Nikola Results Presentation Deck

08

//

PAGE

NIKOLA

WVR | NIKOLA INVESTMENT

Low-Cost, Low-Carbon Hydrogen Production

NIKOLA ACQUIRES 20% INTEREST IN WVR PROJECT

●

Acquired 20% equity interest at $250M valuation (50/50 split between

cash and stock)

(1)

WVR is redeveloping an idle integrated gasification plant and installing a

new Combined Cycle Hydrogen Turbine asset to produce low-

carbon/zero-carbon hydrogen and electricity

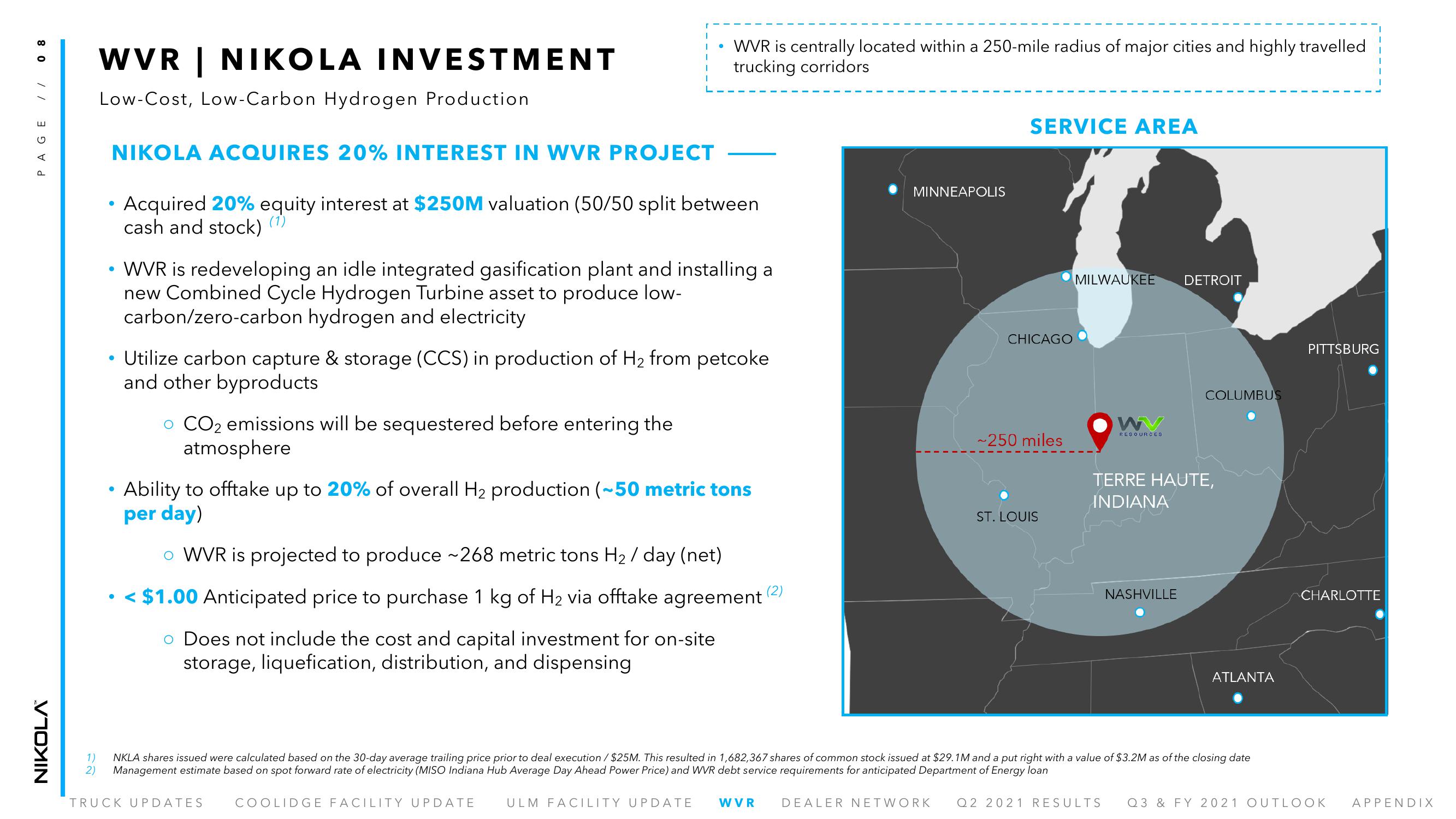

WVR is centrally located within a 250-mile radius of major cities and highly travelled

trucking corridors

• Utilize carbon capture & storage (CCS) in production of H₂ from petcoke

and other byproducts

o CO₂ emissions will be sequestered before entering the

atmosphere

Ability to offtake up to 20% of overall H₂ production (~50 metric tons

per day)

o WVR is projected to produce ~268 metric tons H₂ / day (net)

●

< $1.00 Anticipated price to purchase 1 kg of H₂ via offtake agreement

o Does not include the cost and capital investment for on-site

storage, liquefication, distribution, and dispensing

TRUCK UPDATES

COOLIDGE FACILITY UPDATE

(2)

MINNEAPOLIS

SERVICE AREA

CHICAGO

~250 miles

ST. LOUIS

MILWAUKEE DETROIT

WV

RESOURCES

TERRE HAUTE,

INDIANA

ULM FACILITY UPDATE WVR DEALER NETWORK Q2 2021 RESULTS

COLUMBUS

NASHVILLE

1)

NKLA shares issued were calculated based on the 30-day average trailing price prior to deal execution / $25M. This resulted in 1,682,367 shares of common stock issued at $29.1M and a put right with a value of $3.2M as of the closing date

2) Management estimate based on spot forward rate of electricity (MISO Indiana Hub Average Day Ahead Power Price) and WVR debt service requirements for anticipated Department of Energy loan

ATLANTA

PITTSBURG

CHARLOTTE

Q3 & FY 2021 OUTLOOK

APPENDIXView entire presentation