PJT Partners Investment Banking Pitch Book

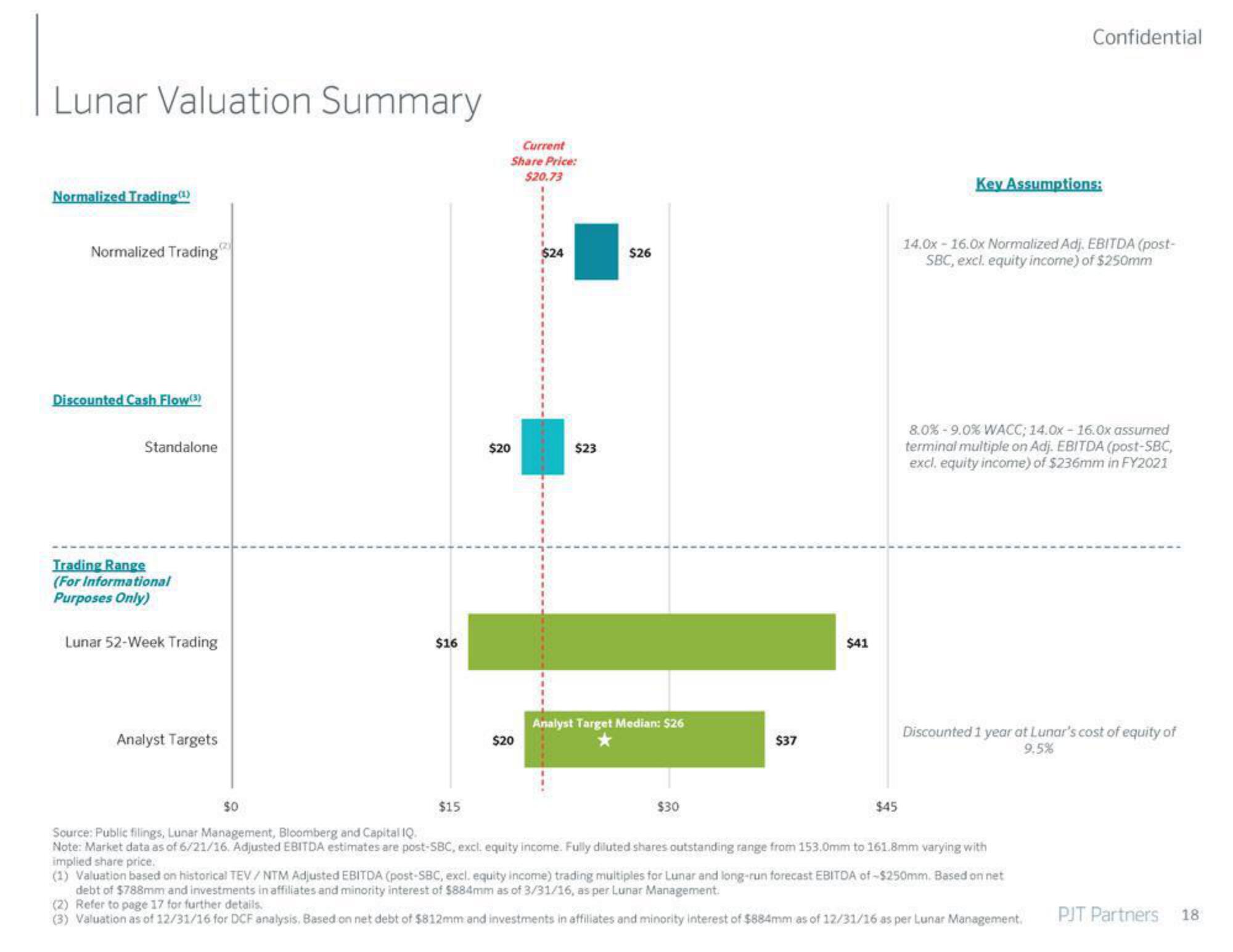

Lunar Valuation Summary

Normalized Trading (¹)

Normalized Trading

Discounted Cash Flow (3)

Standalone

Trading Range

(For Informational

Purposes Only)

Lunar 52-Week Trading

Analyst Targets

$16

$15

Current

Share Price:

$20.73

$20

$20

$24

$23

$26

Analyst Target Median: $26

$30

$37

$41

$45

Confidential

Key Assumptions:

14.0x - 16.0x Normalized Adj. EBITDA (post-

SBC, excl. equity income) of $250mm

8.0%-9.0% WACC; 14.0x - 16.0x assumed

terminal multiple on Adj. EBITDA (post-SBC,

excl. equity income) of $236mm in FY2021

Discounted 1 year at Lunar's cost of equity of

9.5%

$0

Source: Public filings, Lunar Management, Bloomberg and Capital IQ.

Note: Market data as of 6/21/16. Adjusted EBITDA estimates are post-SBC, excl. equity income. Fully diluted shares outstanding range from 153.0mm to 161.8mm varying with

implied share price.

(1) Valuation based on historical TEV/NTM Adjusted EBITDA (post-SBC, excl. equity income) trading multiples for Lunar and long-run forecast EBITDA of-$250mm. Based on net

debt of $788mm and investments in affiliates and minority interest of $884mm as of 3/31/16, as per Lunar Management.

(2) Refer to page 17 for further details.

(3) Valuation as of 12/31/16 for DCF analysis. Based on net debt of $812mm and investments in affiliates and minority interest of $884mm as of 12/31/16 as per Lunar Management.

PJT Partners 18View entire presentation