145 million, with $30 million to be paid at the closing of the plant purchase. (3) Pro Forma Ownership based on proposed Transaction. (4) Assumes no redemptions. (5) Proceeds

from $25.0 million of convertible notes issued by ELMS that will convert into common stock at the closing. (6) Includes investors in ELMS' convertible notes, which will convert into common stock at the closing (does not account for accrued interest under the convertible notes, which will also be converted into common stock). (7) Includes 5.0 million shares of common stock proposed to be paid to SERES for strategic cooperation, consulting and

technical advice provided by SERES to ELMS. (8) Payments contemplated under the SERES Term Sheet ($30.0 million paid at closing of transactions contemplated by the Existing SERES Asset Purchase Agreement and additional payment of $5.0 million pursuant to the SERES Term Sheet). The terms of the payments are subject to finalization and execution of definitive documentation and therefore could change. (9) Each of equity value and

enterprise value (A) include 14.2 million shares to be reserved under the management incentive plan and (B) exclude 5.0 million earnout shares to be issued post-closing upon $14/$16 stock price targets being hit and 15.0 million shares underlying earnout restricted stock unit grants to be made post-closing, which vest upon $14/$16 stock price targets being hit..

38View entire presentation