Experienced Senior Team Overview

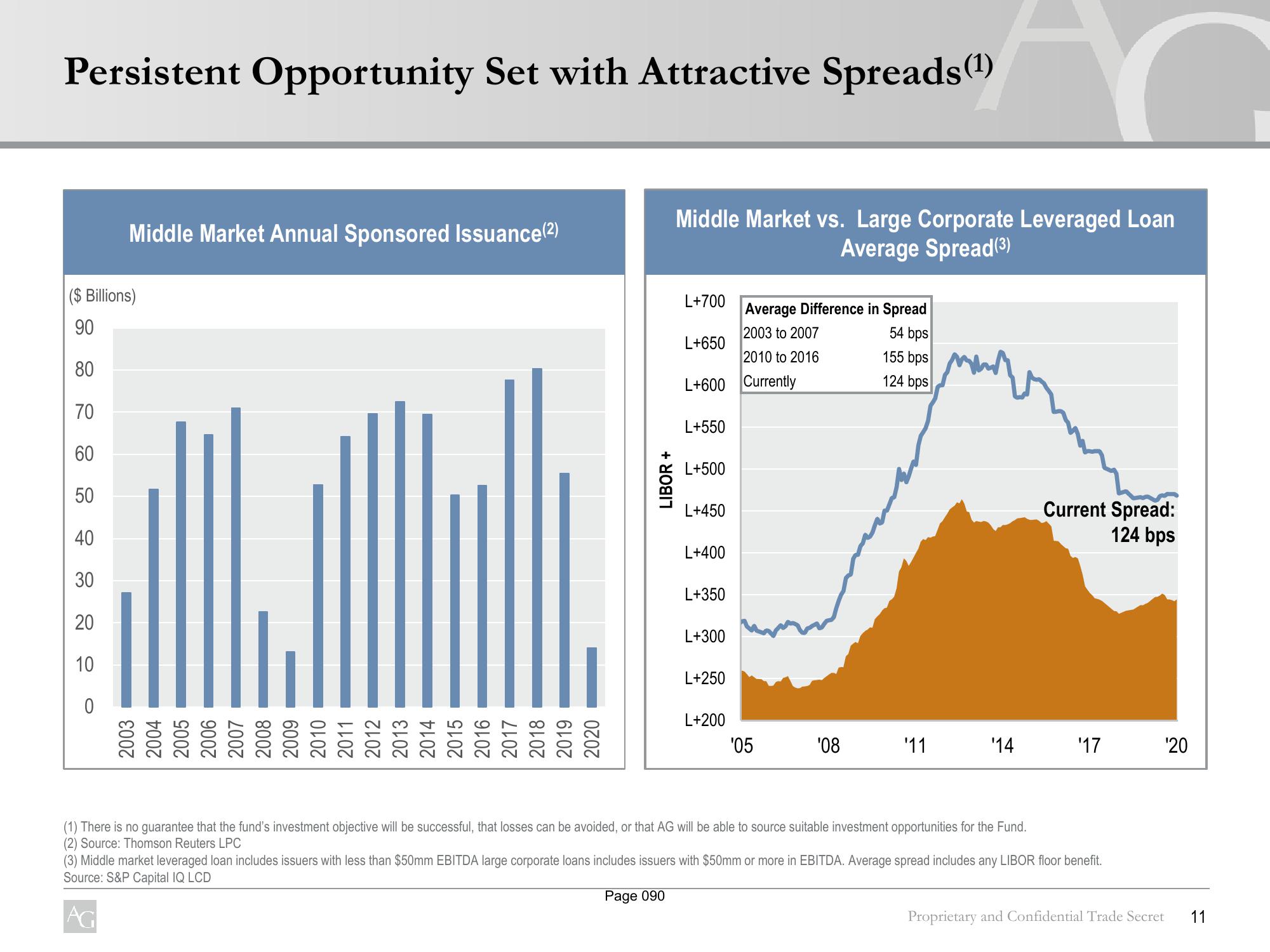

Persistent Opportunity Set with Attractive Spreads(¹)

($ Billions)

: : : 8898 & 은

90

80

70

60

50

40

30

20

10

Middle Market Annual Sponsored Issuance (²)

0

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

LIBOR +

Middle Market vs. Large Corporate Leveraged Loan

Average Spread (3)

L+700

L+650

L+600 Currently

L+550

L+500

L+450

L+400

L+350

L+300

L+250

Average Difference in Spread

2003 to 2007

54 bps

2010 to 2016

155 bps

124 bps

L+200

'05

'08

'11

'14

C

(1) There is no guarantee that the fund's investment objective will be successful, that losses can be avoided, or that AG will be able to source suitable investment opportunities for the Fund.

(2) Source: Thomson Reuters LPC

Current Spread:

124 bps

'17

(3) Middle market leveraged loan includes issuers with less than $50mm EBITDA large corporate loans includes issuers with $50mm or more in EBITDA. Average spread includes any LIBOR floor benefit.

Source: S&P Capital IQ LCD

Page 090

AG

'20

Proprietary and Confidential Trade Secret

11View entire presentation