NuScale Power Investor Presentation

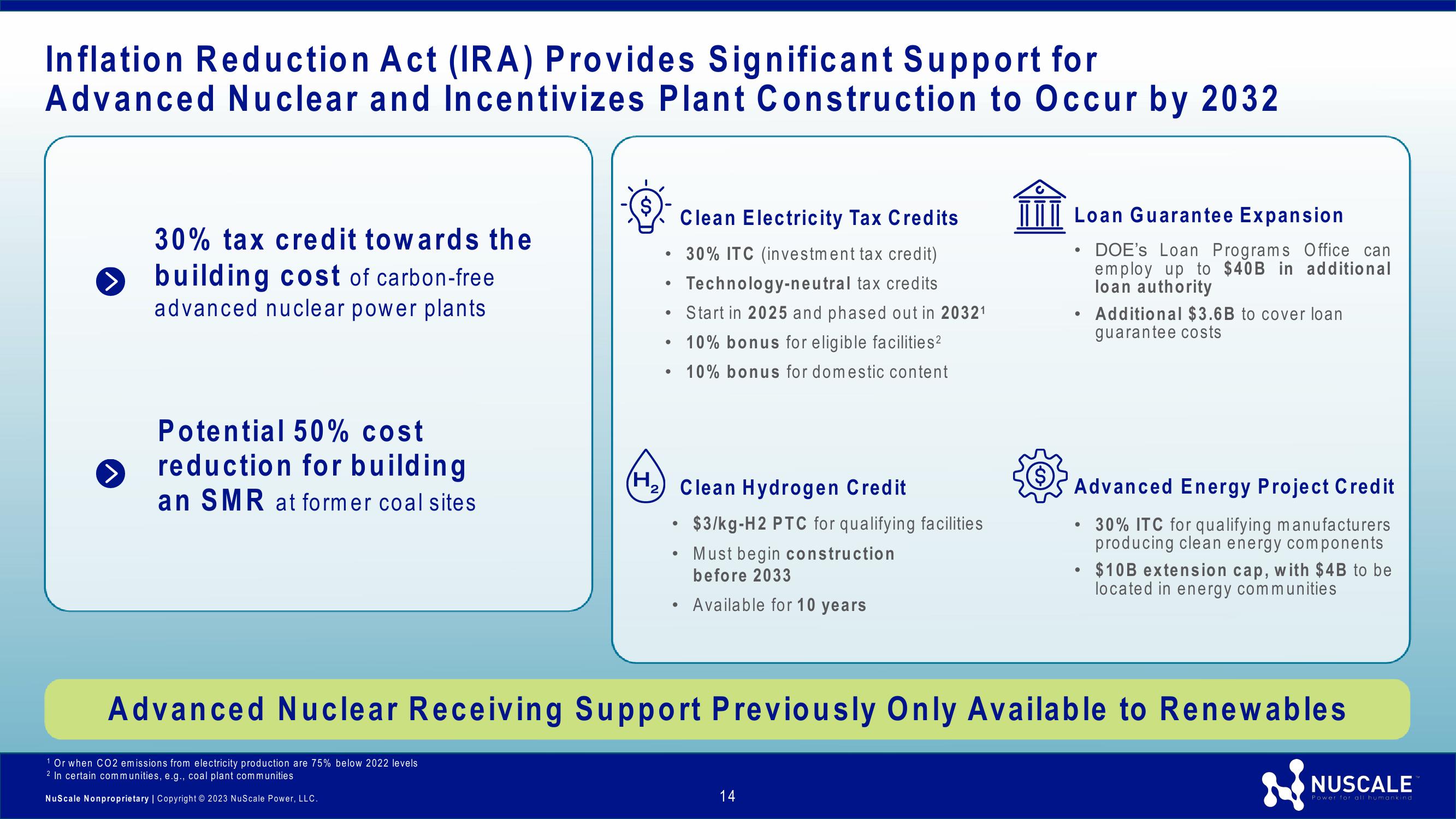

Inflation Reduction Act (IRA) Provides Significant Support for

Advanced Nuclear and Incentivizes Plant Construction to Occur by 2032

>

30% tax credit towards the

building cost of carbon-free

advanced nuclear power plants

Potential 50% cost

reduction for building

an SMR at former coal sites

$

I

(H2)

.

•

.

Clean Electricity Tax Credits

30% ITC (investment tax credit)

Technology-neutral tax credits

Start in 2025 and phased out in 20321

• 10% bonus for eligible facilities²

10% bonus for domestic content

命

$

Clean Hydrogen Credit

•

$3/kg-H2 PTC for qualifying facilities

•

Must begin construction

before 2033

•

• Available for 10 years

Loan Guarantee Expansion

.

DOE's Loan Programs Office can

employ up to $40B in additional

loan authority

Additional $3.6B to cover loan

guarantee costs

Advanced Energy Project Credit

30% ITC for qualifying manufacturers

producing clean energy components

⚫ $10B extension cap, with $4B to be

located in energy communities

Advanced Nuclear Receiving Support Previously Only Available to Renewables

1 Or when CO2 emissions from electricity production are 75% below 2022 levels

2 In certain communities, e.g., coal plant communities

NuScale Nonproprietary | Copyright © 2023 NuScale Power, LLC.

14

NUSCALE

Power for all humankindView entire presentation