Dave Investor Presentation Deck

Our Business at a Glance

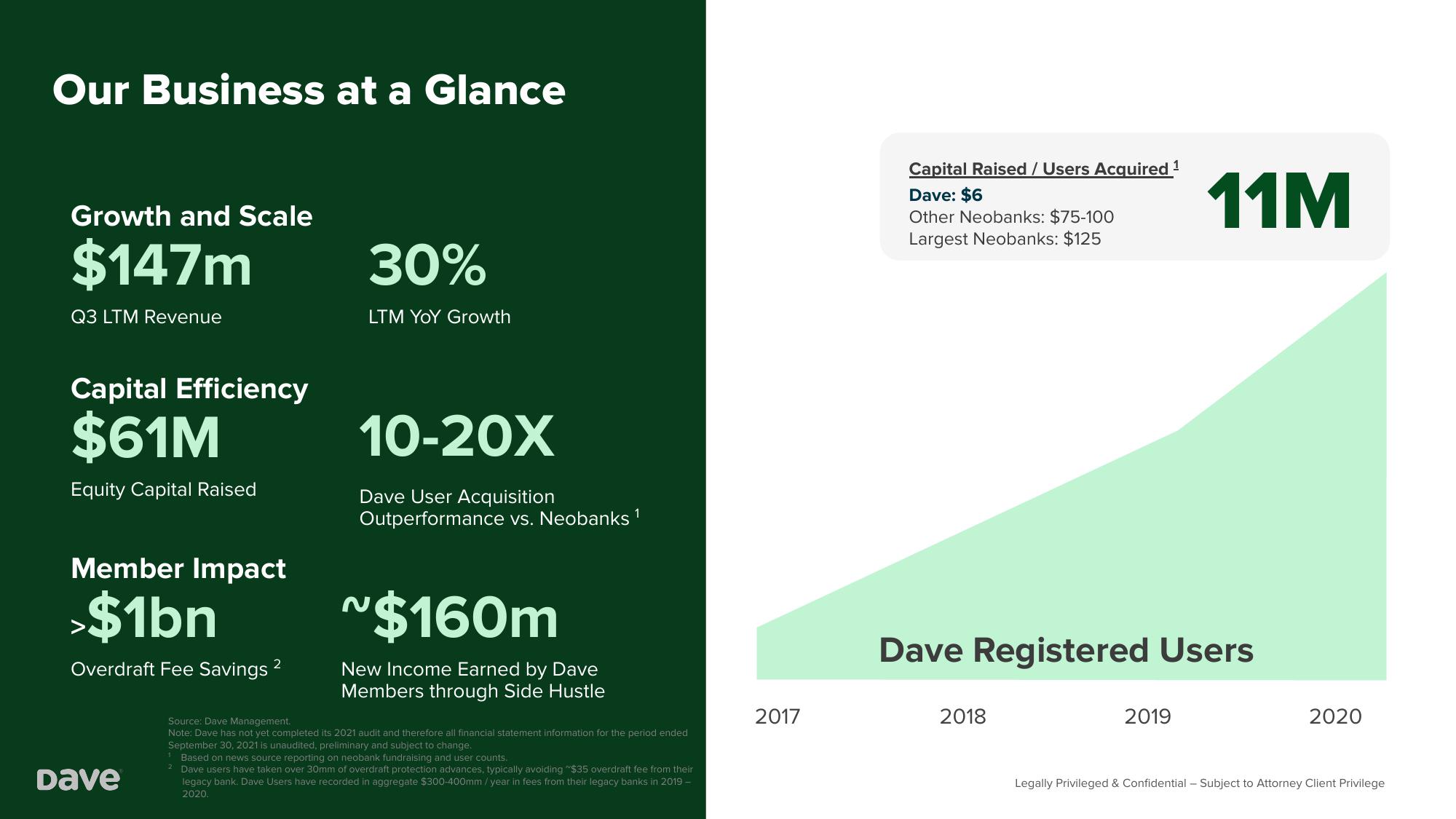

Growth and Scale

$147m

Q3 LTM Revenue

Capital Efficiency

$61M

Equity Capital Raised

Member Impact

>$1bn

Overdraft Fee Savings

Dave

30%

LTM YOY Growth

10-20X

Dave User Acquisition

Outperformance vs. Neobanks

~$160m

New Income Earned by Dave

Members through Side Hustle

1

Source: Dave Management.

Note: Dave has not yet completed its 2021 audit and therefore all financial statement information for the period ended

September 30, 2021 is unaudited, preliminary and subject to change.

1 Based on news source reporting on neobank fundraising and user counts.

2 Dave users have taken over 30mm of overdraft protection advances, typically avoiding "$35 overdraft fee from their

legacy bank. Dave Users have recorded in aggregate $300-400mm / year in fees from their legacy banks in 2019 -

2020.

2017

Capital Raised / Users Acquired ¹

Dave: $6

Other Neobanks: $75-100

Largest Neobanks: $125

Dave Registered Users

2018

11M

2019

2020

Legally Privileged & Confidential - Subject to Attorney Client PrivilegeView entire presentation