Apollo Global Management Investor Day Presentation Deck

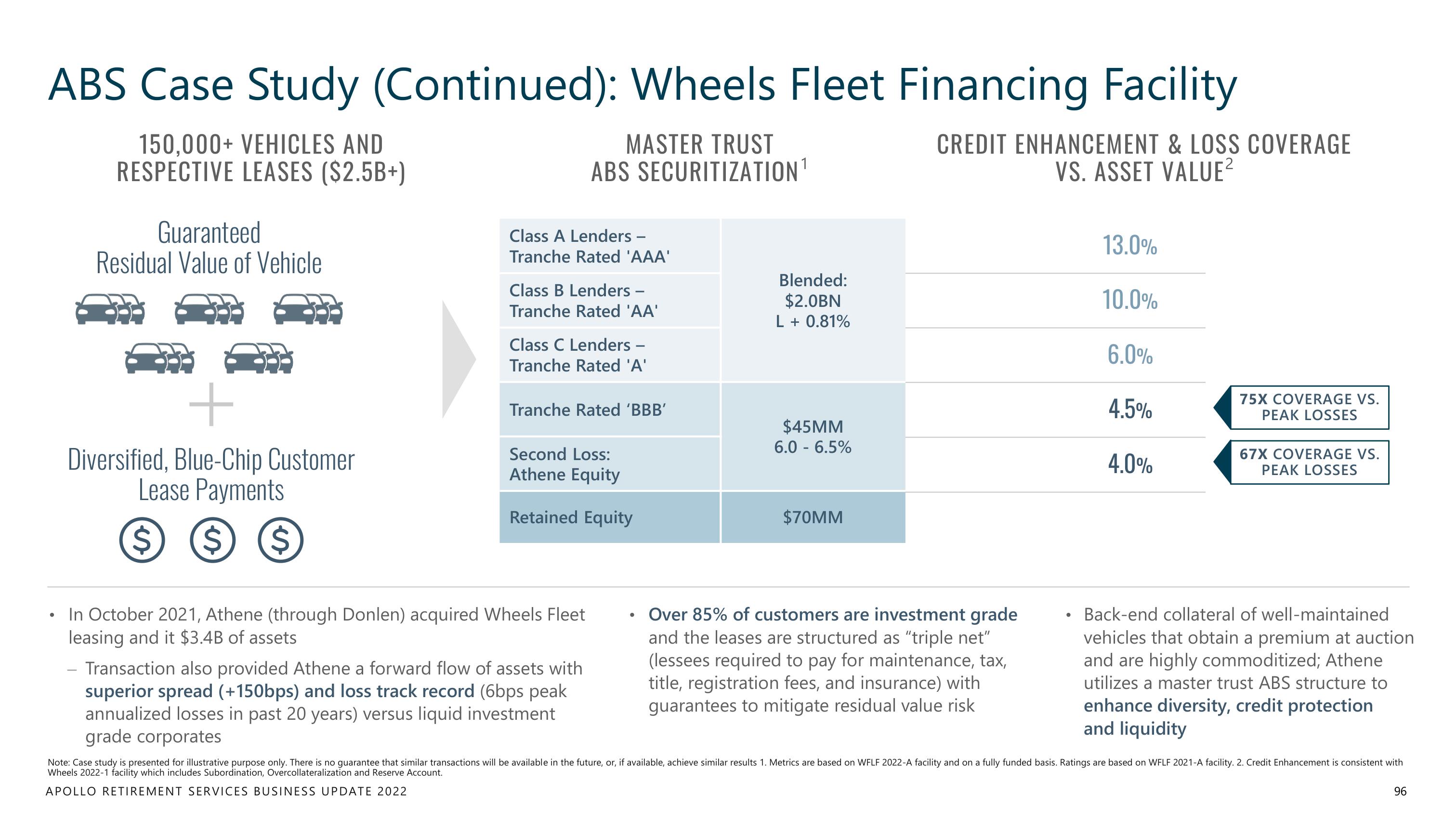

ABS Case Study (Continued): Wheels Fleet Financing Facility

150,000+ VEHICLES AND

RESPECTIVE LEASES ($2.5B+)

CREDIT ENHANCEMENT & LOSS COVERAGE

VS. ASSET VALUE²

●

Guaranteed

Residual Value of Vehicle

+

Diversified, Blue-Chip Customer

Lease Payments

$ $ ($

Class A Lenders -

Tranche Rated 'AAA'

MASTER TRUST

ABS SECURITIZATION

Class B Lenders -

Tranche Rated 'AA'

Class C Lenders -

Tranche Rated 'A'

Tranche Rated 'BBB'

Second Loss:

Athene Equity

Retained Equity

In October 2021, Athene (through Donlen) acquired Wheels Fleet

leasing and it $3.4B of assets

Transaction also provided Athene a forward flow of assets with

superior spread (+150bps) and loss track record (6bps peak

annualized losses in past 20 years) versus liquid investment

grade corporates

●

Blended:

$2.0BN

L + 0.81%

$45MM

6.0 - 6.5%

$70MM

Over 85% of customers are investment grade

and the leases are structured as "triple net"

(lessees required to pay for maintenance, tax,

title, registration fees, and insurance) with

guarantees to mitigate residual value risk

●

13.0%

10.0%

6.0%

4.5%

4.0%

75X COVERAGE VS.

PEAK LOSSES

67X COVERAGE VS.

PEAK LOSSES

Back-end collateral of well-maintained

vehicles that obtain a premium at auction

and are highly commoditized; Athene

utilizes a master trust ABS structure to

enhance diversity, credit protection

and liquidity

Note: Case study is presented for illustrative purpose only. There is no guarantee that similar transactions will be available in the future, or, if available, achieve similar results 1. Metrics are based on WFLF 2022-A facility and on a fully funded basis. Ratings are based on WFLF 2021-A facility. 2. Credit Enhancement is consistent with

Wheels 2022-1 facility which includes Subordination, Overcollateralization and Reserve Account.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

96View entire presentation