Owens&Minor Investor Day Presentation Deck

73

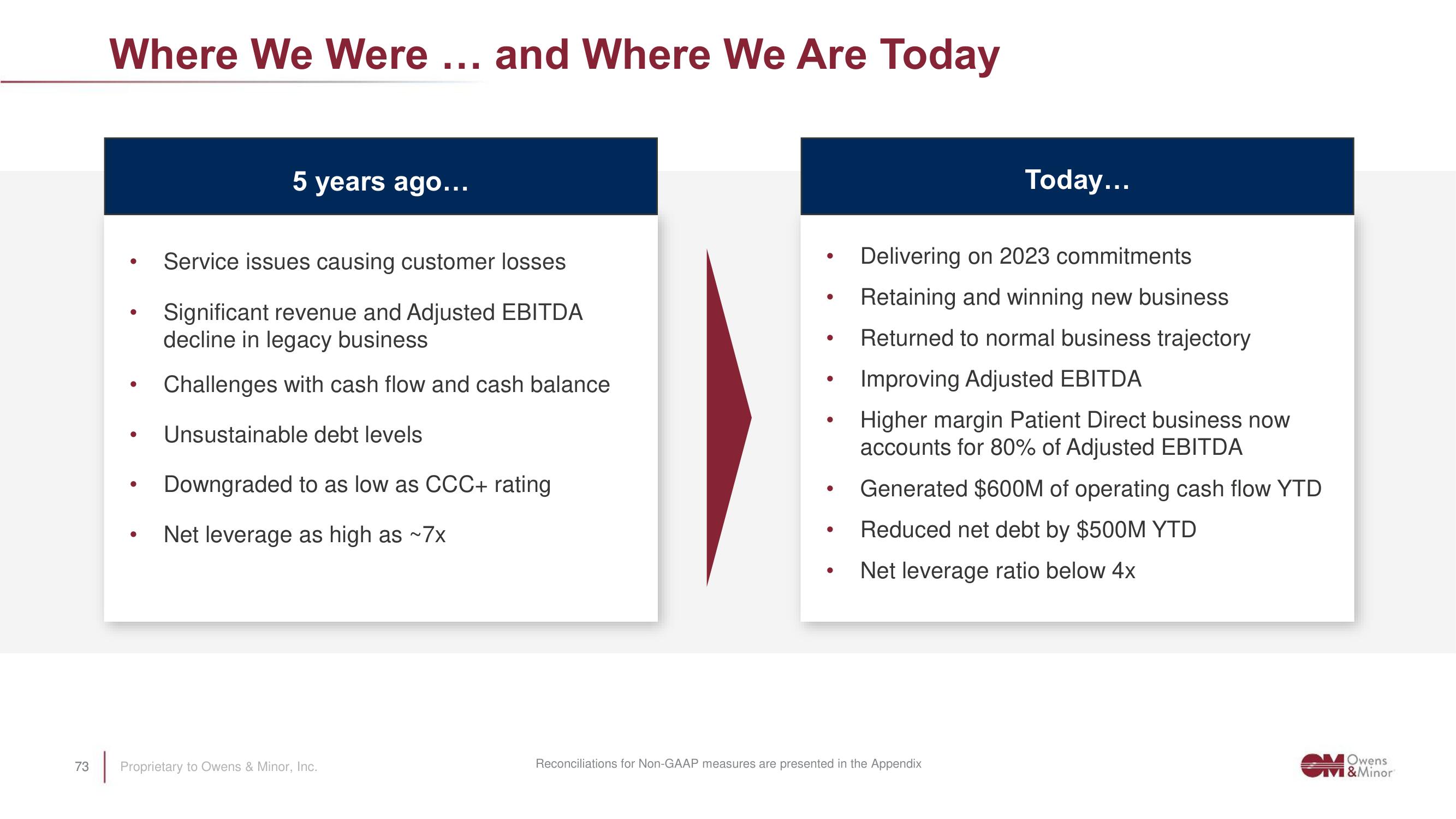

Where We Were ... and Where We Are Today

●

●

●

●

5 years ago...

Service issues causing customer losses

Significant revenue and Adjusted EBITDA

decline in legacy business

Challenges with cash flow and cash balance

Unsustainable debt levels

Downgraded to as low as CCC+ rating

Net leverage as high as ~7x

Proprietary to Owens & Minor, Inc.

●

●

●

●

●

Today...

Delivering on 2023 commitments.

Retaining and winning new business

Returned to normal business trajectory

Improving Adjusted EBITDA

Higher margin Patient Direct business now

accounts for 80% of Adjusted EBITDA

Generated $600M of operating cash flow YTD

Reduced net debt by $500M YTD

Net leverage ratio below 4x

Reconciliations for Non-GAAP measures are presented in the Appendix

MOwens

M&MinorView entire presentation