Evercore Investment Banking Pitch Book

Appendix

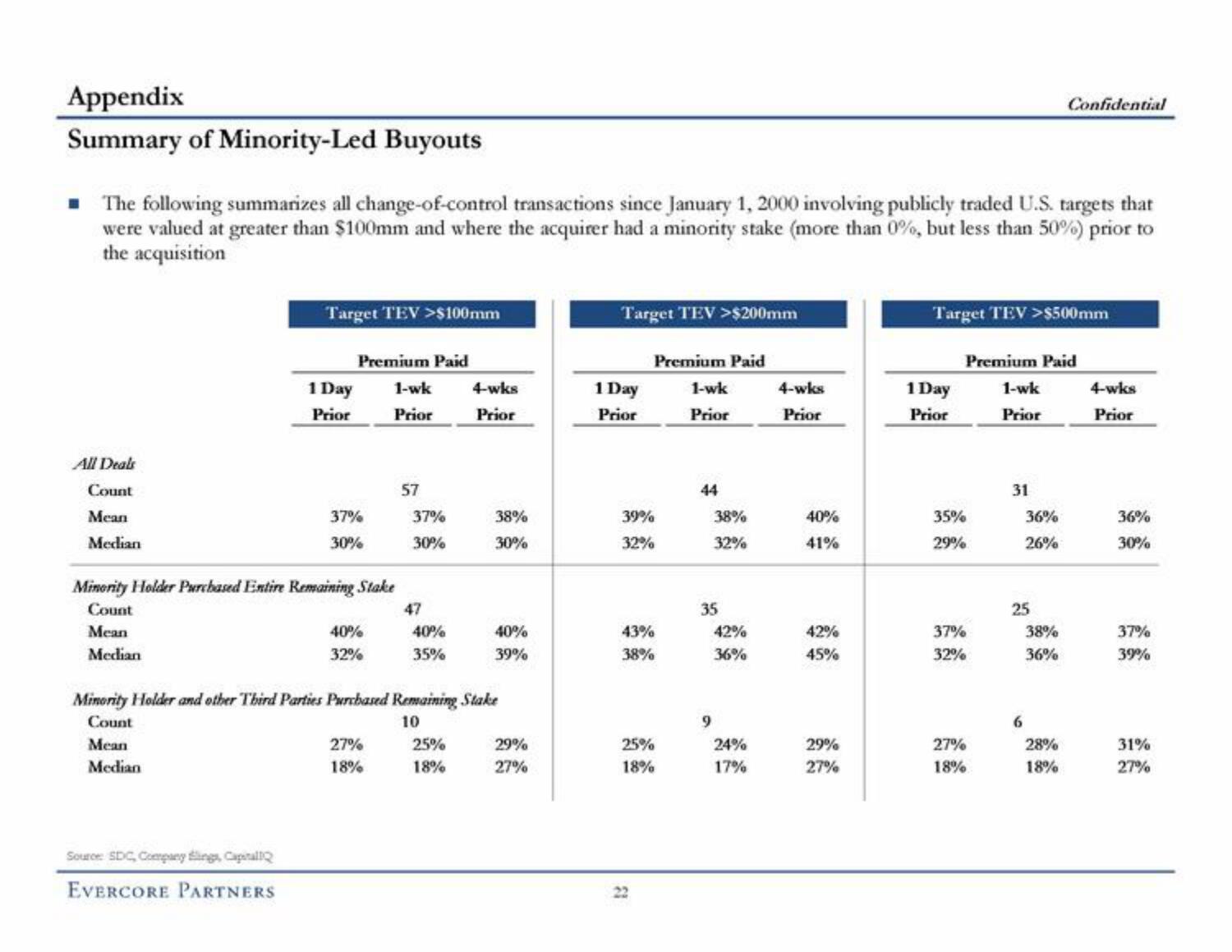

Summary of Minority-Led Buyouts

The following summarizes all change-of-control transactions since January 1, 2000 involving publicly traded U.S. targets that

were valued at greater than $100mm and where the acquirer had a minority stake (more than 0%, but less than 50%) prior to

the acquisition

All Deals

Count

Mean

Median

Target TEV >$100mm

1 Day

Prior

Source: SDC, Company Slings, Capitall

EVERCORE PARTNERS

Premium Paid

1-wk

Prior

37%

30%

Minority Holder Purchased Entire Remaining Stake

Count

Mean

Median

40%

32%

57

27%

18%

37%

30%

47

40%

35%

4-wks

Prior

Minority Holder and other Third Parties Purchased Remaining Stake

Count

10

Mean

Median

25%

18%

38%

30%

40%

39%

29%

27%

Target TEV >$200mm

1 Day

Prior

Premium Paid

1-wk

Prior

39%

32%

43%

38%

25%

18%

13

44

38%

32%

35

9

42%

36%

24%

17%

4-wks

Prior

40%

41%

42%

45%

29%

27%

Target TEV>$500mm

Premium Paid

1 Day 1-wk

Prior

Prior

35%

29%

37%

32%

27%

18%

31

36%

26%

25

6

Confidential

38%

36%

28%

18%

4-wks

Prior

36%

30%

37%

39%

31%

27%View entire presentation