TPG Results Presentation Deck

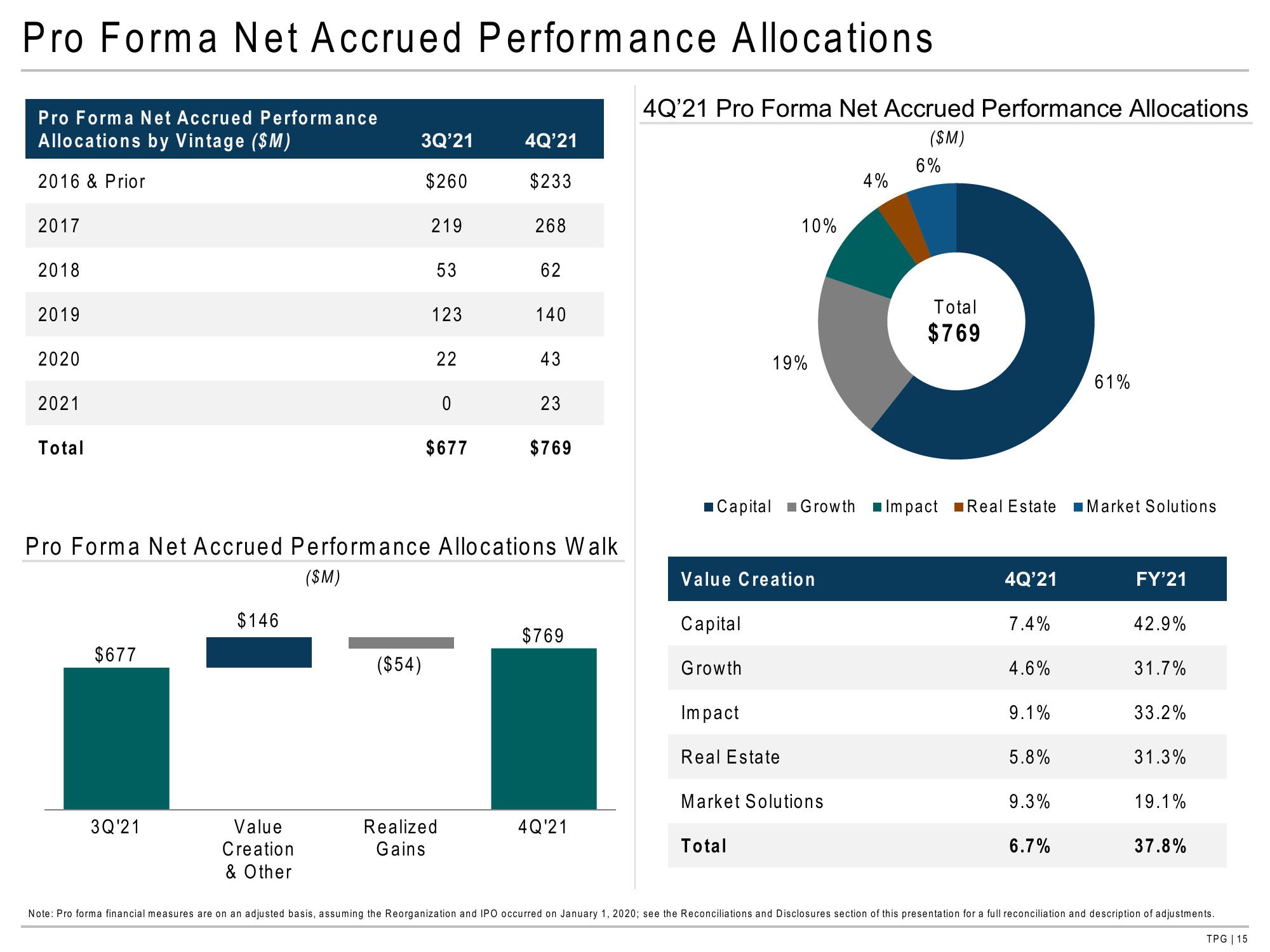

Pro Forma Net Accrued Performance Allocations

Pro Forma Net Accrued Performance

Allocations by Vintage ($M)

2016 & Prior

2017

2018

2019

2020

2021

Total

$677

3Q'21

$146

3Q'21

$260

Value

Creation

& Other

219

($54)

53

123

22

0

$677

Realized

Gains

4Q'21

$233

268

Pro Forma Net Accrued Performance Allocations Walk

($M)

62

140

43

23

$769

$769

4Q'21

4Q'21 Pro Forma Net Accrued Performance Allocations

($M)

10%

19%

Value Creation

Capital

Growth

Impact

Real Estate

4%

Capital Growth Impact Real Estate

Market Solutions

Total

6%

Total

$769

4Q'21

7.4%

4.6%

9.1%

5.8%

9.3%

6.7%

61%

■Market Solutions

FY'21

42.9%

31.7%

33.2%

31.3%

19.1%

37.8%

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

TPG | 15View entire presentation