HSBC Results Presentation Deck

Insurance

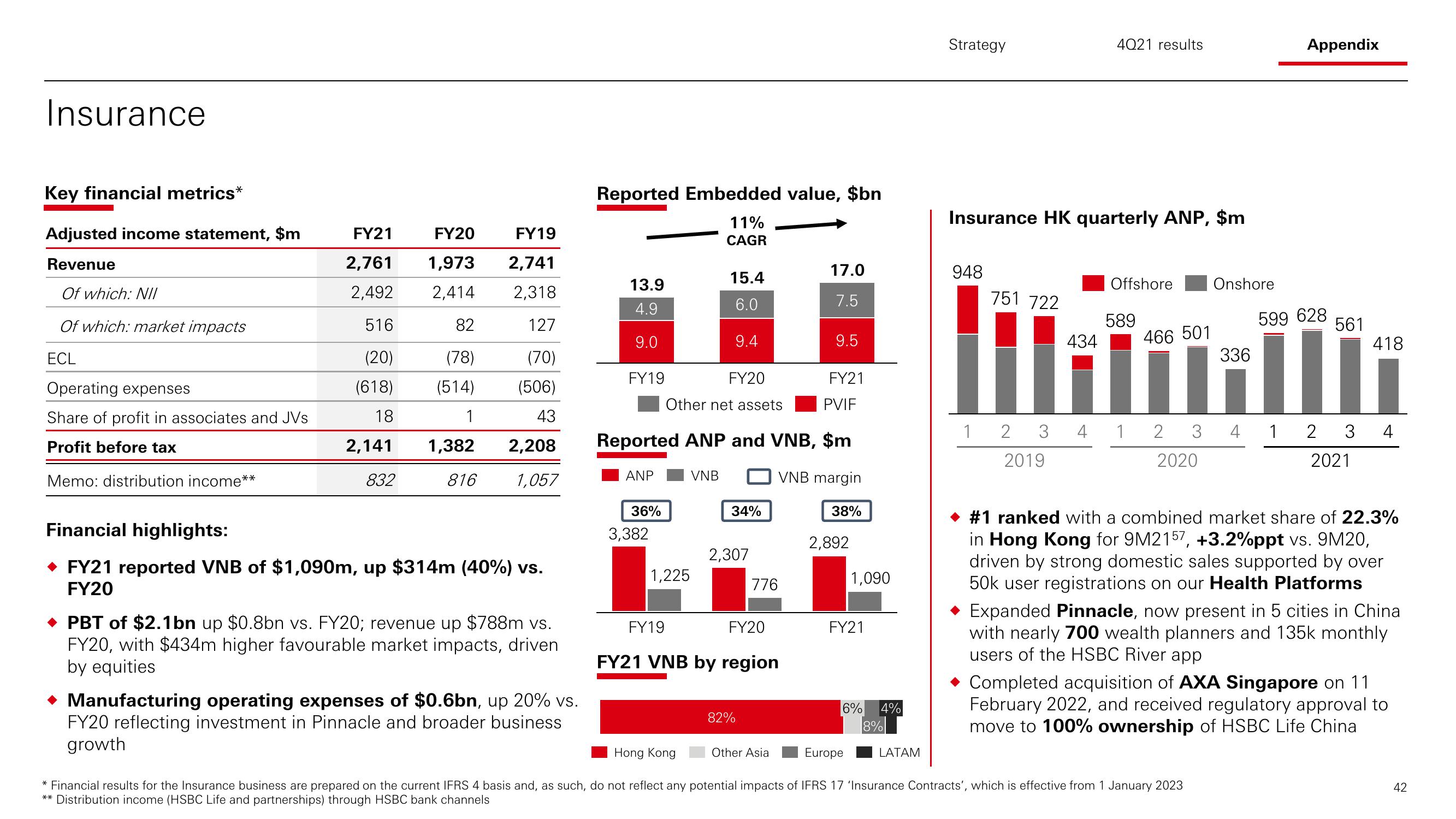

Key financial metrics*

Adjusted income statement, $m

Revenue

Of which: NII

Of which: market impacts

ECL

Operating expenses

Share of profit in associates and JVs

Profit before tax

Memo: distribution income**

FY21

2,761

2,492

516

(20)

(618)

18

2,141

832

FY20

FY19

1,973 2,741

2,414

2,318

82

127

(78)

(70)

(506)

(514)

1

43

1,382 2,208

816

1,057

Financial highlights:

FY21 reported VNB of $1,090m, up $314m (40%) vs.

FY20

◆ PBT of $2.1bn up $0.8bn vs. FY20; revenue up $788m vs.

FY20, with $434m higher favourable market impacts, driven

by equities

◆ Manufacturing operating expenses of $0.6bn, up 20% vs.

FY20 reflecting investment in Pinnacle and broader business

growth

Reported Embedded value, $bn

11%

CAGR

13.9

4.9

9.0

FY19

ANP

36%

3,382

FY19

15.4

6.0

FY20

Other net assets

PVIF

Reported ANP and VNB, $m

VNB margin

VNB

1,225

9.4

34%

2,307

FY20

FY21 VNB by region

82%

776

17.0

7.5

9.5

Other Asia

FY21

38%

2,892

1,090

FY21

6% 4%

8%

Strategy

LATAM

Insurance HK quarterly ANP, $m

948

751 722

1 2 3

2019

4021 results

434

Offshore

589

466 501

4 1 2 3

2020

Hong Kong

Europe

* Financial results for the Insurance business are prepared on the current IFRS 4 basis and, as such, do not reflect any potential impacts of IFRS 17 'Insurance Contracts', which is effective from 1 January 2023

** Distribution income (HSBC Life and partnerships) through HSBC bank channels

Onshore

336

Appendix

599 628

4 1

561

418

2 3 4

2021

#1 ranked with a combined market share of 22.3%

in Hong Kong for 9M2157, +3.2%ppt vs. 9M20,

driven by strong domestic sales supported by over

50k user registrations on our Health Platforms

Expanded Pinnacle, now present in 5 cities in China

with nearly 700 wealth planners and 135k monthly

users of the HSBC River app

Completed acquisition of AXA Singapore on 11

February 2022, and received regulatory approval to

move to 100% ownership of HSBC Life China

42View entire presentation