Neumora Therapeutics IPO Presentation Deck

Offering summary

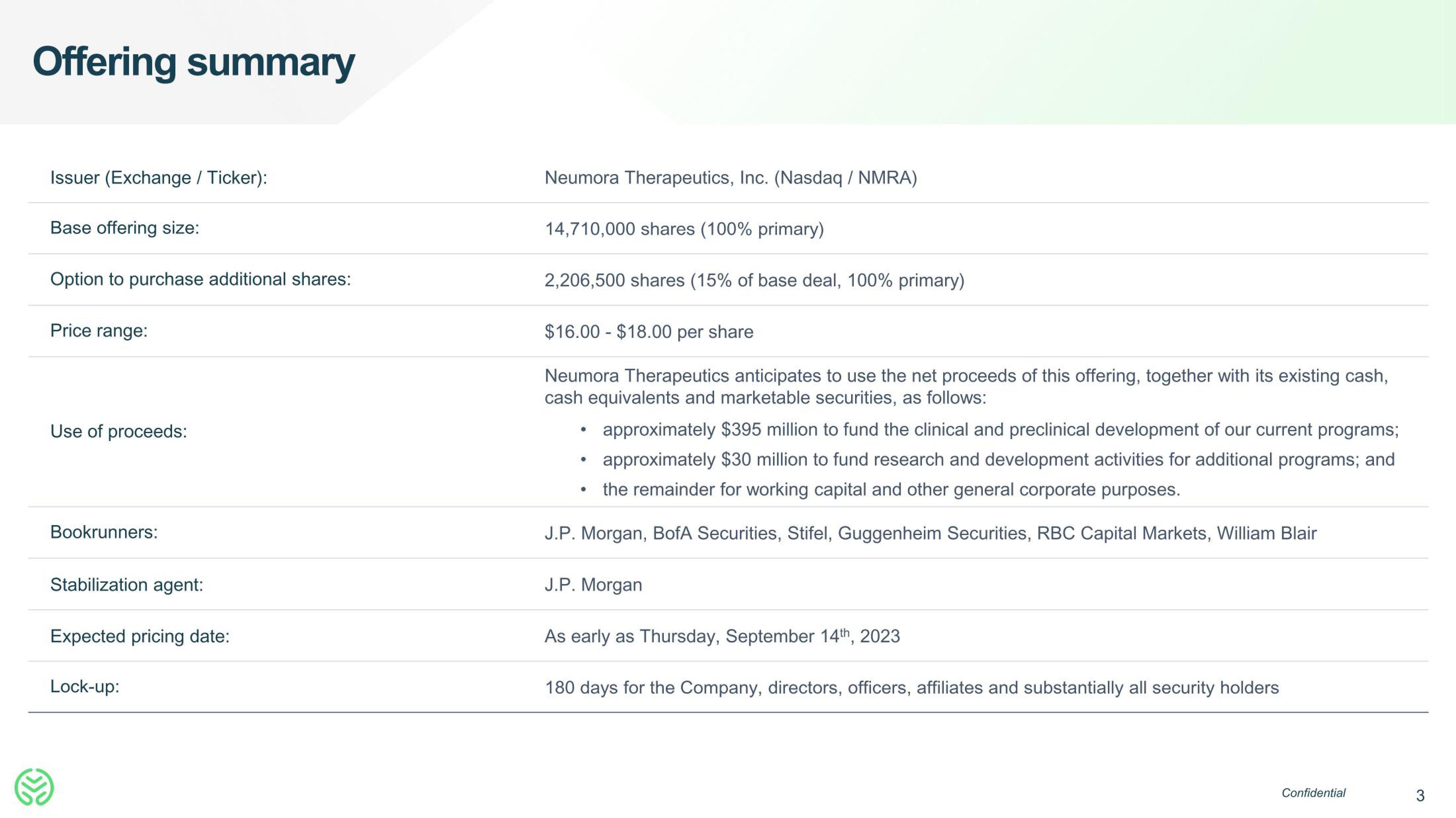

Issuer (Exchange / Ticker):

Base offering size:

Option to purchase additional shares:

Price range:

Use of proceeds:

Bookrunners:

Stabilization agent:

Expected pricing date:

Lock-up:

Neumora Therapeutics, Inc. (Nasdaq / NMRA)

14,710,000 shares (100% primary)

2,206,500 shares (15% of base deal, 100% primary)

$16.00-$18.00 per share

Neumora Therapeutics anticipates to use the net proceeds of this offering, together with its existing cash,

cash equivalents and marketable securities, as follows:

approximately $395 million to fund the clinical and preclinical development of our current programs;

approximately $30 million to fund research and development activities for additional programs; and

the remainder for working capital and other general corporate purposes.

J.P. Morgan, BofA Securities, Stifel, Guggenheim Securities, RBC Capital Markets, William Blair

●

●

●

J.P. Morgan

As early as Thursday, Septem 14th, 2023

180 days for the Company, directors, officers, affiliates and substantially all security holders

Confidential

3View entire presentation