KKR Real Estate Finance Trust Investor Presentation Deck

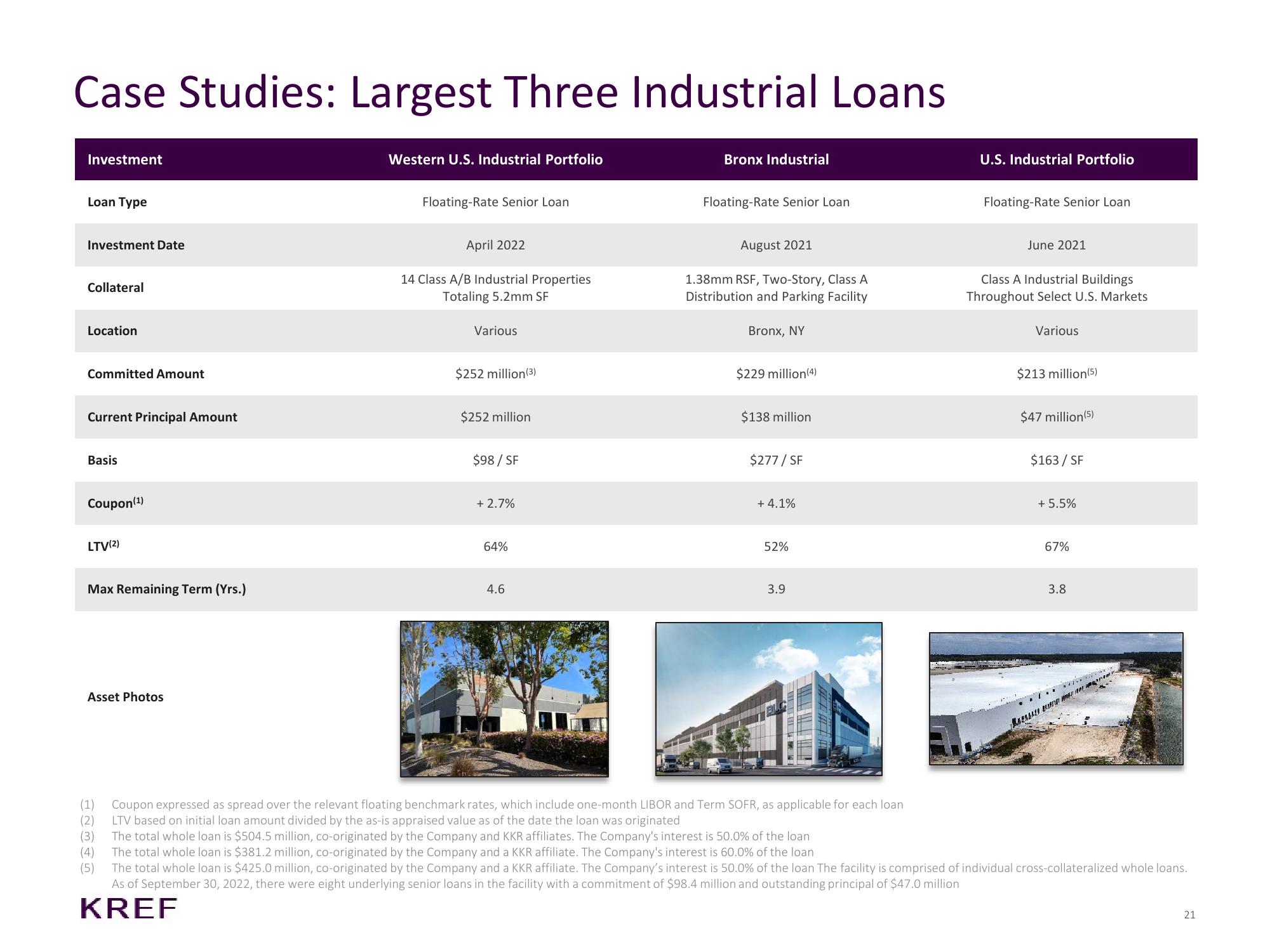

Case Studies: Largest Three Industrial Loans

Investment

Loan Type

Investment Date

Collateral

Location

Committed Amount

Current Principal Amount

Basis

Coupon (¹)

LTV(2)

Max Remaining Term (Yrs.)

Asset Photos

Western U.S. Industrial Portfolio

Floating-Rate Senior Loan

April 2022

14 Class A/B Industrial Properties

Totaling 5.2mm SF

Various

$252 million (3)

$252 million

$98 / SF

+2.7%

64%

4.6

Bronx Industrial

Floating-Rate Senior Loan

August 2021

1.38mm RSF, Two-Story, Class A

Distribution and Parking Facility

Bronx, NY

$229 million (4)

$138 million

$277/ SF

+ 4.1%

52%

3.9

(1) Coupon expressed as spread over the relevant floating benchmark rates, which include one-month LIBOR and Term SOFR, as applicable for each loan

LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated

(2)

(3) The total whole loan is $504.5 million, co-originated by the Company and KKR affiliates. The Company's interest is 50.0% of the loan

(4)

(5)

U.S. Industrial Portfolio

Floating-Rate Senior Loan

June 2021

Class A Industrial Buildings

Throughout Select U.S. Markets

Various

$213 million (5)

$47 million (5)

$163/ SF

+ 5.5%

AKERBAL

67%

3.8

*******

18.01

The total whole loan is $381.2 million, co-originated by the Company and a KKR affiliate. The Company's interest is 60.0% of the loan

The total whole loan is $425.0 million, co-originated by the Company and a KKR affiliate. The Company's interest is 50.0% of the loan The facility is comprised of individual cross-collateralized whole loans.

As of September 30, 2022, there were eight underlying senior loans in the facility with a commitment of $98.4 million and outstanding principal of $47.0 million

KREF

21View entire presentation